PNC Bank 2013 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

16 S

TOCK

B

ASED

C

OMPENSATION

P

LANS

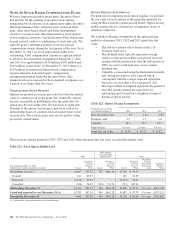

We have long-term incentive award plans (Incentive Plans)

that provide for the granting of incentive stock options,

nonqualified stock options, stock appreciation rights, incentive

shares/performance units, restricted stock, restricted share

units, other share-based awards and dollar-denominated

awards to executives and, other than incentive stock options,

to non-employee directors. Certain Incentive Plan awards may

be paid in stock, cash or a combination of stock and cash. We

typically grant a substantial portion of our stock-based

compensation awards during the first quarter of the year. As of

December 31, 2013, no stock appreciation rights were

outstanding. Total compensation expense recognized related

to all share-based payment arrangements during 2013, 2012

and 2011 was approximately $154 million, $101 million and

$103 million, respectively. At December 31, 2013, there was

$129 million of unamortized share-based compensation

expense related to nonvested equity compensation

arrangements granted under the Incentive Plans. This

unamortized cost is expected to be recognized as expense over

a period of no longer than five years.

N

ONQUALIFIED

S

TOCK

O

PTIONS

Options are granted at exercise prices not less than the market

value of common stock on the grant date. Generally, options

become exercisable in installments after the grant date. No

option may be exercisable after 10 years from its grant date.

Payment of the option exercise price may be in cash or by

surrendering shares of common stock at market value on the

exercise date. The exercise price may also be paid by using

previously owned shares.

O

PTION

P

RICING

A

SSUMPTIONS

For purposes of computing stock option expense, we estimate

the fair value of stock options at the grant date primarily by

using the Black-Scholes option-pricing model. Option pricing

models require the use of numerous assumptions, many of

which are subjective.

We used the following assumptions in the option pricing

models to determine 2013, 2012 and 2011 grant date fair

value:

• The risk-free interest rate is based on the U.S.

Treasury yield curve,

• The dividend yield typically represents average

yields over the previous three-year period, however

starting with the grants made after the first quarter of

2009, we used a yield indicative of our current

dividend rate,

• Volatility is measured using the fluctuation in month-

end closing stock prices over a period which

corresponds with the average expected option life,

but in no case less than a five-year period, and

• The expected life assumption represents the period of

time that options granted are expected to be

outstanding and is based on a weighted-average of

historical option activity.

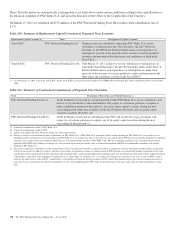

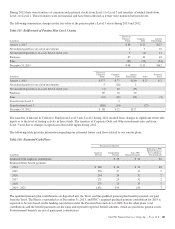

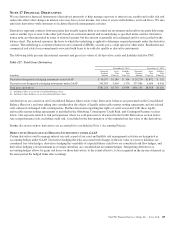

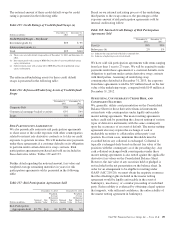

Table 122: Option Pricing Assumptions

Weighted-average for the

year ended December 31 2013 2012 2011

Risk-free interest rate .9% 1.1% 2.8%

Dividend yield 2.5 2.3 0.6

Volatility 34.0 35.1 34.7

Expected life 6.5 yrs. 5.9 yrs. 5.9 yrs.

Grant date fair value $ 16.35 $ 16.22 $ 22.82

There were no options granted in 2013, 2012 and 2011 where the grant date fair value exceeded the market value.

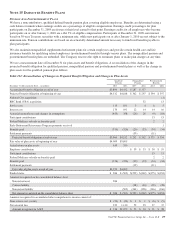

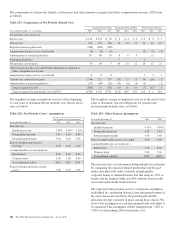

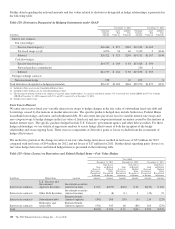

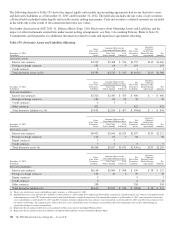

Table 123: Stock Option Rollforward

PNC

PNC Options

Converted From

National City Total

Year ended December 31, 2013

In thousands, except weighted-average data Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

Outstanding, January 1 14,817 $55.52 747 $681.16 15,564 $ 85.55

Granted 161 63.87 161 63.87

Exercised (4,110) 50.51 (4,110) 50.51

Cancelled (514) 56.93 (203) 731.74 (717) 247.91

Outstanding, December 31 10,354 $57.57 544 $662.28 10,898 $ 87.75 4.5 years $207,248

Vested and expected to vest, December 31 (a) 10,339 $57.56 544 $662.28 10,883 $ 87.79 4.5 years $207,025

Exercisable, December 31 9,660 $57.20 544 $662.28 10,204 $ 89.46 4.2 years $196,859

(a) Adjusted for estimated forfeitures on unvested options.

186 The PNC Financial Services Group, Inc. – Form 10-K