PNC Bank 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

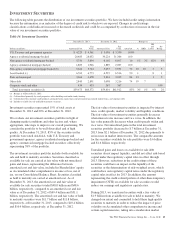

The increase in loans was driven by the increase in

commercial lending as a result of growth in commercial and

commercial real estate loans, primarily from new customers

and organic growth. The increase in consumer lending

resulted from growth in automobile loans, partially offset by

paydowns of education loans.

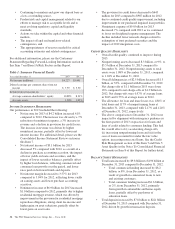

Loans represented 61% of total assets at both December 31,

2013 and December 31, 2012. Commercial lending

represented 60% of the loan portfolio at December 31, 2013

and 59% at December 31, 2012. Consumer lending

represented 40% of the loan portfolio at December 31, 2013

and 41% at December 31, 2012.

Commercial real estate loans represented 11% of total loans at

December 31, 2013 and 10% at December 31, 2012 and

represented 7% of total assets at December 31, 2013 and 6%

at December 31, 2012. See the Credit Risk Management

portion of the Risk Management section of this Item 7 for

additional information regarding our loan portfolio.

Total loans above include purchased impaired loans of $6.1

billion, or 3% of total loans, at December 31, 2013, and $7.4

billion, or 4% of total loans, at December 31, 2012.

Our loan portfolio continued to be diversified among

numerous industries, types of businesses and consumers

across our principal geographic markets.

A

LLOWANCE FOR

L

OAN AND

L

EASE

L

OSSES

(ALLL)

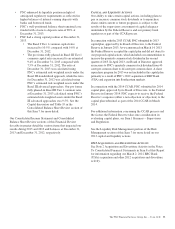

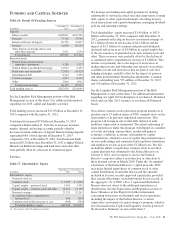

Our total ALLL of $3.6 billion at December 31, 2013

consisted of $1.5 billion and $2.1 billion established for the

commercial lending and consumer lending categories,

respectively. The ALLL included what we believe to be

appropriate loss coverage on all loans, including higher risk

loans, in the commercial and consumer portfolios. We do not

consider government insured or guaranteed loans to be higher

risk as defaults have historically been materially mitigated by

payments of insurance or guarantee amounts for approved

claims. Additional information regarding our higher risk loans

is included in the Credit Risk Management portion of the Risk

Management section of this Item 7 and Note 5 Asset Quality

and Note 7 Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit in our

Notes To Consolidated Financial Statements included in

Item 8 of this Report.

P

URCHASE

A

CCOUNTING

A

CCRETION AND

V

ALUATION OF

P

URCHASED

I

MPAIRED

L

OANS

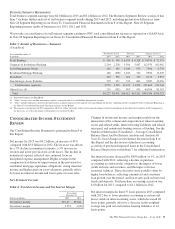

Information related to purchase accounting accretion and

accretable yield for 2013 and 2012 follows. Additional

information is provided in Note 6 Purchased Loans in the

Notes To Consolidated Financial Statements of this Report.

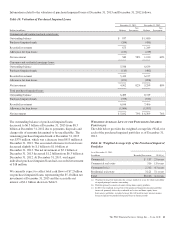

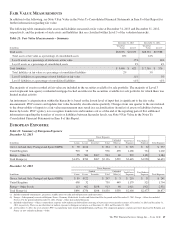

Table 8: Accretion – Purchased Impaired Loans

In millions 2013 2012

Accretion on purchased impaired loans

Scheduled accretion $ 580 $ 671

Reversal of contractual interest on impaired

loans (314) (404)

Scheduled accretion net of contractual interest 266 267

Excess cash recoveries 115 157

Total $ 381 $ 424

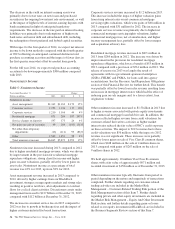

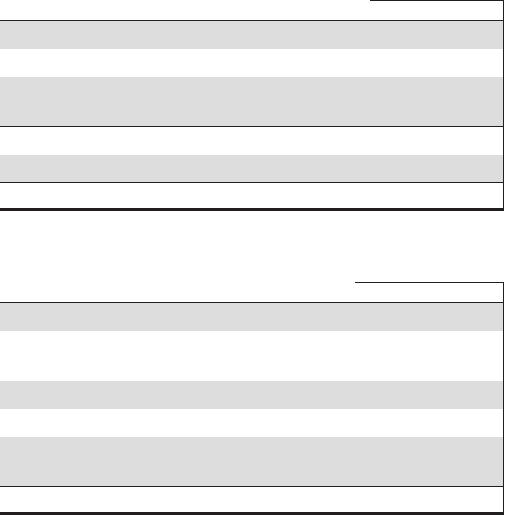

Table 9: Purchased Impaired Loans – Accretable Yield

In millions 2013 2012

January 1 $2,166 $2,109

Addition of accretable yield due to RBC Bank

(USA) acquisition on March 2, 2012 587

Scheduled accretion (580) (671)

Excess cash recoveries (115) (157)

Net reclassifications to accretable from non-

accretable and other activity (a) 584 298

December 31 (b) $2,055 $2,166

(a) Approximately 63% of the net reclassifications for the year were within the consumer

portfolio primarily due to increases in the expected average life of residential and

home equity loans. The remaining net reclassifications were predominantly due to

future cash flow improvements within the commercial portfolio.

(b) As of December 31, 2013, we estimate that the reversal of contractual interest on

purchased impaired loans will total approximately $1.1 billion in future periods.

This will offset the total net accretable interest in future interest income of $2.1

billion on purchased impaired loans.

40 The PNC Financial Services Group, Inc. – Form 10-K