PNC Bank 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

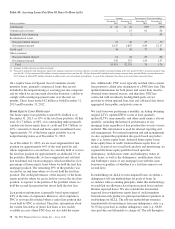

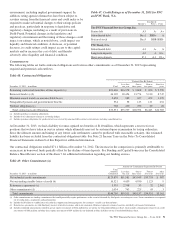

Table 46: Allowance for Loan and Lease Losses

Dollars in millions 2013 2012

January 1 $ 4,036 $ 4,347

Total net charge-offs (1,077) (1,289)

Provision for credit losses 643 987

Net change in allowance for unfunded loan

commitments and letters of credit 8 (10)

Other (1) 1

December 31 $ 3,609 $ 4,036

Net charge-offs to average loans (for the

year ended) (a) .57% .73%

Allowance for loan and lease losses to total

loans 1.84 2.17

Commercial lending net charge-offs $ (249) $ (359)

Consumer lending net charge-offs (828) (930)

Total net charge-offs $(1,077) $(1,289)

Net charge-offs to average loans (for the

year ended)

Commercial lending .22% .35%

Consumer lending (a) 1.07 1.24

(a) Includes charge-offs of $134 million taken pursuant to alignment with interagency

guidance on practices for loans and lines of credit related to consumer lending in the

first quarter of 2013.

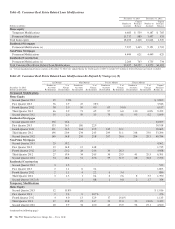

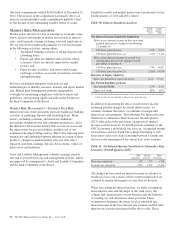

The provision for credit losses totaled $643 million for 2013

compared to $987 million for 2012. The primary driver of the

decrease to the provision was improved overall credit quality,

including improved commercial loan risk factors, lower

consumer loan delinquencies and improvements in expected cash

flows for our purchased impaired loans. For 2013, the provision

for commercial lending credit losses decreased by $102 million,

or 74%, from 2012. The provision for consumer lending credit

losses decreased $242 million, or 29%, from 2012.

At December 31, 2013, total ALLL to total nonperforming

loans was 117%. The comparable amount for December 31,

2012 was 124%. These ratios are 72% and 79%, respectively,

when excluding the $1.4 billion and $1.5 billion, respectively,

of ALLL at December 31, 2013 and December 31, 2012

allocated to consumer loans and lines of credit not secured by

residential real estate and purchased impaired loans. We have

excluded consumer loans and lines of credit not secured by

real estate as they are charged off after 120 to 180 days past

due and not placed on nonperforming status. Additionally, we

have excluded purchased impaired loans as they are

considered performing regardless of their delinquency status

as interest is accreted based on our estimate of expected cash

flows and additional allowance is recorded when these cash

flows are below recorded investment. See Table 35 within this

Credit Risk Management section for additional information.

The ALLL balance increases or decreases across periods in

relation to fluctuating risk factors, including asset quality

trends, charge-offs and changes in aggregate portfolio

balances. During 2013, improving asset quality trends,

including, but not limited to, delinquency status and

improving economic conditions, realization of previously

estimated losses through charge-offs, including the impact of

alignment with interagency guidance and overall portfolio

growth, combined to result in the ALLL balance declining $.4

billion, or 11% to $3.6 billion as of December 31, 2013

compared to December 31, 2012.

See Note 7 Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit and Note

6 Purchased Loans in the Notes To Consolidated Financial

Statements in Item 8 of this Report regarding changes in the

ALLL and in the allowance for unfunded loan commitments

and letters of credit.

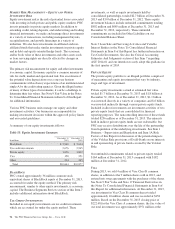

O

PERATIONAL

R

ISK

M

ANAGEMENT

Operational risk is the risk of loss resulting from inadequate or

failed internal processes or systems, human factors, or external

events. This includes losses that may arise as a result of non-

compliance with laws or regulations, failure to fulfill fiduciary

responsibilities, as well as litigation or other legal actions.

Operational risk may occur in any of our business activities and

manifests itself in various ways, including but not limited to:

• Transaction processing errors,

• Unauthorized transactions and fraud by employees or

third parties,

• Material disruption in business activities,

• System breaches and misuse of sensitive information,

• Regulatory or governmental actions, fines or

penalties, and

• Significant legal expenses, judgments or settlements.

PNC’s Operational Risk Management is inclusive of

Technology Risk Management, Compliance and Business

Continuity Risk. Operational Risk Management focuses on

balancing business needs, regulatory expectations and risk

management priorities through an adaptive and proactive

program that is designed to provide a strong governance

model, sound and consistent risk management processes and

transparent operational risk reporting across the enterprise.

The PNC Board determines the strategic approach to

operational risk via establishment of the operational risk

appetite and appropriate risk management structure. This

includes establishment of risk metrics and limits and a

reporting structure to identify, understand and manage

operational risks.

Executive Management has responsibility for operational risk

management. The executive management team is responsible

for monitoring significant risks, key controls and related

issues through management reporting and a governance

structure of risk committees and sub-committees.

Within Risk Management, Operational Risk Management

functions are responsible for developing and maintaining the

84 The PNC Financial Services Group, Inc. – Form 10-K