PNC Bank 2013 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OREO

AND

F

ORECLOSED

A

SSETS

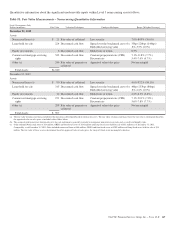

The amounts below for OREO and foreclosed assets represent

the carrying value of OREO and foreclosed assets for which

valuation adjustments were recorded subsequent to the

transfer to OREO and foreclosed assets. Valuation

adjustments are based on the fair value less cost to sell of the

property. Fair value is based on appraised value or sales price.

The appraisal process for OREO and foreclosed properties is

the same as described above for nonaccrual loans. In instances

where we have agreed to sell the property to a third party, the

fair value is based on the contractual sale price adjusted for

costs to sell. The significant unobservable inputs for OREO

and foreclosed assets are the appraised value or the sales price.

The estimated costs to sell are incremental direct costs to

transact a sale such as broker commissions, legal, closing

costs and title transfer fees. The costs must be essential to the

sale and would not have been incurred if the decision to sell

had not been made. The costs to sell are based on costs

associated with our actual sales of commercial and residential

OREO and foreclosed assets, which are assessed annually.

L

ONG

-L

IVED

A

SSETS

H

ELD FOR

S

ALE

The amounts below for Long-lived assets held for sale

represent the carrying value of the asset for which valuation

adjustments were recorded during the current year and

subsequent to the transfer to Long-lived assets held for sale.

Valuation adjustments are based on the fair value of the

property less an estimated cost to sell. Fair value is determined

either by a recent appraisal, recent sales offer or changes in

market or property conditions. Appraisals are provided by

licensed or certified appraisers. Where we have agreed to sell

the property to a third party, the fair value is based on the

contractual sale price. The significant unobservable inputs for

Long-lived assets held for sale are the appraised value, the

sales price or the changes in market or property conditions.

Changes in market or property conditions are subjectively

determined by management through observation of the

physical condition of the property along with the condition of

properties in the surrounding market place. The availability

and recent sales of similar properties is also considered. The

range of fair values can vary significantly as this category

often includes smaller properties such as offsite ATM

locations and smaller rural branches up to large commercial

buildings, operation centers or urban branches.

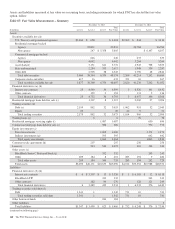

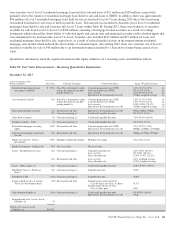

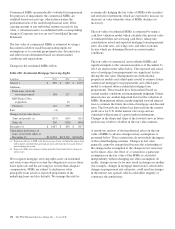

Table 90: Fair Value Measurements – Nonrecurring

Fair Value

In millions

December 31

2013

December 31

2012

Assets (a)

Nonaccrual loans $ 35 $158

Loans held for sale 224 315

Equity investments 6 12

Commercial mortgage servicing rights 543 191

OREO and foreclosed assets 181 207

Long-lived assets held for sale 51 24

Total assets $1,040 $907

Year ended December 31

In millions

Gains (Losses)

2013 2012 2011

Assets

Nonaccrual loans $ (8) $ (68) $ (49)

Loans held for sale (7) (4) (2)

Equity investments (1) (2)

Commercial mortgage servicing rights 88 (5) (157)

OREO and foreclosed assets (26) (73) (71)

Long-lived assets held for sale (40) (20) (5)

Total assets $ 6 $(170) $(286)

(a) All Level 3 as of December 31, 2013 and 2012.

166 The PNC Financial Services Group, Inc. – Form 10-K