PNC Bank 2013 Annual Report Download - page 116

Download and view the complete annual report

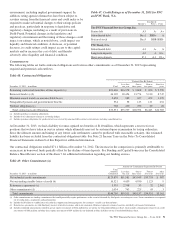

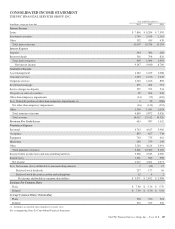

Please find page 116 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loans represented 61% of total assets at December 31, 2012

and 59% of total assets at December 31, 2011. Commercial

lending represented 59% of the loan portfolio at December 31,

2012 and 56% at December 31, 2011. Consumer lending

represented 41% of the loan portfolio at December 31, 2012

and 44% at December 31, 2011. Commercial real estate loans

represented 6% of total assets at both December 31, 2012 and

December 31, 2011.

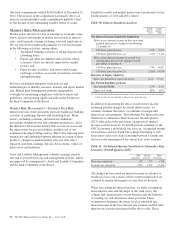

Investment Securities

The carrying amount of investment securities totaled $61.4

billion at December 31, 2012 compared to $60.6 billion at

December 31, 2011. The increase primarily reflected an

increase of $2.0 billion in available for sale asset-backed

securities, which was primarily due to net purchase activity,

and an increase of $.6 billion in available for sale non-agency

residential mortgage-backed securities due to increases in fair

value at December 31, 2012. These increases were partially

offset by a $1.7 billion decrease in held to maturity debt

securities due to principal payments. Investment securities

represented 20% of total assets at December 31, 2012 and

22% at December 31, 2011. Average investment securities

increased $1.1 billion to $60.8 billion in 2012 compared with

2011. Total investment securities comprised 24% of average

interest-earning assets for 2012 and 27% for 2011.

At December 31, 2012, the securities available for sale

portfolio included a net unrealized gain of $1.6 billion, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2011 was a net

unrealized loss of $41 million. As of December 31, 2012, the

amortized cost and fair value of held to maturity securities

were $10.4 billion and $10.9 billion, respectively, compared

to $12.1 billion and $12.5 billion, respectively, at

December 31, 2011. The weighted-average expected maturity

of the investment securities portfolio (excluding corporate

stocks and other) was 4.0 years at December 31, 2012 and 3.7

years at December 31, 2011.

Loans Held For Sale

Loans held for sale totaled $3.7 billion at December 31, 2012

compared with $2.9 billion at December 31, 2011.

For commercial mortgages held for sale designated at fair

value, we stopped originating these and have pursued

opportunities to reduce these positions. At December 31,

2012, the balance relating to these loans was $772 million,

compared to $843 million at December 31, 2011. For

commercial mortgages held for sale at lower of cost or fair

value, we sold $2.2 billion during 2012 compared with $2.4

billion in 2011. The increase in these loans to $620 million at

December 31, 2012, compared to $451 million at

December 31, 2011, was due to an increase in loans awaiting

sale to government agencies. We recognized total net gains of

$41 million in 2012 and $48 million in 2011 on the valuation

and sale of commercial mortgage loans held for sale, net of

hedges.

Residential mortgage loan origination volume was $15.2

billion in 2012 compared with $11.4 billion in 2011.

Substantially all such loans were originated under agency or

FHA standards. We sold $13.8 billion of loans and recognized

related gains of $747 million during 2012. The comparable

amounts for 2011 were $11.9 billion and $384 million,

respectively.

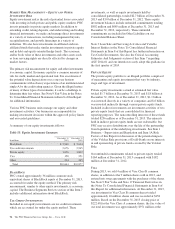

Asset Quality

Overall credit quality continued to improve during 2012.

Nonperforming loans declined $.3 billion, or 9%, to $3.3

billion as of December 31, 2012 from December 31, 2011.

Overall loan delinquencies decreased $.8 billion, or 18%, to

$3.7 billion at December 31, 2012 compared to the prior year

end. Net charge-offs decreased to $1.3 billion in 2012, a

decrease of $.3 billion, or 21%, compared to 2011.

The ALLL was $4.0 billion, or 2.17% of total loans and 124%

of nonperforming loans, as of December 31, 2012, compared

to $4.3 billion, or 2.73% of total loans and 122% of

nonperforming loans, as of December 31, 2011.

At December 31, 2012, our largest nonperforming asset was

$38 million in the Real Estate Rental and Leasing Industry

and our average nonperforming loan associated with

commercial lending was under $1 million.

Goodwill and Other Intangible Assets

Goodwill and other intangible assets totaled $10.9 billion at

December 31, 2012 and $10.1 billion at December 31, 2011.

During 2012, we recorded goodwill of $950 million and other

intangible assets of $180 million associated with the RBC

Bank (USA) acquisition. In the fourth quarter of 2012, we sold

certain deposits and assets of the Smartstreet business unit,

which was acquired by PNC as part of the RBC Bank (USA)

acquisition, which resulted in a reduction of goodwill and core

deposit intangibles by approximately $46 million and $13

million, respectively. Also in the fourth quarter of 2012, we

recorded a $45 million noncash charge for goodwill

impairment related to PNC’s Residential Mortgage Banking

reporting unit. See Note 2 Acquisition and Divestiture

Activity and Note 10 Goodwill and Other Intangible Assets in

the Notes To Consolidated Financial Statements included in

Item 8 of this Report and in our 2012 Form 10-K.

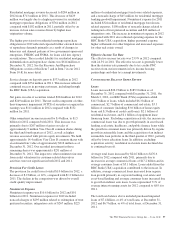

Funding Sources

Total funding sources were $254.0 billion at December 31,

2012 and $224.7 billion at December 31, 2011.

Total deposits increased $25.2 billion, or 13%, at December 31,

2012 to $213.1 billion compared to December 31, 2011. On

March 2, 2012, our RBC Bank (USA) acquisition added $18.1

billion of deposits, including $6.9 billion of money market, $6.7

billion of demand, $4.1 billion of retail certificates of deposit, and

$.4 billion of savings. Excluding acquisition activity, money

market and demand deposits increased during 2012, partially

offset by the runoff of maturing retail certificates of deposit.

98 The PNC Financial Services Group, Inc. – Form 10-K