PNC Bank 2013 Annual Report Download - page 106

Download and view the complete annual report

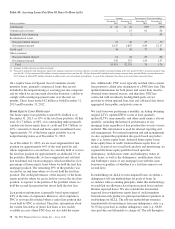

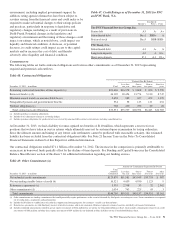

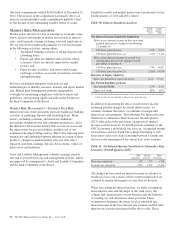

Please find page 106 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.had $18.8 billion pledged as collateral for borrowings, trust,

and other commitments. The level of liquid assets fluctuates

over time based on many factors, including market conditions,

loan and deposit growth and balance sheet management

activities.

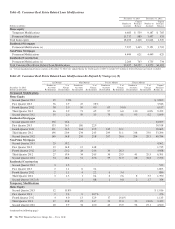

In addition to the customer deposit base, which has

historically provided the single largest source of relatively

stable and low-cost funding, the bank also obtains liquidity

through the issuance of traditional forms of funding including

long-term debt (senior notes and subordinated debt and FHLB

advances) and short-term borrowings (Federal funds

purchased, securities sold under repurchase agreements,

commercial paper issuances and other short-term borrowings).

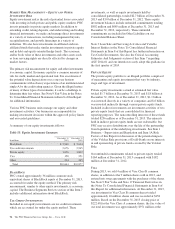

In 2004, PNC Bank, N.A. was authorized by its Board to offer

up to $20 billion in senior and subordinated unsecured debt

obligations with maturities of more than nine months.

Through December 31, 2013, PNC Bank, N.A. had issued

$18.9 billion of debt under this program including the

following during 2013:

• $750 million of fixed rate senior notes with a

maturity date of January 28, 2016. Interest is payable

semi-annually, at a fixed rate of .80%, on January 28

and July 28 of each year, beginning on July 28, 2013,

• $250 million of floating rate senior notes with a

maturity date of January 28, 2016. Interest is payable

at the 3-month LIBOR rate, reset quarterly, plus a

spread of .31%, on January 28, April 28, July 28, and

October 28 of each year, beginning on April 28,

2013,

• $750 million of subordinated notes with a maturity

date of January 30, 2023. Interest is payable semi-

annually, at a fixed rate of 2.950%, on January 30

and July 30 of each year, beginning on July 30, 2013,

• $1.4 billion of senior extendible floating rate bank

notes issued to an affiliate with an initial maturity

date of April 14, 2014, subject to the holder’s

monthly option to extend, and a final maturity date of

January 14, 2015. Interest is payable at the 3-month

LIBOR rate, reset quarterly, plus a spread of .225%,

which spread is subject to four potential one basis

point increases in the event of certain extensions of

maturity by the holder. Interest is payable on

March 14, June 14, September 14, and December 14

of each year, beginning on June 14, 2013,

• $645 million of floating rate senior notes with a

maturity date of April 29, 2016. Interest is payable at

the 3-month LIBOR rate, reset quarterly, plus a

spread of .32% on January 29, April 29, July 29 and

October 29 of each year, beginning on July 29, 2013,

• $800 million of senior extendible floating rate bank

notes with an initial maturity date of July 18, 2014,

subject to the holder’s monthly option to extend, and

a final maturity date of June 18, 2015. Interest is

payable at the 3-month LIBOR rate, reset quarterly,

plus a spread of .225%, which spread is subject to

four potential one basis point increases in the event

of certain extensions of maturity by the holder.

Interest is payable on March 20, June 20,

September 20 and December 20 of each year,

beginning on September 20, 2013,

• $750 million of subordinated notes with a maturity

date of July 25, 2023. Interest is payable semi-

annually, at a fixed rate of 3.80% on January 25 and

July 25 of each year, beginning on January 25, 2014,

• $750 million of fixed rate senior notes with a maturity

date of October 3, 2016. Interest is payable semi-

annually, at a fixed rate of 1.30% on April 3 and

October 3 of each year, beginning on April 3, 2014,

• $500 million of senior extendible floating rate bank

notes issued to an affiliate with an initial maturity

date of October 12, 2014, subject to the holder’s

monthly option to extend, and a final maturity date of

September 12, 2015. Interest is payable at the 3-

month LIBOR rate, reset quarterly, plus a spread of

.225%, which spread is subject to four potential one

basis point increases in the event of certain

extensions of maturity by the holder. Interest is

payable on March 12, June 12, September 12 and

December 12 of each year, beginning on

December 12, 2013,

• $750 million of fixed rate senior notes with a

maturity date of November 1, 2016. Interest is

payable semi-annually, at a fixed rate of 1.15% on

May 1 and November 1 of each year, beginning on

May 1, 2014,

• $500 million of subordinated notes with a maturity

date of November 1, 2025. Interest is payable semi-

annually, at a fixed rate of 4.20% on May 1 and

November 1 of each year, beginning on May 1, 2014,

and

• $600 million of senior extendible floating rate bank

notes issued to an affiliate with an initial maturity

date of December 7, 2014, subject to the holder’s

monthly option to extend, and a final maturity date of

November 7, 2015. Interest is payable at the 3-month

LIBOR rate, reset quarterly, plus a spread of .330%,

which spread is subject to four potential one basis

point increases in the event of certain extensions of

maturity by the holder. Interest is payable on

February 7, May 7, August 7 and November 7 of

each year, beginning on February 7, 2014.

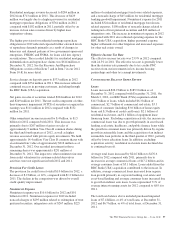

Total senior and subordinated debt of PNC Bank, N.A.

increased to $14.6 billion at December 31, 2013 from $9.3

billion at December 31, 2012 primarily due to $8.4 billion in

new borrowing less $2.9 billion in calls and maturities.

On January 16, 2014, PNC Bank, N.A. established a new bank

note program under which it may from time to time offer up to

$25 billion aggregate principal amount at any one time

outstanding of its unsecured senior and subordinated notes due

more than nine months from their date of issue (in the case of

88 The PNC Financial Services Group, Inc. – Form 10-K