PNC Bank 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

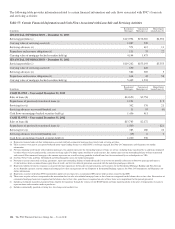

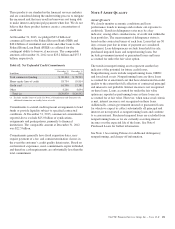

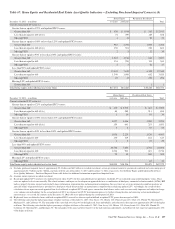

December 31, 2012 Credit Card Tax Credit

In millions Market Street Securitization Trust (e) Investments Total

Assets

Cash and due from banks $4 $ 4

Interest-earning deposits with banks 66

Investment securities $ 9 9

Loans 6,038 $1,743 7,781

Allowance for loan and lease losses (75) (75)

Equity investments 1,429 1,429

Other assets 536 31 714 1,281

Total assets $6,583 $1,699 $2,153 $10,435

Liabilities

Commercial paper $6,045 $ 6,045

Other borrowed funds $ 257 257

Accrued expenses 132 132

Other liabilities 529 447 976

Total liabilities $6,574 $ 836 $ 7,410

(a) Amounts represent carrying value on PNC’s Consolidated Balance Sheet.

(b) Difference between total assets and total liabilities represents the equity portion of the VIE or intercompany assets and liabilities which are eliminated in consolidation.

(c) During the fourth quarter of 2013, PNC finalized the wind down of Market Street. All commitments and loans of Market Street have been assigned to PNC Bank, National Association

(PNC Bank, N.A.).

(d) During the first quarter of 2013, PNC consolidated a Non-agency securitization trust due to modification of contractual provisions.

(e) During the first quarter of 2012, the last securitization series issued by the SPE matured, resulting in the zero balance of liabilities at December 31, 2012.

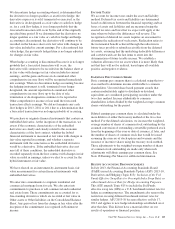

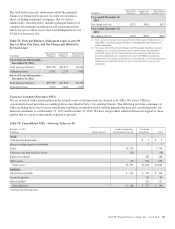

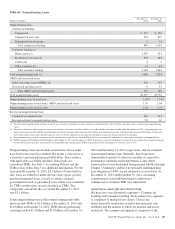

Table 60: Non-Consolidated VIEs

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC

Risk of

Loss (a)

Carrying

Value of

Assets

Carrying

Value of

Liabilities

December 31, 2013

Commercial Mortgage-Backed Securitizations (b) $ 65,757 $ 65,757 $1,747 $1,747(d)

Residential Mortgage-Backed Securitizations (b) 37,962 37,962 4,171 4,171(d) $ 5(f)

Tax Credit Investments and Other (c) 7,086 2,622 2,134 2,160(e) 826(g)

Total $110,805 $106,341 $8,052 $8,078 $831

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC

Risk of

Loss (a)

Carrying

Value of

Assets

Carrying

Value of

Liabilities

December 31, 2012

Commercial Mortgage-Backed Securitizations (b) $ 72,370 $ 72,370 $1,829 $1,829(d)

Residential Mortgage-Backed Securitizations (b) 42,719 42,719 5,456 5,456(d) $ 90(f)

Tax Credit Investments and Other (c) 6,232 2,375 1,536 1,555(e) 642(g)

Total $121,321 $117,464 $8,821 $8,840 $732

(a) This represents loans, investments and other assets related to non-consolidated VIEs, net of collateral (if applicable). Our total exposure related to our involvement in loan sale and

servicing activities is disclosed in Table 57. Additionally, we also invest in other mortgage and asset-backed securities issued by third-party VIEs with which we have no continuing

involvement. Further information on these securities is included in Note 8 Investment Securities and values disclosed represent our maximum exposure to loss for those securities’

holdings.

(b) Amounts reflect involvement with securitization SPEs where PNC transferred to and/or services loans for an SPE and we hold securities issued by that SPE. Asset amounts equal

outstanding liability amounts of the SPEs due to limited availability of SPE financial information.

(c) Aggregate assets and aggregate liabilities are based on limited availability of financial information associated with certain acquired partnerships and certain LLCs engaged in solar

power generation to which PNC provides lease financing. The aggregate assets and aggregate liabilities of LLCs engaged in solar power generation may not be reflective of the size of

these VIEs due to differences in classification of leases by these entities.

(d) Included in Trading securities, Investment securities, Other intangible assets and Other assets on our Consolidated Balance Sheet.

(e) Included in Loans, Equity investments and Other assets on our Consolidated Balance Sheet.

(f) Included in Other liabilities on our Consolidated Balance Sheet.

(g) Included in Deposits and Other liabilities on our Consolidated Balance Sheet.

128 The PNC Financial Services Group, Inc. – Form 10-K