PNC Bank 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

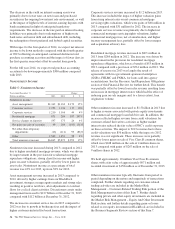

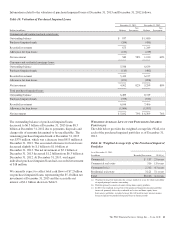

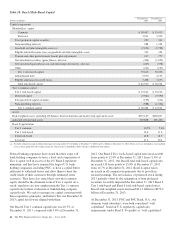

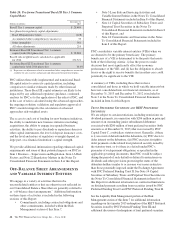

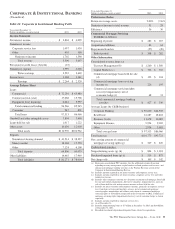

Table 18: Basel I Risk-Based Capital

Dollars in millions

December 31

2013

December 31

2012

Capital components

Shareholders’ equity

Common $ 38,467 $ 35,413

Preferred 3,941 3,590

Trust preferred capital securities 199 331

Noncontrolling interests 988 1,354

Goodwill and other intangible assets (a) (9,654) (9,798)

Eligible deferred income taxes on goodwill and other intangible assets 333 354

Pension and other postretirement benefit plan adjustments 237 777

Net unrealized securities (gains)/losses, after-tax (434) (1,052)

Net unrealized (gains)/losses on cash flow hedge derivatives, after-tax (243) (578)

Other (222) (165)

Tier 1 risk-based capital 33,612 30,226

Subordinated debt 5,930 4,735

Eligible allowance for credit losses 3,408 3,273

Total risk-based capital $ 42,950 $ 38,234

Tier 1 common capital

Tier 1 risk-based capital $ 33,612 $ 30,226

Preferred equity (3,941) (3,590)

Trust preferred capital securities (199) (331)

Noncontrolling interests (988) (1,354)

Tier 1 common capital $ 28,484 $ 24,951

Assets

Risk-weighted assets, including off-balance sheet instruments and market risk equivalent assets $272,169 $260,847

Adjusted average total assets 303,828 291,426

Basel I capital ratios

Tier 1 common 10.5% 9.6%

Tier 1 risk-based 12.4 11.6

Total risk-based 15.8 14.7

Leverage 11.1 10.4

(a) Excludes commercial and residential mortgage servicing rights of $1.6 billion at December 31, 2013 and $1.1 billion at December 31, 2012. These assets are included in risk-weighted

assets at their applicable risk weights except for a haircut that is included in Other which is a deduction from capital.

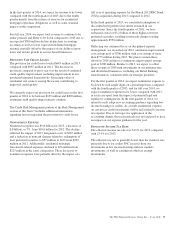

Federal banking regulators have stated that they expect all

bank holding companies to have a level and composition of

Tier 1 capital well in excess of the 4% Basel I regulatory

minimum, and they have required the largest U.S. bank

holding companies, including PNC, to have a capital buffer

sufficient to withstand losses and allow them to meet the

credit needs of their customers through estimated stress

scenarios. They have also stated their view that common

equity should be the dominant form of Tier 1 capital. As a

result, regulators are now emphasizing the Tier 1 common

capital ratio in their evaluation of bank holding company

capital levels. We seek to manage our capital consistent with

these regulatory principles, and believe that our December 31,

2013 capital levels were aligned with them.

Our Basel I Tier 1 common capital ratio was 10.5% at

December 31, 2013, compared with 9.6% at December 31,

2012. Our Basel I Tier 1 risk-based capital ratio increased 80

basis points to 12.4% at December 31, 2013 from 11.6% at

December 31, 2012. Our Basel I total risk-based capital ratio

increased 110 basis points to 15.8% at December 31, 2013

from 14.7% at December 31, 2012. Basel I capital ratios

increased in all comparisons primarily due to growth in

retained earnings. The net issuance of preferred stock during

2013 partially offset by the redemption of trust preferred

securities favorably impacted the December 31, 2013 Basel I

Tier 1 risk-based and Basel I total risk-based capital ratios.

Basel I risk-weighted assets increased $11.3 billion to $272.2

billion at December 31, 2013.

At December 31, 2013, PNC and PNC Bank, N.A., our

domestic bank subsidiary, were both considered “well

capitalized” based on U.S. regulatory capital ratio

requirements under Basel I. To qualify as “well capitalized”

46 The PNC Financial Services Group, Inc. – Form 10-K