PNC Bank 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

investor’s claim that a breach of a loan covenant and

representation and warranty has occurred, such breach has not

been cured, and the effect of such breach is deemed to have

had a material and adverse effect on the value of the

transferred loan. Depending on the sale agreement and upon

proper notice from the investor, we typically respond to home

equity indemnification and repurchase requests within 60

days, although final resolution of the claim may take a longer

period of time. Most home equity sale agreements do not

provide for penalties or other remedies if we do not respond

timely to investor indemnification or repurchase requests.

Investor indemnification or repurchase claims are typically

settled on an individual loan basis through make-whole

payments or loan repurchases; however, on occasion we may

negotiate pooled settlements with investors. In connection

with pooled settlements, we typically do not repurchase loans

and the consummation of such transactions generally results in

us no longer having indemnification and repurchase exposure

with the investor in the transaction.

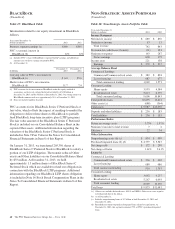

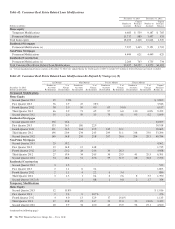

The following table details the unpaid principal balance of our

unresolved home equity indemnification and repurchase

claims at December 31, 2013 and December 31, 2012,

respectively.

Table 33: Analysis of Home Equity Unresolved Asserted

Indemnification and Repurchase Claims

In millions

December 31

2013

December 31

2012

Home equity loans/lines of credit:

Private investors (a) $17 $74

(a) Activity relates to brokered home equity loans/lines of credit sold through loan sale

transactions which occurred during 2005-2007.

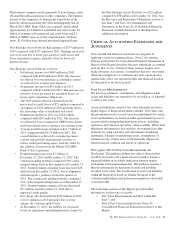

The table below details our home equity indemnification and repurchase claim settlement activity during 2013 and 2012.

Table 34: Analysis of Home Equity Indemnification and Repurchase Claim Settlement Activity

2013 2012

Year ended December 31 – In millions

Unpaid

Principal

Balance (a)

Losses

Incurred (b)

Fair Value of

Repurchased

Loans (c)

Unpaid

Principal

Balance (a)

Losses

Incurred (b)

Fair Value of

Repurchased

Loans (c)

Home equity loans/lines of credit:

Private investors – Repurchases (d) $9 $36 $1 $22 $18 $4

(a) Represents unpaid principal balance of loans at the indemnification or repurchase date. Excluded from these balances are amounts associated with pooled settlement payments as loans

are typically not repurchased in these transactions.

(b) Represents the difference between loan repurchase price and fair value of the loan at the repurchase date. These losses are charged to the indemnification and repurchase liability.

Losses incurred in 2013 also include amounts for settlement payments.

(c) Represents fair value of loans repurchased only as we have no exposure to changes in the fair value of loans or underlying collateral when indemnification/settlement payments are

made to investors.

(d) Activity relates to brokered home equity loans/lines of credit sold through loan sale transactions which occurred during 2005-2007.

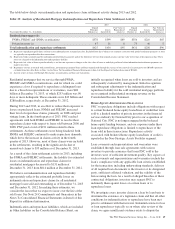

During 2013 and 2012, unresolved and settled investor

indemnification and repurchase claims were primarily related to

one of the following alleged breaches in representations and

warranties: (i) misrepresentation of income, assets or

employment, (ii) property evaluation or status issues (e.g.,

appraisal, title, etc.) or (iii) underwriting guideline violations. The

lower balance of unresolved indemnification and repurchase

claims at December 31, 2013 is attributed to settlement activity in

2013. The lower repurchase activity in 2013 was affected by

lower claim activity and lower inventory of claims.

An indemnification and repurchase liability for estimated

losses for which indemnification is expected to be provided or

for loans that are expected to be repurchased was established

at the acquisition of National City. Management’s evaluation

of these indemnification and repurchase liabilities is based

upon trends in indemnification and repurchase claims, actual

loss experience, risks in the underlying serviced loan

portfolios, current economic conditions and the periodic

negotiations that management may enter into with investors to

settle existing and potential future claims.

At December 31, 2013 and December 31, 2012, the liability

for estimated losses on indemnification and repurchase claims

for home equity loans/lines of credit was $22 million and $58

million, respectively. We believe our indemnification and

repurchase liability appropriately reflects the estimated

probable losses on indemnification and repurchase claims for

all home equity loans/lines of credit sold and outstanding as of

December 31, 2013 and December 31, 2012. In making these

estimates, we consider the losses that we expect to incur over

the life of the sold loans. See Note 24 Commitments and

Guarantees in the Notes To Consolidated Financial Statements

in Item 8 of this Report for additional information.

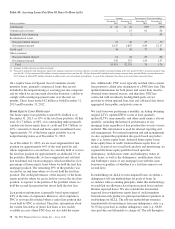

Indemnification and repurchase liabilities, which are included

in Other liabilities on the Consolidated Balance Sheet, are

evaluated by management on a quarterly basis. Initial

recognition and subsequent adjustments to the indemnification

and repurchase liability for home equity loans/lines of credit

are recognized in Other noninterest income on the

Consolidated Income Statement.

70 The PNC Financial Services Group, Inc. – Form 10-K