PNC Bank 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F

UNDING AND

C

APITAL

S

OURCES

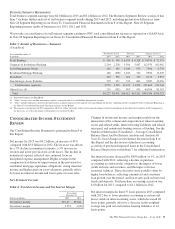

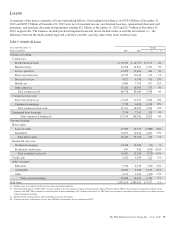

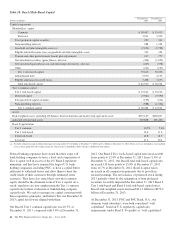

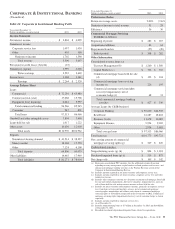

Table 16: Details Of Funding Sources

In millions

December 31

2013

December 31

2012

Deposits

Money market $108,631 $102,706

Demand 77,756 73,995

Retail certificates of deposit 20,795 23,837

Savings 11,078 10,350

Time deposits in foreign offices and

other time deposits 2,671 2,254

Total deposits 220,931 213,142

Borrowed funds

Federal funds purchased and

repurchase agreements 4,289 3,327

Federal Home Loan Bank borrowings 12,912 9,437

Bank notes and senior debt 12,603 10,429

Subordinated debt 8,244 7,299

Commercial paper 4,997 8,453

Other 3,060 1,962

Total borrowed funds 46,105 40,907

Total funding sources $267,036 $254,049

See the Liquidity Risk Management portion of the Risk

Management section of this Item 7 for additional information

regarding our 2013 capital and liquidity activities.

Total funding sources increased $13.0 billion at December 31,

2013 compared with December 31, 2012.

Total deposits increased $7.8 billion at December 31, 2013

compared with December 31, 2012 due to increases in money

market, demand, and savings accounts, partially offset by

decreases in retail certificates of deposit. Interest-bearing deposits

represented 68% of total deposits at December 31, 2013

compared to 67% at December 31, 2012. Total borrowed funds

increased $5.2 billion since December 31, 2012 as higher Federal

Home Loan Bank borrowings and bank notes and senior debt

were partially offset by a decrease in commercial paper.

C

APITAL

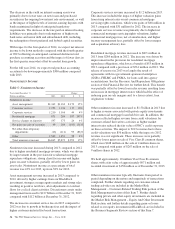

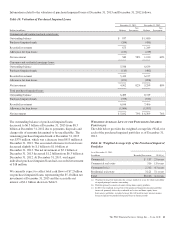

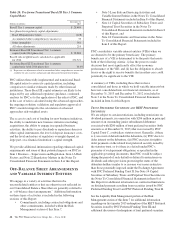

Table 17: Shareholders’ Equity

In millions

December 31

2013

December 31

2012

Shareholders’ equity

Preferred stock (a)

Common stock $ 2,698 $ 2,690

Capital surplus – preferred stock 3,941 3,590

Capital surplus – common stock and other 12,416 12,193

Retained earnings 23,325 20,265

Accumulated other comprehensive

income (loss) 436 834

Common stock held in treasury at cost (408) (569)

Total shareholders’ equity $42,408 $39,003

(a) Par value less than $.5 million at each date.

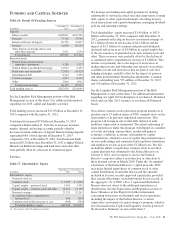

We manage our funding and capital positions by making

adjustments to our balance sheet size and composition, issuing

debt, equity or other capital instruments, executing treasury

stock transactions and capital redemptions, managing dividend

policies and retaining earnings.

Total shareholders’ equity increased $3.4 billion, to $42.4

billion at December 31, 2013 compared with December 31,

2012, primarily reflecting an increase in retained earnings of

$3.1 billion (driven by net income of $4.2 billion and the

impact of $1.1 billion of common and preferred dividends

declared) and an increase of $.6 billion in capital surplus due

to the net issuances of preferred stock and common stock and

other. These increases were partially offset by the decline of

accumulated other comprehensive income of $.4 billion. This

decline was primarily due to the impact of an increase in

market interest rates and widening asset spreads on securities

available for sale and derivatives that are part of cash flow

hedging strategies, partially offset by the impact of pension

and other postretirement benefit plan adjustments. Common

shares outstanding were 533 million at December 31, 2013

and 528 million at December 31, 2012.

See the Liquidity Risk Management portion of the Risk

Management section of this Item 7 for additional information

regarding our April 2013 redemption of our Series L Preferred

Stock and our May 2013 issuance of our Series R Preferred

Stock.

Our current common stock repurchase program permits us to

purchase up to 25 million shares of PNC common stock on the

open market or in privately negotiated transactions. This

program will remain in effect until fully utilized or until

modified, superseded or terminated. The extent and timing of

share repurchases under this program will depend on a number

of factors including, among others, market and general

economic conditions, economic and regulatory capital

considerations, alternative uses of capital, the potential impact

on our credit ratings and contractual and regulatory limitations

and regulatory review as part of the CCAR process. We did

include the ability to repurchase common stock in our 2014

capital plan that was submitted to the Federal Reserve on

January 6, 2014, and we expect to receive the Federal

Reserve’s response (either a non-objection or objection) to

these planned actions in March 2014. Under the “de minimis”

safe harbor of the Federal Reserve’s capital plan rule, PNC

may make limited repurchases of common stock or other

capital distributions in amounts that exceed the amounts

included in its most recently approved capital plan, provided

that, among other things, such distributions do not exceed, in

the aggregate, 1% of PNC’s Tier 1 capital and the Federal

Reserve does not object to the additional repurchases or

distributions. See the Supervision and Regulation section of

Item 1 Business in this Report for further information

concerning restrictions on dividends and stock repurchases,

including the impact of the Federal Reserve’s current

supervisory assessment of capital adequacy program, which is

also discussed in the Capital and Liquidity Actions portion of

the Executive Summary section of this Item 7.

The PNC Financial Services Group, Inc. – Form 10-K 45