PNC Bank 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for all legally binding unfunded equity commitments. These

liabilities are reflected in Other liabilities on our Consolidated

Balance Sheet.

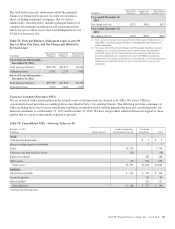

Table 60 also includes our involvement in lease financing

transactions with LLCs engaged in solar power generation that

to a large extent provided returns in the form of tax credits.

The outstanding financings and operating lease assets are

reflected as Loans and Other assets, respectively, on our

Consolidated Balance Sheet. Our lease financing liabilities are

reported in Deposits and Other liabilities.

During 2013, PNC sold limited partnership or non-managing

member interests previously held in certain consolidated

funds. As a result, PNC no longer met the consolidation

criteria for those investments and deconsolidated

approximately $675 million of net assets related to the funds.

R

ESIDENTIAL AND

C

OMMERCIAL

M

ORTGAGE

-B

ACKED

S

ECURITIZATIONS

In connection with each Agency and Non-agency

securitization discussed above, we evaluate each SPE utilized

in these transactions for consolidation. In performing these

assessments, we evaluate our level of continuing involvement

in these transactions as the nature of our involvement

ultimately determines whether or not we hold a variable

interest and/or are the primary beneficiary of the SPE. Factors

we consider in our consolidation assessment include the

significance of (i) our role as servicer, (ii) our holdings of

mortgage-backed securities issued by the securitization SPE,

and (iii) the rights of third-party variable interest holders.

The first step in our assessment is to determine whether we

hold a variable interest in the securitization SPE. We hold

variable interests in Agency and Non-agency securitization

SPEs through our holding of mortgage-backed securities

issued by the SPEs and/or our recourse obligations. Each SPE

in which we hold a variable interest is evaluated to determine

whether we are the primary beneficiary of the entity. For

Agency securitization transactions, our contractual role as

servicer does not give us the power to direct the activities that

most significantly affect the economic performance of the

SPEs. Thus, we are not the primary beneficiary of these

entities. For Non-agency securitization transactions, we would

be the primary beneficiary to the extent our servicing activities

give us the power to direct the activities that most

significantly affect the economic performance of the SPE and

we hold a more than insignificant variable interest in the

entity.

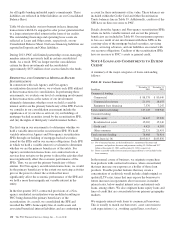

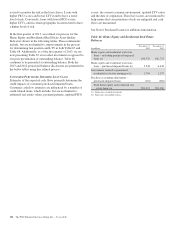

In the first quarter 2013, contractual provisions of a Non-

agency residential securitization were modified resulting in

PNC being deemed the primary beneficiary of the

securitization. As a result, we consolidated the SPE and

recorded the SPE’s home equity line of credit assets and

associated beneficial interest liabilities and are continuing to

account for these instruments at fair value. These balances are

included within the Credit Card and Other Securitization

Trusts balances line in Table 59. Additionally, creditors of the

SPE have no direct recourse to PNC.

Details about the Agency and Non-agency securitization SPEs

where we hold a variable interest and are not the primary

beneficiary are included in Table 60. Our maximum exposure

to loss as a result of our involvement with these SPEs is the

carrying value of the mortgage-backed securities, servicing

assets, servicing advances, and our liabilities associated with

our recourse obligations. Creditors of the securitization SPEs

have no recourse to PNC’s assets or general credit.

N

OTE

4L

OANS AND

C

OMMITMENTS TO

E

XTEND

C

REDIT

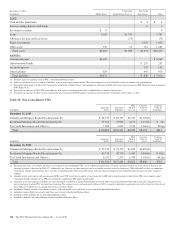

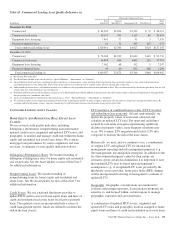

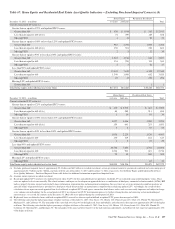

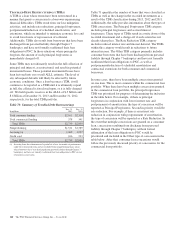

A summary of the major categories of loans outstanding

follows:

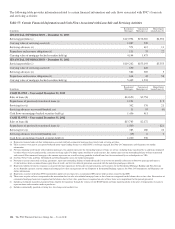

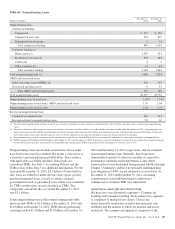

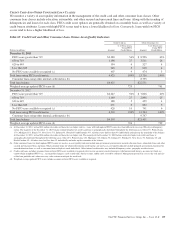

Table 61: Loans Summary

In millions

December 31

2013

December 31

2012

Commercial lending

Commercial $ 88,378 $ 83,040

Commercial real estate 21,191 18,655

Equipment lease financing 7,576 7,247

Total commercial lending 117,145 108,942

Consumer lending

Home equity 36,447 35,920

Residential real estate 15,065 15,240

Credit card 4,425 4,303

Other consumer 22,531 21,451

Total consumer lending 78,468 76,914

Total loans (a) (b) $195,613 $185,856

(a) Net of unearned income, net deferred loan fees, unamortized discounts and

premiums, and purchase discounts and premiums totaling $2.1 billion and $2.7

billion at December 31, 2013 and December 31, 2012, respectively.

(b) Future accretable yield related to purchased impaired loans is not included in the

loans summary.

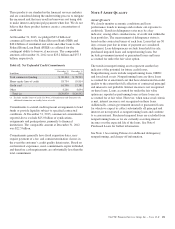

In the normal course of business, we originate or purchase

loan products with contractual features, when concentrated,

that may increase our exposure as a holder of those loan

products. Possible product features that may create a

concentration of credit risk would include a high original or

updated LTV ratio, terms that may expose the borrower to

future increases in repayments above increases in market

interest rates, below-market interest rates and interest-only

loans, among others. We also originate home equity loans and

lines of credit that are concentrated in our primary geographic

markets.

We originate interest-only loans to commercial borrowers.

This is usually to match our borrowers’ asset conversion to

cash expectations (e.g., working capital lines, revolvers).

130 The PNC Financial Services Group, Inc. – Form 10-K