PNC Bank 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

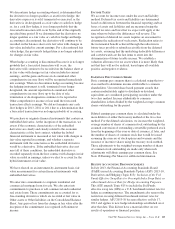

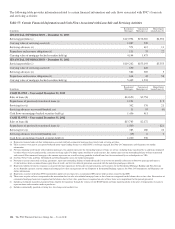

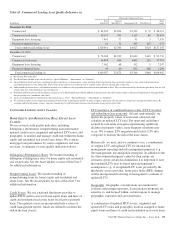

The following table provides information related to certain financial information and cash flows associated with PNC’s loan sale

and servicing activities:

Table 57: Certain Financial Information and Cash Flows Associated with Loan Sale and Servicing Activities

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

FINANCIAL INFORMATION – December 31, 2013

Servicing portfolio (c) $113,994 $176,510 $4,902

Carrying value of servicing assets (d) 1,087 549

Servicing advances (e) 571 412 11

Repurchase and recourse obligations (f) 131 33 22

Carrying value of mortgage-backed securities held (g) 4,144 1,475

FINANCIAL INFORMATION – December 31, 2012

Servicing portfolio (c) $119,262 $153,193 $5,353

Carrying value of servicing assets (d) 650 420

Servicing advances (e) 582 505 5

Repurchase and recourse obligations (f) 614 43 58

Carrying value of mortgage-backed securities held (g) 5,445 1,533

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

CASH FLOWS – Year ended December 31, 2013

Sales of loans (h) $14,650 $2,754

Repurchases of previously transferred loans (i) 1,191 $ 9

Servicing fees (j) 362 176 21

Servicing advances recovered/(funded), net 11 93 (6)

Cash flows on mortgage-backed securities held (g) 1,456 411

CASH FLOWS – Year ended December 31, 2012

Sales of loans (h) $13,783 $2,172

Repurchases of previously transferred loans (i) 1,500 $21

Servicing fees (j) 383 180 22

Servicing advances recovered/(funded), net (19) 6 3

Cash flows on mortgage-backed securities held (g) 1,220 536

(a) Represents financial and cash flow information associated with both commercial mortgage loan transfer and servicing activities.

(b) These activities were part of an acquired brokered home equity lending business in which PNC is no longer engaged. See Note 24 Commitments and Guarantees for further

information.

(c) For our continuing involvement with residential mortgages, this amount represents the outstanding balance of loans we service, including loans transferred by us and loans originated

by others where we have purchased the associated servicing rights. For home equity loan/line of credit transfers, this amount represents the outstanding balance of loans transferred

and serviced. For commercial mortgages, this amount represents our overall servicing portfolio in which loans have been transferred by us or third parties to VIEs.

(d) See Note 9 Fair Value and Note 10 Goodwill and Other Intangible Assets for further information.

(e) Pursuant to certain contractual servicing agreements, represents outstanding balance of funds advanced (i) to investors for monthly collections of borrower principal and interest,

(ii) for borrower draws on unused home equity lines of credit, and (iii) for collateral protection associated with the underlying mortgage collateral.

(f) Represents liability for our loss exposure associated with loan repurchases for breaches of representations and warranties for our Residential Mortgage Banking and Non-Strategic

Assets Portfolio segments, and our commercial mortgage loss share arrangements for our Corporate & Institutional Banking segment. See Note 24 Commitments and Guarantees for

further information.

(g) Represents securities held where PNC transferred to and/or services loans for a securitization SPE and we hold securities issued by that SPE.

(h) There were no gains or losses recognized on the transaction date for sales of residential mortgage loans as these loans are recognized on the balance sheet at fair value. For transfers of

commercial mortgage loans not recognized on the balance sheet at fair value, gains/losses recognized on sales of these loans were insignificant for the periods presented.

(i) Includes government insured or guaranteed loans eligible for repurchase through the exercise of our ROAP option and loans repurchased due to breaches of origination covenants or

representations and warranties made to purchasers.

(j) Includes contractually specified servicing fees, late charges and ancillary fees.

126 The PNC Financial Services Group, Inc. – Form 10-K