PNC Bank 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.L

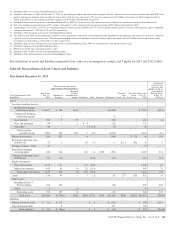

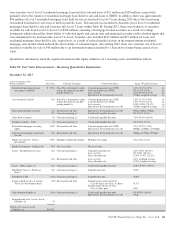

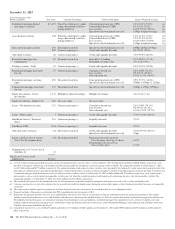

OANS

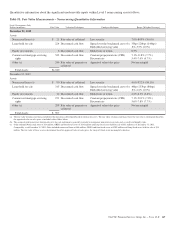

Loans accounted for at fair value consist primarily of

residential mortgage loans. These loans are generally valued

similarly to residential mortgage loans held for sale and are

classified as Level 2. However, similar to residential mortgage

loans held for sale, if these loans are repurchased and

unsalable, they are classified as Level 3. In addition,

repurchased VA loans, where only a portion of the principal

will be reimbursed, are classified as Level 3. The fair value is

determined using a discounted cash flow calculation based on

our historical loss rate. Due to the unobservable nature of this

pool level approach, these loans are classified as Level 3.

Significant increases (decreases) in these assumptions would

result in a significantly lower (higher) fair value measurement.

During the first quarter of 2013, we elected to account for

certain home equity lines of credit at fair value. These loans

are classified as Level 3. This category also includes

repurchased brokered home equity loans. These loans are

repurchased due to a breach of representations or warranties in

the loan sales agreements and occur typically after the loan is

in default. Similar to existing loans classified as Level 3 due

to being repurchased and unsalable, the fair value price is

based on bids and market observations of transactions of

similar vintage. Because transaction details regarding the

credit and underwriting quality are often unavailable,

unobservable bid information from brokers and investors is

heavily relied upon. Accordingly, based on the significance of

unobservable inputs, these loans are classified as Level 3. The

fair value of these loans is included in the Loans – Home

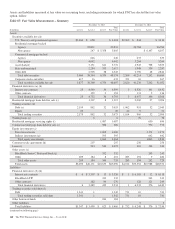

equity line item in Table 89 in this Note 9.

Significant inputs to the valuation of residential mortgage

loans include credit and liquidity discount, cumulative default

rate, loss severity and gross discount rate and are deemed

representative of current market conditions. Significant

increases (decreases) in an assumption would result in a

significantly lower (higher) fair value measurement.

B

LACK

R

OCK

S

ERIES

CP

REFERRED

S

TOCK

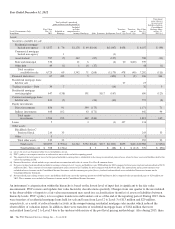

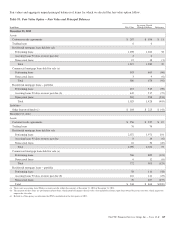

We have elected to account for the shares of BlackRock Series

C Preferred Stock received in a stock exchange with

BlackRock at fair value. On January 31, 2013, we transferred

205,350 shares to BlackRock pursuant to our obligation to

partially fund a portion of certain BlackRock LTIP programs.

After this transfer, we hold approximately 1.3 million shares

of BlackRock Series C Preferred Stock, which are available to

fund our obligation in connection with the BlackRock LTIP

programs. The Series C Preferred Stock economically hedges

the BlackRock LTIP liability that is accounted for as a

derivative. The fair value of the Series C Preferred Stock is

determined using a third-party modeling approach, which

includes both observable and unobservable inputs. This

approach considers expectations of a default/liquidation event

and the use of liquidity discounts based on our inability to sell

the security at a fair, open market price in a timely manner.

Although dividends are equal to common shares and other

preferred series, significant transfer restrictions exist on our

Series C shares for any purpose other than to satisfy the LTIP

obligation. Due to the significance of unobservable inputs, this

security is classified as Level 3. Significant increases

(decreases) in the liquidity discount would result in a

significantly lower (higher) asset value for the BlackRock

Series C and vice versa for the BlackRock LTIP liability.

O

THER

A

SSETS AND

L

IABILITIES

We have entered into a prepaid forward contract with a

financial institution to mitigate the risk on a portion of PNC’s

deferred compensation, supplemental incentive savings plan

liabilities and certain stock based compensation awards that

are based on PNC’s stock price and are subject to market risk.

The prepaid forward contract is initially valued at the

transaction price and is subsequently valued by reference to

the market price of PNC’s stock and is recorded in either

Other Assets or Other Liabilities at fair value and is classified

in Level 2. In addition, deferred compensation and

supplemental incentive savings plan participants may also

invest based on fixed income and equity-based funds. PNC

utilizes a Rabbi Trust to hedge the returns by purchasing

similar funds on which the participant returns are based. The

Rabbi Trust balances are recorded in Other Assets at fair value

using the quoted market price. These assets are primarily

being classified in Levels 1 and 2. The other asset category

also includes FHLB interests and the retained interests related

to the Small Business Administration (SBA) securitizations

which are classified as Level 3. All Level 3 other assets are

included in the Insignificant Level 3 assets, net of liabilities

line item in Table 89 in this Note 9.

O

THER

B

ORROWED

F

UNDS

During the first quarter of 2013, we elected to account for

certain other borrowed funds consisting primarily of secured

debt at fair value. These other borrowed funds are classified as

Level 3. Significant unobservable inputs for these borrowed

funds include credit and liquidity discount and spread over the

benchmark curve. Significant increases (decreases) in these

assumptions would result in significantly lower (higher) fair

value measurement.

The PNC Financial Services Group, Inc. – Form 10-K 159