PNC Bank 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

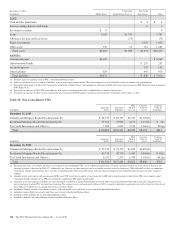

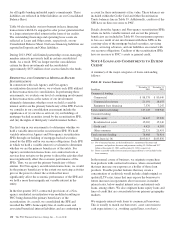

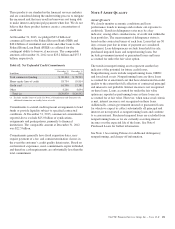

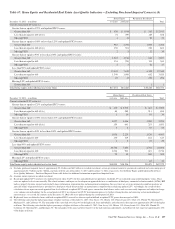

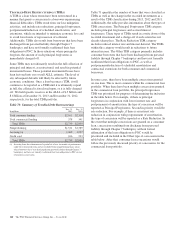

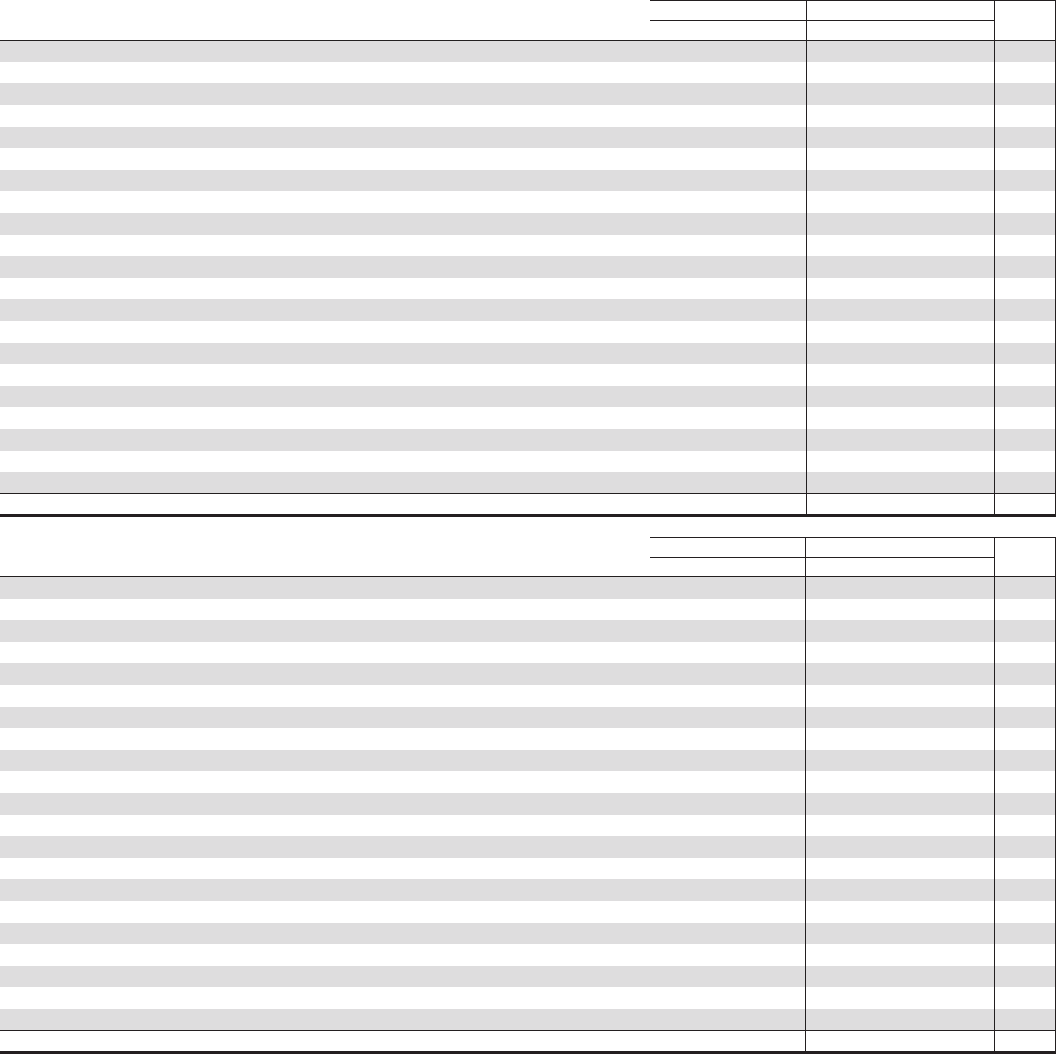

Table 68: Home Equity and Residential Real Estate Asset Quality Indicators – Purchased Impaired Loans (a)

Home Equity (b) (c) Residential Real Estate (b) (c)

TotalDecember 31, 2013 – in millions 1st Liens 2nd Liens

Current estimated LTV ratios (d)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 13 $ 435 $ 361 $ 809

Less than or equal to 660 15 215 296 526

Missing FICO 12 24 36

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 21 516 373 910

Less than or equal to 660 15 239 281 535

Missing FICO 14 14 28

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 15 202 197 414

Less than or equal to 660 12 101 163 276

Missing FICO 7613

Less than 90% and updated FICO scores:

Greater than 660 93 261 646 1,000

Less than or equal to 660 126 198 590 914

Missing FICO 111 4759

Missing LTV and updated FICO scores:

Greater than 660 11112

Less than or equal to 660 13 13

Missing FICO 33

Total home equity and residential real estate loans $312 $2,211 $3,025 $5,548

Home Equity (b) (c) Residential Real Estate (b) (c)

December 31, 2012 – in millions 1st Liens 2nd Liens Total

Current estimated LTV ratios (d)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 17 $ 791 $ 597 $1,405

Less than or equal to 660 17 405 498 920

Missing FICO 23 46 69

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 26 552 435 1,013

Less than or equal to 660 20 269 383 672

Missing FICO 18 23 41

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 14 140 216 370

Less than or equal to 660 14 99 182 295

Missing FICO 71118

Less than 90% and updated FICO scores:

Greater than 660 86 174 589 849

Less than or equal to 660 142 163 598 903

Missing FICO 2 8 39 49

Missing LTV and updated FICO scores:

Greater than 660 18 18

Less than or equal to 660 77

Missing FICO 99

Total home equity and residential real estate loans $338 $2,649 $3,651 $6,638

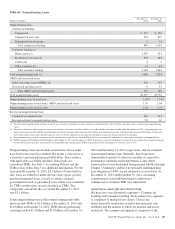

(a) Amounts shown represent outstanding balance. See Note 6 Purchased Loans for additional information.

(b) For the estimate of cash flows utilized in our purchased impaired loan accounting, other assumptions and estimates are made, including amortization of first lien balances, pre-payment

rates, etc., which are not reflected in this table.

(c) The following states had the highest percentage of purchased impaired loans at December 31, 2013: California 17%, Florida 16%, Illinois 11%, Ohio 8%, North Carolina 8%, and

Michigan 5%. The remainder of the states had lower than a 4% concentration of purchased impaired loans individually, and collectively they represent approximately 35% of the

purchased impaired portfolio. The following states had the highest percentage of purchased impaired loans at December 31, 2012: California 18%, Florida 15%, Illinois 12%, Ohio

7%, North Carolina 6% and Michigan 5%. The remainder of the states had lower than a 4% concentration of purchased impaired loans individually, and collectively they represent

approximately 37% of the purchased impaired portfolio.

(d) Based upon updated LTV (inclusive of combined loan-to-value (CLTV) for first and subordinate lien positions). Updated LTV are estimated using modeled property values. These

ratios are updated at least semi-annually. The related estimates and inputs are based upon an approach that uses a combination of third-party automated valuation models (AVMs), HPI

indices, property location, internal and external balance information, origination data and management assumptions. In cases where we are in an originated second lien position, we

generally utilize origination balances provided by a third-party which do not include an amortization assumption when calculating updated LTV. Accordingly, the results of these

calculations do not represent actual appraised loan level collateral or updated LTV based upon a current first lien balance, and as such, are necessarily imprecise and subject to change

as we enhance our methodology. In the second quarter of 2013, we enhanced our CLTV determination process by further refining the data and correcting certain methodological

inconsistencies. As a result, the amounts in the December 31, 2012 table were updated during the second quarter of 2013.

138 The PNC Financial Services Group, Inc. – Form 10-K