PNC Bank 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

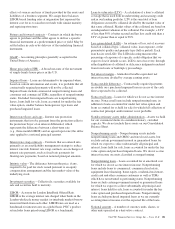

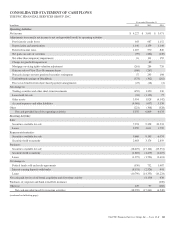

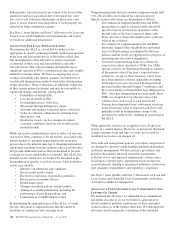

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

THE PNC FINANCIAL SERVICES GROUP, INC.

Shareholders’ Equity

In millions

Shares

Outstanding

Common

Stock

Common

Stock

Capital

Surplus -

Preferred

Stock

Capital

Surplus -

Common

Stock and

Other

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Treasury

Stock

Noncontrolling

Interests

Total

Equity

Balance at December 31, 2010 (a) 526 $2,682 $ 647 $12,057 $15,859 $(431) $(572) $2,596 $32,838

Net income 3,056 15 3,071

Other comprehensive income (loss), net of tax 326 326

Cash dividends declared

Common (604) (604)

Preferred (56) (56)

Preferred stock discount accretion 2 (2)

Common stock activity 1 1 10 11

Treasury stock activity (b) (36) 85 49

Preferred stock issuance – Series O (c) 988 988

Other 41 582 623

Balance at December 31, 2011 (a) 527 $2,683 $1,637 $12,072 $18,253 $(105) $(487) $3,193 $37,246

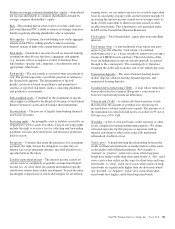

Net income (loss) 3,013 (12) 3,001

Other comprehensive income (loss), net of tax 939 939

Cash dividends declared

Common (820) (820)

Preferred (177) (177)

Preferred stock discount accretion 4 (4)

Common stock activity 1 7 45 52

Treasury stock activity (b) 51 (82) (31)

Preferred stock issuance – Series P (d) 1,482 1,482

Preferred stock issuance – Series Q (e) 467 467

Other 25 (419) (394)

Balance at December 31, 2012 (a) (f) 528 $2,690 $3,590 $12,193 $20,265 $ 834 $(569) $2,762 $41,765

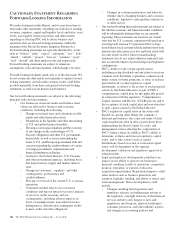

Net income 4,220 7 4,227

Other comprehensive income (loss), net of tax (398) (398)

Cash dividends declared

Common (911) (911)

Preferred (237) (237)

Preferred stock discount accretion 5 (5)

Redemption of noncontrolling interests (g) (7) (368) (375)

Common stock activity 2 8 97 105

Treasury stock activity 3 (47) 161 114

Preferred stock redemption – Series L (h) (150) (150)

Preferred stock issuance – Series R (i) 496 496

Other (j) 173 (712) (539)

Balance at December 31, 2013 (a) 533 $2,698 $3,941 $12,416 $23,325 $ 436 $(408) $1,689 $44,097

(a) The par value of our preferred stock outstanding was less than $.5 million at each date and, therefore, is excluded from this presentation.

(b) Net treasury stock activity totaled less than .5 million shares issued or redeemed.

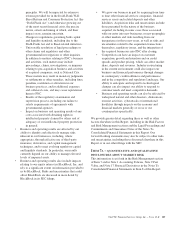

(c) 10,000 Series O preferred shares with a $1 par value were issued on July 20, 2011.

(d) 15,000 Series P preferred shares with a $1 par value were issued on April 24, 2012.

(e) 4,500 Series Q preferred shares with a $1 par value were issued on September 21, 2012 and 300 shares were issued on October 9, 2012.

(f) 5,001 Series M preferred shares with a $1 par value were issued and redeemed on December 10, 2012.

(g) Relates to the redemption of REIT preferred securities in the first quarter of 2013. See Note 14 Capital Securities of Subsidiary Trusts and Perpetual Trust Securities for additional

information.

(h) 1,500 Series L preferred shares with a $1 par value were redeemed on April 19, 2013.

(i) 5,000 Series R preferred shares with a $1 par value were issued on May 7, 2013.

(j) Includes an impact to noncontrolling interests for deconsolidation of limited partnership or non-managing member interests related to tax credit investments in the amount of $675

million during the second quarter of 2013. See Note 3 Loan Sale and Servicing Activities and Variable Interest Entities for additional information.

See accompanying Notes To Consolidated Financial Statements.

110 The PNC Financial Services Group, Inc. – Form 10-K