PNC Bank 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Continuing to maintain and grow our deposit base as

a low-cost funding source,

• Prudent risk and capital management related to our

efforts to manage risk to acceptable levels and to

meet evolving regulatory capital and liquidity

standards,

• Actions we take within the capital and other financial

markets,

• The impact of legal and regulatory-related

contingencies, and

• The appropriateness of reserves needed for critical

accounting estimates and related contingencies.

For additional information, please see the Cautionary

Statement Regarding Forward-Looking Information section in

this Item 7 and Item 1A Risk Factors in this Report.

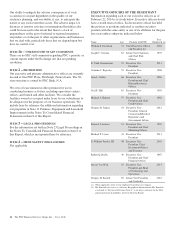

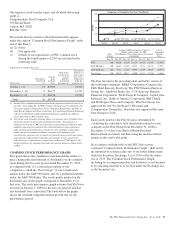

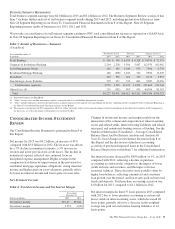

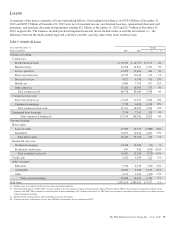

Table 1: Summary Financial Results

Year ended December 31 2013 2012

Net income (millions) $4,227 $3,001

Diluted earnings per common share from net

income $ 7.39 $ 5.30

Return from net income on:

Average common shareholders’ equity 10.88% 8.31%

Average assets 1.38% 1.02%

I

NCOME

S

TATEMENT

H

IGHLIGHTS

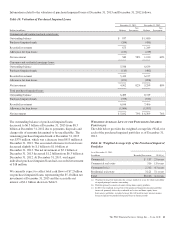

Our performance in 2013 included the following:

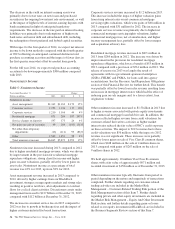

• Net income for 2013 of $4.2 billion increased 41%

compared to 2012. The increase was driven by a 7%

reduction of noninterest expense, a 3% increase in

revenue and a decline in provision for credit losses.

The increase in revenue was driven by higher

noninterest income, partially offset by lower net

interest income. For additional detail, please see the

Consolidated Income Statement Review section in

this Item 7.

• Net interest income of $9.1 billion for 2013

decreased 5% compared with 2012, as a result of a

decline in purchase accounting accretion, the impact

of lower yields on loans and securities, and the

impact of lower securities balances, partially offset

by higher loan balances, reflecting commercial and

consumer loan growth over the period, and lower

rates paid on borrowed funds and deposits.

• Net interest margin decreased to 3.57% for 2013

compared to 3.94% for 2012, reflecting lower yields

on earning assets and lower purchase accounting

accretion.

• Noninterest income of $6.9 billion for 2013 increased

$1.0 billion compared to 2012, primarily due to higher

residential mortgage revenue, which was driven by

improvement in the provision for residential mortgage

repurchase obligations, strong client fee income and

higher gains on asset valuations, partially offset by

lower gains on asset sales.

• The provision for credit losses decreased to $643

million for 2013 compared to $987 million for 2012

due to continued credit quality improvement, including

improvement in our purchased impaired loan portfolio.

• Noninterest expense of $9.8 billion for 2013

decreased 7% compared with 2012 as we continued

to focus on disciplined expense management. The

decline included lower noncash charges related to

redemption of trust preferred securities and the

impact of 2012 integration costs.

C

REDIT

Q

UALITY

H

IGHLIGHTS

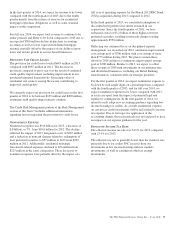

• Overall credit quality continued to improve during

2013.

• Nonperforming assets decreased $.3 billion, or 9%, to

$3.5 billion at December 31, 2013 compared to

December 31, 2012. Nonperforming assets to total

assets were 1.08% at December 31, 2013, compared

to 1.24% at December 31, 2012.

• Overall delinquencies of $2.5 billion decreased $1.3

billion, or 33%, compared with December 31, 2012.

• Net charge-offs of $1.1 billion in 2013 were down

16% compared to net charge-offs of $1.3 billion in

2012. Net charge-offs were 0.57% of average loans

in 2013 and 0.73% of average loans in 2012.

• The allowance for loan and lease losses was 1.84% of

total loans and 117% of nonperforming loans at

December 31, 2013, compared with 2.17% and 124%

at December 31, 2012, respectively.

• The above comparisons to December 31, 2012 were

impacted by alignment with interagency guidance in

the first quarter of 2013 on practices for loans and

lines of credit related to consumer lending. This had

the overall effect of (i) accelerating charge-offs,

(ii) increasing nonperforming loans and (iii) in the

case of loans accounted for under the fair value

option, increasing nonaccrual loans. See the Credit

Risk Management section of this Item 7 and Note 5

Asset Quality in the Notes To Consolidated Financial

Statements in Item 8 of this Report for further detail.

B

ALANCE

S

HEET

H

IGHLIGHTS

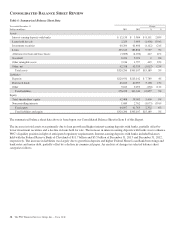

• Total loans increased by $9.8 billion to $196 billion at

December 31, 2013 compared to December 31, 2012.

• Total commercial lending increased by $8.2

billion, or 8%, from December 31, 2012, as a

result of growth in commercial loans to new

and existing customers.

• Total consumer lending increased $1.6 billion,

or 2%, from December 31, 2012, primarily

from growth in automobile and home equity

loans, partially offset by paydowns of

education loans.

• Total deposits increased by $7.8 billion to $221 billion

at December 31, 2013 compared with December 31,

2012, driven by growth in transaction deposits.

32 The PNC Financial Services Group, Inc. – Form 10-K