PNC Bank 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

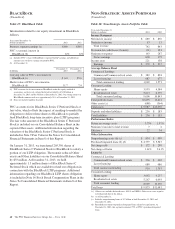

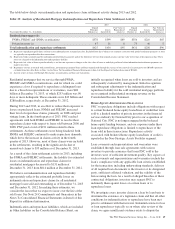

The table below details our indemnification and repurchase claim settlement activity during 2013 and 2012.

Table 32: Analysis of Residential Mortgage Indemnification and Repurchase Claim Settlement Activity

2013 2012

Year ended December 31 – In millions

Unpaid

Principal

Balance (a)

Losses

Incurred (b)

Fair Value of

Repurchased

Loans (c)

Unpaid

Principal

Balance (a)

Losses

Incurred (b)

Fair Value of

Repurchased

Loans (c)

Residential mortgages (d):

FNMA, FHLMC and GNMA securitizations $378 $399 $89 $356 $210 $85

Private investors (e) 47 31 6 75 46 5

Total indemnification and repurchase settlements $425 $430 $95 $431 $256 $90

(a) Represents unpaid principal balance of loans at the indemnification or repurchase date. Excluded from these balances are amounts associated with pooled settlement payments as loans

are typically not repurchased in these transactions.

(b) Represents both i) amounts paid for indemnification/settlement payments and ii) the difference between loan repurchase price and fair value of the loan at the repurchase date. These

losses are charged to the indemnification and repurchase liability.

(c) Represents fair value of loans repurchased only as we have no exposure to changes in the fair value of loans or underlying collateral when indemnification/settlement payments are

made to investors.

(d) Repurchase activity associated with insured loans, government-guaranteed loans and loans repurchased through the exercise of our removal of account provision (ROAP) option are

excluded from this table. Refer to Note 3 in the Notes To Consolidated Financial Statements in Item 8 of this Report for further discussion of ROAPs.

(e) Activity relates to loans sold through Non-Agency securitizations and loan sale transactions.

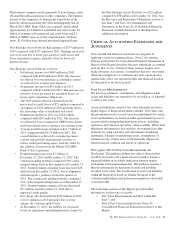

Residential mortgages that we service through FNMA,

FHLMC and GNMA securitizations, and for which we could

experience a loss if required to repurchase a delinquent loan

due to a breach in representations or warranties, were $48

billion at December 31, 2013, of which $253 million was 90

days or more delinquent. These amounts were $43 billion and

$288 million, respectively, at December 31, 2012.

During 2013 and 2012, in an effort to reduce their exposure to

losses on purchased loans, FNMA and FHLMC increased

their level of repurchase claims, primarily on 2008 and prior

vintage loans. In the fourth quarter of 2013, PNC reached

agreements with both FNMA and FHLMC to resolve their

repurchase claims with respect to loans sold between 2000 and

2008. PNC paid a total of $191 million related to these

settlements. As these settlements were being finalized, both

FNMA and FHLMC continued to make repurchase demands,

which drove the increase in claims activity in the fourth

quarter of 2013. However, most of these claims were included

in the settlements, resulting in the significant decline of

unresolved claims to $35 million as of December 31, 2013.

As a result of the claim settlement activity in 2013, including

the FNMA and FHLMC settlements, the liability for estimated

losses on indemnification and repurchase claims for

residential mortgages decreased to $131 million at

December 31, 2013 from $614 million at December 31, 2012.

We believe our indemnification and repurchase liability

appropriately reflects the estimated probable losses on

indemnification and repurchase claims for all residential

mortgage loans sold and outstanding as of December 31, 2013

and December 31, 2012. In making these estimates, we

consider the losses that we expect to incur over the life of the

sold loans. See Note 24 Commitments and Guarantees in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information.

Indemnification and repurchase liabilities, which are included

in Other liabilities on the Consolidated Balance Sheet, are

initially recognized when loans are sold to investors and are

subsequently evaluated by management. Initial recognition

and subsequent adjustments to the indemnification and

repurchase liability for the sold residential mortgage portfolio

are recognized in Residential mortgage revenue on the

Consolidated Income Statement.

H

OME

E

QUITY

R

EPURCHASE

O

BLIGATIONS

PNC’s repurchase obligations include obligations with respect

to certain brokered home equity loans/lines of credit that were

sold to a limited number of private investors in the financial

services industry by National City prior to our acquisition of

National City. PNC is no longer engaged in the brokered

home equity lending business, and our exposure under these

loan repurchase obligations is limited to repurchases of the

loans sold in these transactions. Repurchase activity

associated with brokered home equity loans/lines of credit is

reported in the Non-Strategic Assets Portfolio segment.

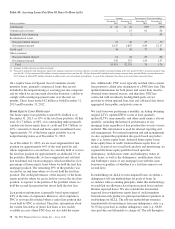

Loan covenants and representations and warranties were

established through loan sale agreements with various

investors to provide assurance that loans PNC sold to the

investors were of sufficient investment quality. Key aspects of

such covenants and representations and warranties include the

loan’s compliance with any applicable loan criteria established

for the transaction, including underwriting standards, delivery

of all required loan documents to the investor or its designated

party, sufficient collateral valuation, and the validity of the

lien securing the loan. As a result of alleged breaches of these

contractual obligations, investors may request PNC to

indemnify them against losses on certain loans or to

repurchase loans.

We investigate every investor claim on a loan by loan basis to

determine the existence of a legitimate claim and that all other

conditions for indemnification or repurchase have been met

prior to settlement with that investor. Indemnifications for loss

or loan repurchases typically occur when, after review of the

claim, we agree insufficient evidence exists to dispute the

The PNC Financial Services Group, Inc. – Form 10-K 69