PNC Bank 2013 Annual Report Download - page 115

Download and view the complete annual report

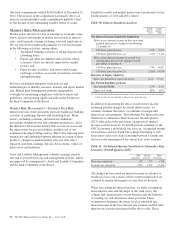

Please find page 115 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Residential mortgage revenue decreased to $284 million in

2012 from $713 million in 2011. This decrease of $429

million was largely due to a higher provision for residential

mortgage repurchase obligations of $761 million in 2012

compared with $102 million in 2011, partially offset by an

increase in loan sales revenue driven by higher loan

origination volume.

The higher provision for residential mortgage repurchase

obligations in 2012 reflected expected further elevated levels

of repurchase demands primarily as a result of changes in

behaviors and demand patterns of two government-sponsored

enterprises, FHLMC and FNMA, for loans sold into Agency

securitizations. The recorded liability for residential mortgage

indemnification and repurchase claims was $614 million at

December 31, 2012. See the Recourse And Repurchase

Obligations section of this Item 7 and in Item 7 in our 2012

Form 10-K for more detail.

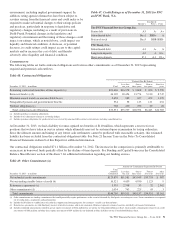

Service charges on deposits grew to $573 million in 2012

compared with $534 million in 2011. This increase reflected

continued success in growing customers, including through

the RBC Bank (USA) acquisition.

Net gains on sales of securities totaled $204 million for 2012

and $249 million for 2011. The net credit component of other-

than-temporary impairment (OTTI) of securities recognized in

earnings was $111 million in 2012 compared with $152

million for 2011.

Other noninterest income increased by $.4 billion, to $1.5

billion for 2012 compared with 2011. This increase was

primarily due to $267 million of gains on sales of

approximately 9 million Visa Class B common shares during

the third and fourth quarters of 2012, as well as higher

revenue associated with private equity investments. We held

approximately 14.4 million Visa Class B common shares with

an estimated fair value of approximately $916 million as of

December 31, 2012. Our recorded investment in those

remaining shares was approximately $251 million at

December 31, 2012. The impacts to other noninterest income

from credit valuations for customer-related derivatives

activities were not significant in both 2012 and 2011.

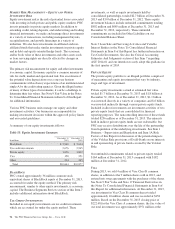

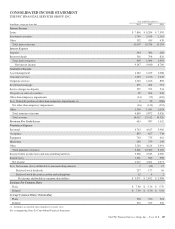

Provision For Credit Losses

The provision for credit losses totaled $1.0 billion for 2012, a

decrease of $.2 billion, or 14%, compared with $1.2 billion for

2011. The decline in the comparison was driven by overall

credit quality improvement.

Noninterest Expense

Noninterest expense was $10.6 billion for 2012 and $9.1

billion for 2011. Noninterest expense for 2012 included

noncash charges of $295 million related to redemption of trust

preferred securities, integration costs of $267 million, $225

million of residential mortgage foreclosure-related expenses,

and a noncash charge of $45 million for residential mortgage

banking goodwill impairment. Noninterest expense for 2011

included $324 million of residential mortgage foreclosure-

related expenses, $198 million of noncash charges related to

redemption of trust preferred securities and $42 million of

integration costs. The increase in noninterest expense in 2012

compared with 2011 also reflected operating expense for the

RBC Bank (USA) acquisition, higher personnel expense,

higher settlements for other litigation and increased expenses

for other real estate owned.

Effective Income Tax Rate

The effective income tax rate was 23.9% in 2012 compared

with 24.5% in 2011. The effective tax rate is generally lower

than the statutory rate primarily due to tax credits PNC

receives from our investments in low income housing

partnerships and other tax exempt investments.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

Loans

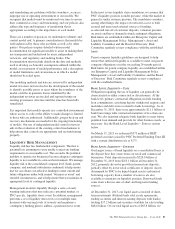

Loans increased $26.9 billion to $185.9 billion as of

December 31, 2012 compared with December 31, 2011. On

March 2, 2012, our RBC Bank (USA) acquisition added

$14.5 billion of loans, which included $6.3 billion of

commercial, $2.7 billion of commercial real estate, $3.3

billion of consumer (including $3.0 billion of home equity

loans and $.3 billion of credit card loans), $2.1 billion of

residential real estate, and $.1 billion of equipment lease

financing loans. Excluding acquisition activity, the increase in

commercial loans was due to growth primarily in asset-based

lending, real estate, healthcare, and public finance loans while

the growth in consumer loans was primarily driven by organic

growth in automobile loans and the acquisition of an indirect

automobile loan portfolio in the third quarter of 2012, partially

offset by lower education loans. In addition, excluding

acquisition activity, residential real estate loans declined due

to continued run-off.

Average total loans increased by $24.6 billion to $176.6

billion for 2012 compared with 2011, primarily due to

increases in average commercial loans of $17.2 billion and in

average consumer loans of $5.1 billion. Loans added from the

RBC Bank (USA) acquisition contributed to the increase. In

addition, average commercial loans increased from organic

loan growth primarily in corporate banking, real estate and

asset-based lending and average consumer loans increased due

to growth in indirect auto loans. Loans represented 71% of

average interest-earning assets for 2012 compared to 68% for

2011.

The total loan balance above included purchased impaired

loans of $7.4 billion, or 4% of total loans, at December 31,

2012 and $6.7 billion, or 4% of total loans, at December 31,

2011.

The PNC Financial Services Group, Inc. – Form 10-K 97