PNC Bank 2013 Annual Report Download - page 79

Download and view the complete annual report

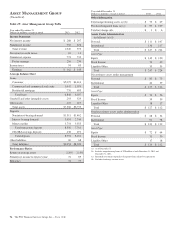

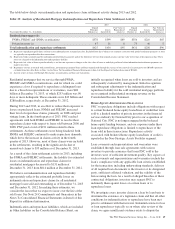

Please find page 79 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.This business segment consists primarily of non-strategic assets

obtained through acquisitions of other companies. The business

activity of this segment is to manage the wind-down of the

portfolio while maximizing the value and mitigating risk. In

March 2012, RBC Bank (USA) was acquired, which added

approximately $1.0 billion of residential real estate loans, $.2

billion of commercial/commercial real estate loans and $.2

billion of OREO assets as of the acquisition date. Of these

assets, $1.0 billion were deemed purchased impaired loans.

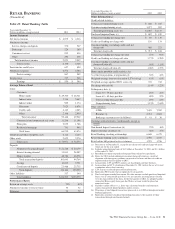

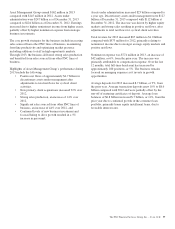

Non-Strategic Assets Portfolio had earnings of $379 million in

2013 compared with $237 million in 2012. Earnings increased

year-over-year due to lower provision for credit losses and

lower noninterest expense, partially offset by lower net

interest income.

Non-Strategic Assets Portfolio overview:

• Net interest income was $689 million in 2013

compared with $830 million in 2012. The decrease

was driven by lower purchase accounting accretion

as well as lower average loan balances.

• Noninterest income was $53 million in 2013

compared with $13 million in 2012. The increase was

driven by lower provision for estimated losses on

home equity repurchase obligations.

• The 2013 period reflected a benefit from the

provision for credit losses of $21 million compared to

an expense of $181 million in 2012 primarily due to

the increasing value of residential real estate.

• Noninterest expense in 2013 was $163 million

compared with $287 million in 2012. The decrease

was driven by lower commercial OREO write-downs

and lower shared service expenses on consumer loans.

• Average portfolio loans declined to $10.7 billion in

2013 compared with $12.4 billion in 2012. The

overall decline was driven by customer payment

activity and portfolio management activities to

reduce under-performing assets, partially offset by

the addition of loans from the March 2012 RBC

Bank (USA) acquisition.

• Nonperforming loans were $.7 billion at

December 31, 2013 and December 31, 2012. The

consumer lending portfolio comprised 90% of the

nonperforming loans in this segment at December 31,

2013. Nonperforming consumer loans increased $28

million from December 31, 2012, due to alignment

with interagency guidance in the first quarter of

2013. The commercial lending portfolio comprised

10% of the nonperforming loans as of December 31,

2013. Nonperforming commercial loans decreased

$71 million from December 31, 2012 due to

improved credit quality.

• Net charge-offs declined from $299 million in 2012

to $172 million in 2013 primarily due to lower

charge-offs on home equity loans.

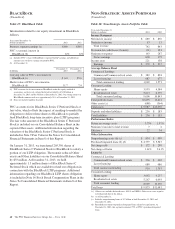

• At December 31, 2013, the liability for estimated

losses on repurchase and indemnification claims for

the Non-Strategic Assets Portfolio was $22 million

compared to $58 million at December 31, 2012. See

the Recourse and Repurchase Obligations section of

this Item 7 and Note 24 Commitments and

Guarantees in the Notes To Consolidated Financial

Statements included in Item 8 of this Report for

additional information.

C

RITICAL

A

CCOUNTING

E

STIMATES AND

J

UDGMENTS

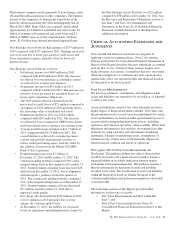

Our consolidated financial statements are prepared by

applying certain accounting policies. Note 1 Accounting

Policies in the Notes To Consolidated Financial Statements in

Item 8 of this Report describes the most significant accounting

policies that we use. Certain of these policies require us to

make estimates or economic assumptions that may vary under

different assumptions or conditions and such variations may

significantly affect our reported results and financial position

for the period or in future periods.

F

AIR

V

ALUE

M

EASUREMENTS

We must use estimates, assumptions, and judgments when

assets and liabilities are required to be recorded at, or adjusted

to reflect, fair value.

Assets and liabilities carried at fair value inherently result in a

higher degree of financial statement volatility. Fair values and

the information used to record valuation adjustments for certain

assets and liabilities are based on either quoted market prices or

are provided by independent third-party sources, including

appraisers and valuation specialists, when available. When such

third-party information is not available, we estimate fair value

primarily by using cash flow and other financial modeling

techniques. Changes in underlying factors, assumptions, or

estimates in any of these areas could materially impact our

future financial condition and results of operations.

PNC applies ASC 820 Fair Value Measurements and

Disclosures. This guidance defines fair value as the price that

would be received to sell a financial asset or paid to transfer a

financial liability in an orderly transaction between market

participants at the measurement date. This guidance requires a

three level hierarchy for disclosure of assets and liabilities

recorded at fair value. The classification of assets and liabilities

within the hierarchy is based on whether the inputs to the

valuation methodology used in the measurement are observable

or unobservable.

The following sections of this Report provide further

information on this type of activity:

• Fair Value Measurements included within this

Item 7, and

• Note 9 Fair Value included in the Notes To

Consolidated Financial Statements in Item 8 of this

Report.

The PNC Financial Services Group, Inc. – Form 10-K 61