PNC Bank 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

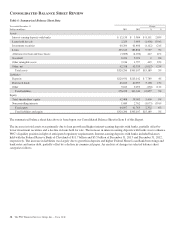

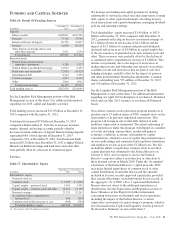

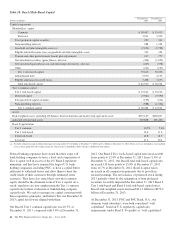

conditions and changes to regulatory capital requirements

under Basel III capital standards. Beginning in 2014, other

comprehensive income related to available for sale securities

(as well as pension and other post-retirement plans) are

included in PNC’s regulatory capital (subject to a phase-in

schedule) and, therefore will affect PNC’s regulatory capital

ratios. For additional information, see the Supervision and

Regulation section in Item 1 – Business and the Capital

portion of the Balance Sheet Review section in this Item 7 of

this Report.

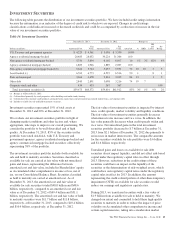

The duration of investment securities was 2.9 years at

December 31, 2013. We estimate that, at December 31, 2013,

the effective duration of investment securities was 3.0 years

for an immediate 50 basis points parallel increase in interest

rates and 2.8 years for an immediate 50 basis points parallel

decrease in interest rates. Comparable amounts at

December 31, 2012 were 2.3 years and 2.2 years, respectively.

We conduct a quarterly comprehensive security-level

impairment assessment on all securities. For securities in an

unrealized loss position, we determine whether the loss

represents OTTI. For debt securities that we neither intend to

sell nor believe we will be required to sell prior to expected

recovery, we recognize the credit portion of OTTI charges in

current earnings and include the noncredit portion of OTTI in

Net unrealized gains (losses) on OTTI securities on our

Consolidated Statement of Comprehensive Income and net of

tax in Accumulated other comprehensive income (loss) on our

Consolidated Balance Sheet. During 2013 and 2012 we

recognized OTTI credit losses of $16 million and $111

million, respectively. Substantially all of the credit losses

related to residential mortgage-backed and asset-backed

securities collateralized by non-agency residential loans.

If current housing and economic conditions were to

deteriorate from current levels, and if market volatility and

illiquidity were to deteriorate from current levels, or if market

interest rates were to increase or credit spreads were to widen

appreciably, the valuation of our investment securities

portfolio could be adversely affected and we could incur

additional OTTI credit losses that would impact our

Consolidated Income Statement.

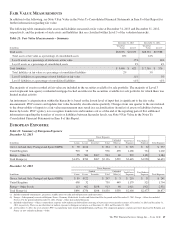

Additional information regarding our investment securities is

included in Note 8 Investment Securities and Note 9 Fair

Value in the Notes To Consolidated Financial Statements

included in Item 8 of this Report.

L

OANS

H

ELD FOR

S

ALE

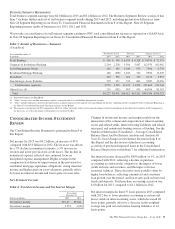

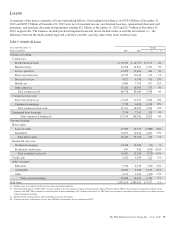

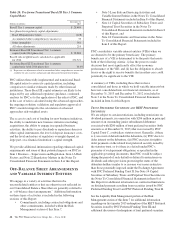

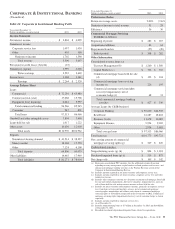

Table 15: Loans Held For Sale

In millions

December 31

2013

December 31

2012

Commercial mortgages at fair value $ 586 $ 772

Commercial mortgages at lower of cost or

fair value 281 620

Total commercial mortgages 867 1,392

Residential mortgages at fair value 1,315 2,096

Residential mortgages at lower of cost or

fair value 41 124

Total residential mortgages 1,356 2,220

Other 32 81

Total $2,255 $3,693

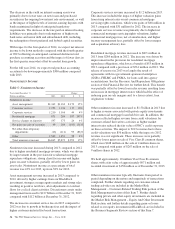

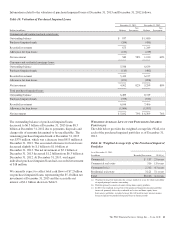

For commercial mortgages held for sale designated at fair

value, we stopped originating these and continue to pursue

opportunities to reduce these positions. At December 31,

2013, the balance relating to these loans was $586 million

compared to $772 million at December 31, 2012. For

commercial mortgages held for sale carried at lower of cost or

fair value, we sold $2.8 billion in 2013 compared to $2.2

billion in 2012. All of these loan sales were to government

agencies. Total gains of $79 million were recognized on the

valuation and sale of commercial mortgage loans held for sale,

net of hedges, in 2013, and $41 million in 2012.

Residential mortgage loan origination volume was $15.1

billion in 2013 compared to $15.2 billion in 2012.

Substantially all such loans were originated under agency or

Federal Housing Administration (FHA) standards. We sold

$14.7 billion of loans and recognized related gains of $568

million in 2013. The comparable amounts for 2012 were $13.8

billion and $747 million, respectively.

Interest income on loans held for sale was $157 million in

2013 and $168 million in 2012. These amounts are included in

Other interest income on our Consolidated Income Statement.

Additional information regarding our loan sale and servicing

activities is included in Note 3 Loan Sales and Servicing

Activities and Variable Interest Entities and Note 9 Fair Value

in our Notes To Consolidated Financial Statements included

in Item 8 of this Report.

G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

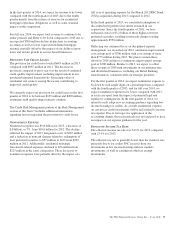

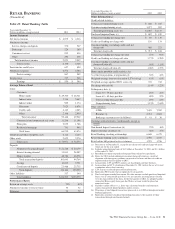

Goodwill and other intangible assets totaled $11.3 billion at

December 31, 2013 and $10.9 billion at December 31, 2012.

The increase of $.4 billion was primarily due to additions to

and changes in value of mortgage and other loan servicing

rights. See additional information regarding our goodwill and

intangible assets in Note 10 Goodwill and Other Intangible

Assets included in the Notes To Consolidated Financial

Statements in Item 8 of this Report.

44 The PNC Financial Services Group, Inc. – Form 10-K