PNC Bank 2013 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

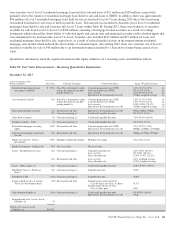

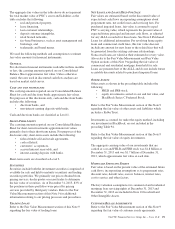

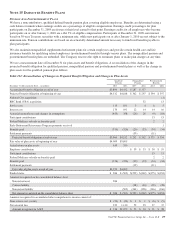

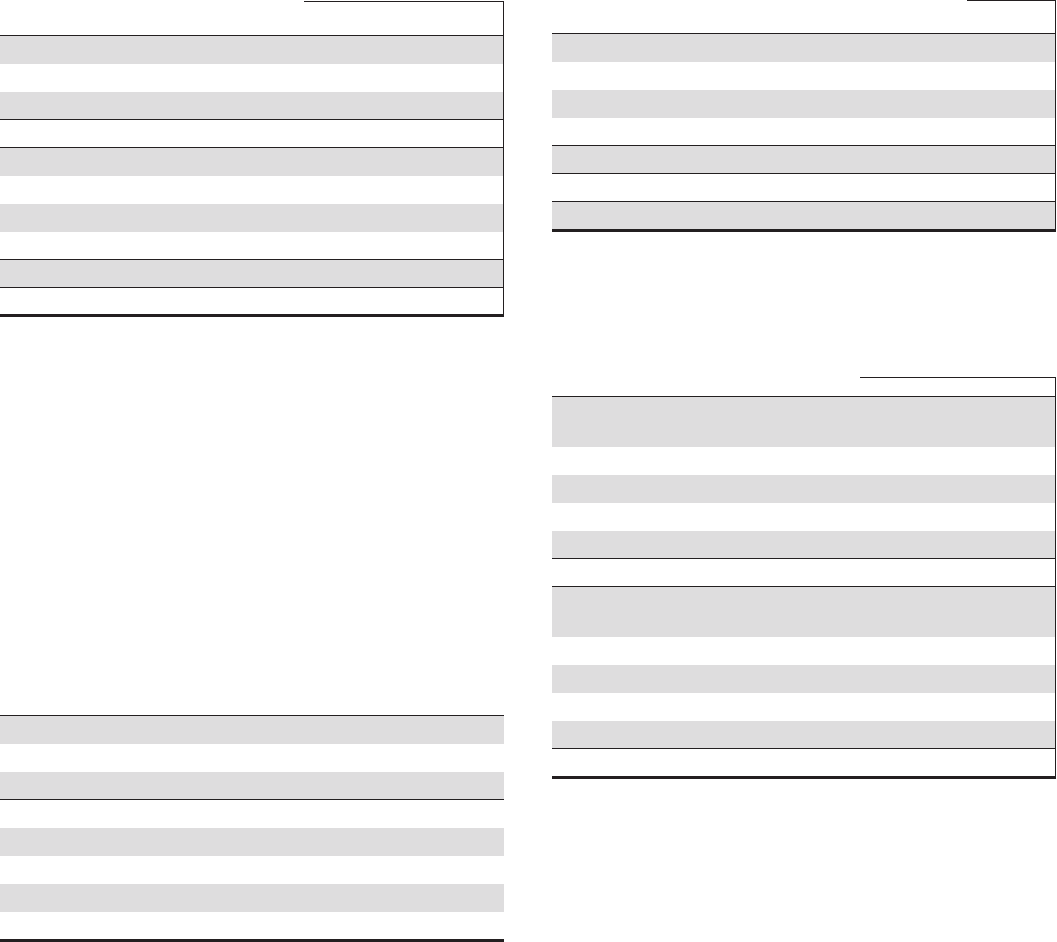

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

Table 96: Other Intangible Assets

In millions

December 31

2013

December 31

2012

Customer-related and other intangibles

Gross carrying amount $ 1,676 $1,676

Accumulated amortization (1,096) (950)

Net carrying amount $ 580 $ 726

Mortgage and other loan servicing rights

Gross carrying amount $ 2,620 $2,071

Valuation allowance (88) (176)

Accumulated amortization (896) (824)

Net carrying amount (a) $ 1,636 $1,071

Total $ 2,216 $1,797

(a) Included mortgage servicing rights for other loan portfolios of less than $1 million at

December 31, 2013 and $1 million at December 31, 2012, respectively.

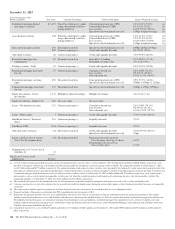

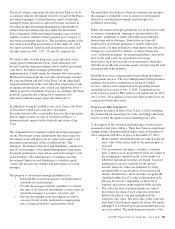

Our other intangible assets have finite lives and are amortized

primarily on a straight-line basis. Core deposit intangibles are

amortized on an accelerated basis.

For customer-related and other intangibles, the estimated

remaining useful lives range from less than 1 year to 10 years,

with a weighted-average remaining useful life of 7 years.

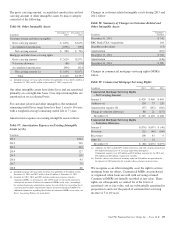

Amortization expense on existing intangible assets follows:

Table 97: Amortization Expense on Existing Intangible

Assets (a) (b)

In millions

2011 $324

2012 310

2013 243

2014 127

2015 110

2016 93

2017 79

2018 68

(a) Included mortgage servicing rights for other loan portfolios of $1 million at both

December 31, 2011 and 2012 and less than $1 million at December 31, 2013.

(b) Amounts for 2011, 2012 and 2013 include amortization expense related to

commercial MSRs. As of January 1, 2014, PNC made an irrevocable election to

subsequently measure all classes of commercial MSRs at fair value. Accordingly,

the estimated aggregate amortization expense for each of the five succeeding fiscal

years presented excludes amortization expense related to commercial MSRs. For

additional information regarding the election of commercial MSRs at fair value, see

Note 1 Accounting Policies for more detail.

Changes in customer-related intangible assets during 2013 and

2012 follow:

Table 98: Summary of Changes in Customer-Related and

Other Intangible Assets

In millions

Customer-

Related

December 31, 2011 $ 742

RBC Bank (USA) Acquisition 164

SmartStreet divestiture (13)

Amortization (167)

December 31, 2012 $ 726

Amortization (146)

December 31, 2013 $ 580

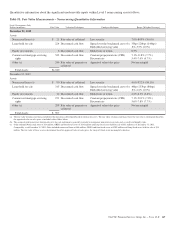

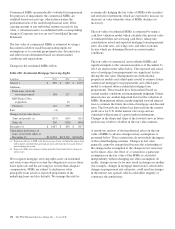

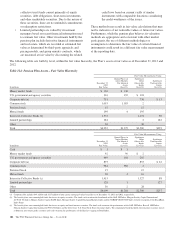

Changes in commercial mortgage servicing rights (MSRs)

follow:

Table 99: Commercial Mortgage Servicing Rights

In millions 2013 2012 2011

Commercial Mortgage Servicing Rights

– Net Carrying Amount

January 1 $ 420 $ 468 $ 665

Additions (a) 138 73 120

Amortization expense (b) (97) (142) (160)

Change in valuation allowance 88 21 (157)

December 31 $ 549 $ 420 $ 468

Commercial Mortgage Servicing Rights

– Valuation Allowance

January 1 $(176) $(197) $ (40)

Provision (21) (46) (166)

Recoveries 108 43 9

Other (b) 1 24

December 31 $ (88) $(176) $(197)

(a) Additions for 2013 included $53 million from loans sold with servicing retained and

$85 million from purchases of servicing rights from third parties.

Comparable amounts were $45 million and $28 million, respectively, for 2012 and

$55 million and $65 million, respectively, for 2011.

(b) Includes a direct write-down of servicing rights for $24 million recognized in the

first quarter of 2012 primarily due to market-driven changes in interest rates.

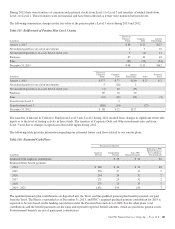

We recognize as an other intangible asset the right to service

mortgage loans for others. Commercial MSRs are purchased

or originated when loans are sold with servicing retained.

Commercial MSRs are initially recorded at fair value. These

rights are subsequently accounted for at the lower of

amortized cost or fair value, and are substantially amortized in

proportion to and over the period of estimated net servicing

income of 5 to 10 years.

The PNC Financial Services Group, Inc. – Form 10-K 173