PNC Bank 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.R

ECENTLY

I

SSUED

A

CCOUNTING

S

TANDARDS

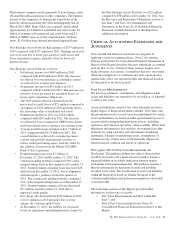

In January 2014, the Financial Accounting Standards Board

(FASB) issued Accounting Standards Update (ASU) 2014-04,

Receivables – Troubled Debt Restructurings by Creditors

(Subtopic 310-40): Reclassification of Residential Real Estate

Collateralized Consumer Mortgage Loans upon Foreclosure.

This ASU clarifies that an in substance repossession or

foreclosure occurs, and a creditor is considered to have received

physical possession of residential real estate property

collateralizing a consumer mortgage loan, upon (1) the creditor

obtaining legal title to the residential real estate property upon

completion of a foreclosure or (2) the borrower conveying all

interest in the residential real estate property to the creditor to

satisfy the loan through completion of a deed in lieu of

foreclosure or through a similar legal agreement. This ASU will

also require additional disclosures, including: (1) the amount of

foreclosed residential real estate property held by the creditor

and (2) the recorded investment in consumer mortgage loans

collateralized by residential real estate properties that are in the

process of foreclosure. This ASU is effective for annual

periods, and interim reporting periods within those annual

periods, beginning after December 15, 2014. This ASU may be

adopted using either a modified retrospective transition method

or a prospective transition method. Early adoption is permitted.

This guidance is effective as of January 1, 2015 and we do not

expect this ASU to have a material effect on our results of

operations or financial position.

In January 2014, the FASB issued ASU 2014-01, Investments

– Equity Method and Joint Ventures (Topic 323): Accounting

for Investments in Qualified Affordable Housing Projects.

This ASU provides guidance on accounting for investments in

flow-through limited liability entities that manage or invest in

affordable housing projects that qualify for the low-income

housing tax credit. If certain criteria are satisfied, investment

amortization, net of tax credits, may be recognized in the

income statement as a component of income taxes attributable

to continuing operations under the proportional amortization

method. This ASU is effective for annual periods, and interim

reporting periods within those annual periods, beginning after

December 15, 2014. Retrospective application is required and

early adoption is permitted. We intend to early adopt this

guidance in the first quarter of 2014 and are currently

assessing its impact.

In July 2013, the FASB issued ASU 2013-11, Income Taxes

(Topic 740): Presentation of an Unrecognized Tax Benefit

When a Net Operating Loss Carryforward, a Similar Tax

Loss, or a Tax Credit Carryforward Exists. This ASU clarifies

current guidance to require that an unrecognized tax benefit or

a portion thereof be presented in the statement of financial

position as a reduction to a deferred tax asset for a net

operating loss (NOL) carryforward, similar tax loss, or a tax

credit carryforward except when an NOL carryforward,

similar tax loss, or tax credit carryforward is not available

under the tax law of the applicable jurisdiction to settle any

additional income taxes that would result from the

disallowance of a tax position. In such a case, the

unrecognized tax benefit would be presented in the statement

of financial position as a liability. No additional recurring

disclosures are required by this ASU. This ASU is effective

for fiscal years, and interim periods within those years,

beginning after December 15, 2013. Early adoption is

permitted with prospective application to all unrecognized tax

benefits that exist at the effective date. Retrospective

application is also permitted. This guidance is effective as of

January 1, 2014 and we do not expect this ASU to have a

material effect on our results of operations or financial

position.

In June 2013, the FASB issued ASU 2013-08, Financial

Services – Investment Companies (Topic 946): Amendments

to the Scope, Measurement and Disclosure Requirement. This

ASU modifies the guidance in ASC 946 for determining

whether an entity is an investment company, as well as the

measurement and disclosure requirements for investment

companies. The ASU does not change current accounting

where a noninvestment company parent retains the specialized

accounting applied by an investment company subsidiary in

consolidation. ASU 2013-08 will be applied prospectively for

all periods beginning after December 15, 2013. We do not

expect this ASU to have a material effect on our results of

operations or financial position.

In March 2013, the FASB issued ASU 2013-05, Foreign

Currency Matters (Topic 830): Parent’s Accounting for the

Cumulative Translation Adjustment upon Derecognition of

Certain Subsidiaries or Groups of Assets within a Foreign

Entity or of an Investment in a Foreign Entity. This ASU

clarifies the timing of release of Currency Translation

Adjustments (CTA) from Accumulated Other Comprehensive

Income upon deconsolidation or derecognition of a foreign

entity, subsidiary or a group of assets within a foreign entity and

in a step acquisition. ASU 2013-05 will be applied

prospectively for all periods beginning after December 15, 2013

and early adoption is permitted. We do not expect this ASU to

have an effect on our results of operations or financial position.

In February 2013, the FASB issued ASU 2013-04, Liabilities

(Topic 405): Obligations Resulting from Joint and Several

Liability Arrangements for Which the Total Amount of the

Obligation is Fixed at the Reporting Date. This ASU requires

entities to measure obligations resulting from joint and several

liability arrangements for which the total amount of the

obligation is fixed at the reporting date, as the sum of the

following: a) the amount the reporting entity agreed to pay on

the basis of its arrangement with its co-obligors and b) any

additional amount the reporting entity expects to pay on behalf

of its co-obligors. Required disclosures include a description of

the joint and several arrangements and the total outstanding

amount of the obligation for all joint parties. ASU 2013-04 is

effective for fiscal years, and interim periods within those years,

beginning after December 15, 2013 and should be applied

retrospectively to joint and several obligations existing at the

The PNC Financial Services Group, Inc. – Form 10-K 65