PNC Bank 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

USINESS

S

EGMENT

H

IGHLIGHTS

Total business segment earnings were $4.0 billion in 2013 and $3.4 billion in 2012. The Business Segments Review section of this

Item 7 includes further analysis of our business segment results during 2013 and 2012, including presentation differences from

Note 26 Segment Reporting in our Notes To Consolidated Financial Statements in Item 8 of this Report. Note 26 Segment

Reporting presents results of businesses for 2013, 2012 and 2011.

We provide a reconciliation of total business segment earnings to PNC total consolidated net income as reported on a GAAP basis

in Note 26 Segment Reporting in our Notes To Consolidated Financial Statements in Item 8 of this Report.

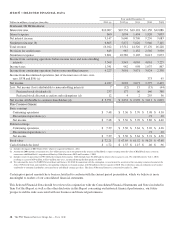

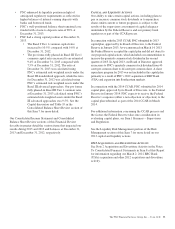

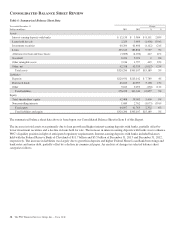

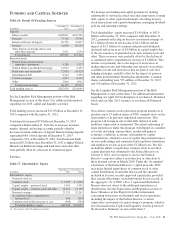

Table 3: Results of Businesses – Summary

(Unaudited)

Year ended December 31

In millions

Net Income (Loss) Revenue Average Assets (a)

2013 2012 2013 2012 2013 2012

Retail Banking $ 550 $ 596 $ 6,100 $ 6,328 $ 74,971 $ 72,573

Corporate & Institutional Banking 2,264 2,328 5,506 5,697 112,970 102,962

Asset Management Group 162 145 1,040 973 7,366 6,735

Residential Mortgage Banking 148 (308) 1,100 526 9,896 11,529

BlackRock 469 395 621 512 6,272 5,857

Non-Strategic Assets Portfolio 379 237 742 843 9,987 12,050

Total business segments 3,972 3,393 15,109 14,879 221,462 211,706

Other (b) (c) (d) 255 (392) 903 633 84,304 83,319

Total $4,227 $3,001 $16,012 $15,512 $305,766 $295,025

(a) Period-end balances for BlackRock.

(b) “Other” average assets include investment securities associated with asset and liability management activities.

(c) “Other” includes differences between the total business segment financial results and our total consolidated net income. Additional detail is included in Note 26 Segment Reporting in

the Notes To Consolidated Financial Statements in Item 8 of this Report.

(d) The increase in net income for 2013 compared to 2012 for “Other” primarily reflects lower noncash charges related to redemptions of trust preferred securities in 2013 compared to

the prior year, as well as the impact of integration costs recorded in 2012.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Our Consolidated Income Statement is presented in Item 8 of

this Report.

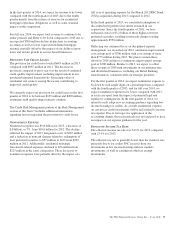

Net income for 2013 was $4.2 billion, an increase of 41%

compared with $3.0 billion for 2012. The increase was driven

by a 7% decline in noninterest expense, a 3% increase in

revenue and lower provision for credit losses. The decline in

noninterest expense reflected our continued focus on

disciplined expense management. Higher revenue in the

comparison was driven by improvement in the provision for

residential mortgage repurchase obligations, strong client fee

income and higher gains on asset valuations, partially offset

by lower net interest income and lower gains on asset sales.

N

ET

I

NTEREST

I

NCOME

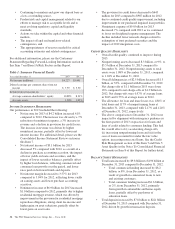

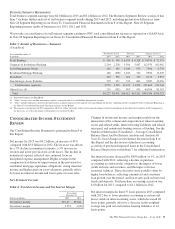

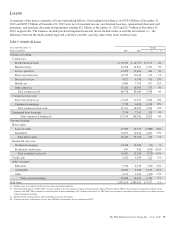

Table 4: Net Interest Income and Net Interest Margin

Year ended

December 31

Dollars in millions 2013 2012

Net interest income $9,147 $9,640

Net interest margin 3.57% 3.94%

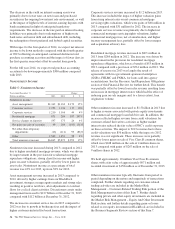

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding. See the

Statistical Information (Unaudited) – Average Consolidated

Balance Sheet And Net Interest Analysis and Analysis Of

Year-To-Year Changes in Net Interest Income in Item 8 of

this Report and the discussion of purchase accounting

accretion of purchased impaired loans in the Consolidated

Balance Sheet review in this Item 7 for additional information.

Net interest income decreased by $493 million, or 5%, in 2013

compared with 2012, reflecting a decline in purchase

accounting accretion in the comparison, the impact of lower

yields on loans and securities, and the impact of lower

securities balances. These decreases were partially offset by

higher loan balances, reflecting commercial and consumer

loan growth over the period, and lower rates paid on borrowed

funds and deposits. Total purchase accounting accretion was

$.8 billion for 2013 compared to $1.1 billion in 2012.

Net interest margin declined 37 basis points in 2013 compared

with 2012 due to lower purchase accounting accretion and

lower yields on interest-earning assets, which decreased 48

basis points, partially offset by a decrease in the weighted-

average rate paid on total interest-bearing liabilities of 14

basis points.

The PNC Financial Services Group, Inc. – Form 10-K 35