PNC Bank 2013 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

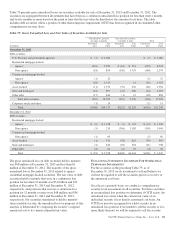

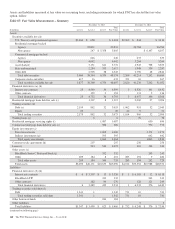

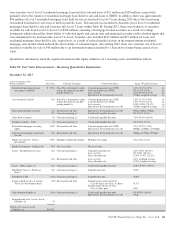

(a) Included in Other assets on our Consolidated Balance Sheet.

(b) Amounts at December 31, 2013 and December 31, 2012 are presented gross and are not reduced by the impact of legally enforceable master netting agreements that allow PNC to net

positive and negative positions and cash collateral held or placed with the same counterparty. The net asset amounts were $1.7 billion at December 31, 2013 compared with $2.4

billion at December 31, 2012 and the net liability amounts were $.9 billion and $.6 billion, respectively.

(c) Included in Loans held for sale on our Consolidated Balance Sheet. PNC has elected the fair value option for certain residential and commercial mortgage loans held for sale.

(d) Fair value includes net unrealized gains of $11 million at December 31, 2013 compared with net unrealized gains of $59 million at December 31, 2012.

(e) Approximately 17% of these securities are residential mortgage-backed securities and 69% are U.S. Treasury and government agencies securities at December 31, 2013. Comparable

amounts at December 31, 2012 were 25% and 52%, respectively.

(f) Included in Other intangible assets on our Consolidated Balance Sheet.

(g) The indirect equity funds are not redeemable, but PNC receives distributions over the life of the partnership from liquidation of the underlying investments by the investee, which we

expect to occur over the next twelve years. The amount of unfunded contractual commitments related to indirect equity investments was $128 million and related to direct equity

investments was $36 million as of December 31, 2013, respectively.

(h) Included in Federal funds sold and resale agreements on our Consolidated Balance Sheet. PNC has elected the fair value option for these items.

(i) Included in Loans on our Consolidated Balance Sheet.

(j) PNC has elected the fair value option for these shares.

(k) Included in Other liabilities on our Consolidated Balance Sheet.

(l) Included in Other borrowed funds on our Consolidated Balance Sheet.

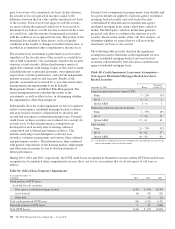

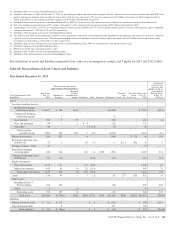

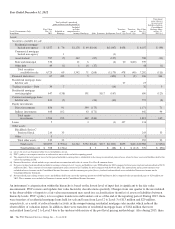

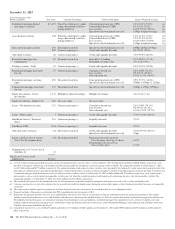

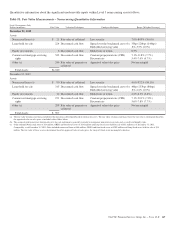

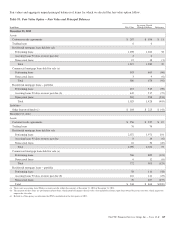

Reconciliations of assets and liabilities measured at fair value on a recurring basis using Level 3 inputs for 2013 and 2012 follow.

Table 88: Reconciliation of Level 3 Assets and Liabilities

Year Ended December 31, 2013

Total realized / unrealized

gains or losses for the period (a)

Unrealized

gains (losses)

on assets and

liabilities held on

Consolidated

Balance Sheet

at Dec. 31,

2013 (c)

Level 3 Instruments Only

In millions

Fair Value

Dec. 31,

2012

Included in

Earnings

Included

in Other

comprehensive

income Purchases Sales Issuances Settlements

Transfers

into

Level 3 (b)

Transfers

out of

Level 3 (b)

Fair Value

Dec. 31,

2013

Assets

Securities available for sale

Residential mortgage-

backed non-agency $ 6,107 $ 189 $147 $(1,085) $ 5,358 $ (10)

Commercial mortgage-

backed non-agency 3 (3)

Asset-backed 708 9 53 (129) 641 (6)

State and municipal 339 1 2 $ 4 (13) 333

Other debt 48 3 $ (10) (3) 38

Total securities

available for sale 7,202 202 202 7 (10) (1,233) 6,370 (16)

Financial derivatives 106 297 4 (369) $ (2) 36 166

Residential mortgage loans

held for sale 27 2 61 (3) 4 $ 13 (96) 8 2

Trading securities – Debt 32 32

Residential mortgage

servicing rights 650 366 110 (4) $158 (193) 1,087 354

Commercial mortgage loans

held for sale 772 (11) (130) (45) 586 (12)

Equity investments

Direct investments 1,171 141 177 (420) 1,069 62

Indirect investments 642 81 (3) 26 (151) 595 76

Total equity investments 1,813 222 (3) 203 (571) 1,664 138

Loans 134 46 1 (1) 83 277 (28) 512 34

Other assets

BlackRock Series C

Preferred Stock 243 122 (33) 332 122

Other 9 (1) 8

Total other assets 252 122 (1) (33) 340 122

Total assets $10,988 $1,246(e) $198 $386 $(719) $158 $(1,786) $290 $(126) $10,635 $788(f)

Liabilities

Financial derivatives (d) $ 376 $ 317 $ 2 $ (256) $ 439 $181

Other borrowed funds 9 175 184

Total liabilities $ 376 $ 326(e) $ 2 $ (81) $ 623 $181(f)

The PNC Financial Services Group, Inc. – Form 10-K 161