PNC Bank 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

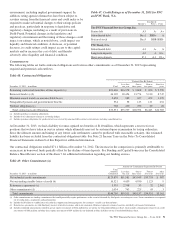

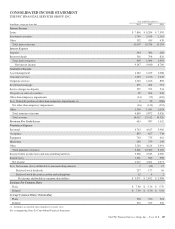

Interest-bearing deposits represented 67% of total deposits at

December 31, 2012 compared to 69% at December 31, 2011.

Average total deposits increased by $18.5 billion to $201.6 billion

in 2012 compared with 2011. This increase primarily resulted

from an increase in average transaction deposits of $23.9 billion

partially offset by a decrease of $7.4 billion in retail certificates of

deposit attributable to runoff of maturing accounts. Growth in

average noninterest-bearing deposits, average money market

deposits and average interest-bearing demand deposits drove the

increase in transaction deposits, which resulted from deposits

added in the RBC Bank (USA) acquisition and organic growth.

Average total deposits represented 68% of average total assets for

2012 and 69% for 2011.

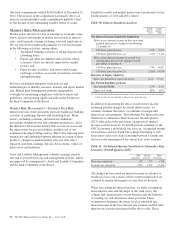

Total borrowed funds increased $4.2 billion from December 31,

2011 to $40.9 billion at December 31, 2012, due to increases in

Federal funds purchased and repurchase agreements, FHLB

borrowings and commercial paper net issuances, partially offset

by net repayments and maturities of bank notes and senior debt

and a reduction in subordinated debt due to redemptions of trust

preferred securities and hybrid capital securities.

Average borrowed funds increased to $41.8 billion for 2012

compared with $35.7 billion for 2011. An increase in

commercial paper and net issuances of FHLB borrowings

during 2012 drove the increase compared with 2011.

Shareholders’ Equity

Total shareholders’ equity increased $5.0 billion to $39.0

billion at December 31, 2012 compared with December 31,

2011 and included the impact of the following:

• An increase of $2.0 billion to retained earnings,

• The issuance of $2.0 billion of preferred stock during

2012, which contributed to the increase in capital

surplus – preferred stock to $3.6 billion at

December 31, 2012 compared to $1.6 billion at

December 31, 2011, and

• A $.9 billion increase in accumulated other

comprehensive income primarily due to higher net

unrealized gains on securities, partially offset by

lower unrealized gains on cash flow hedge

derivatives.

Risk-Based Capital

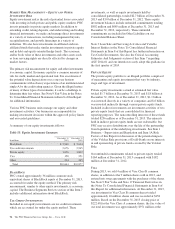

Regulatory capital ratios at December 31, 2012 were 9.6% for

Tier 1 common, 10.4% for leverage, 11.6% for Tier 1 risk-

based and 14.7% for total risk-based capital. At December 31,

2011, the regulatory capital ratios were 10.3% for Tier 1

common, 11.1% for leverage, 12.6% for Tier 1 risk-based and

15.8% for total risk-based capital. The decline in these ratios

was primarily due to the RBC Bank (USA) acquisition, which

resulted in higher goodwill and risk-weighted assets, partially

offset by retention of earnings which more than offset organic

asset growth. Our Tier 1 risk-based capital ratio reflected our

2012 capital actions of issuing approximately $2.0 billion of

preferred stock and redeeming approximately $2.3 billion of

trust preferred securities and hybrid capital securities.

G

LOSSARY

O

F

T

ERMS

Accretable net interest (Accretable yield) – The excess of cash

flows expected to be collected on a purchased impaired loan

over the carrying value of the loan. The accretable net interest

is recognized into interest income over the remaining life of

the loan using the constant effective yield method.

Adjusted average total assets – Primarily comprised of total

average quarterly (or annual) assets plus (less) unrealized

losses (gains) on investment securities, less goodwill and

certain other intangible assets (net of eligible deferred taxes).

Annualized – Adjusted to reflect a full year of activity.

Assets under management – Assets over which we have sole

or shared investment authority for our customers/clients. We

do not include these assets on our Consolidated Balance Sheet.

Basel I Tier 1 common capital – Basel I Tier 1 risk-based

capital, less preferred equity, less trust preferred capital

securities, and less noncontrolling interests.

Basel I Tier 1 common capital ratio – Basel I Tier 1 common

capital divided by period-end Basel I risk-weighted assets.

Basel I Leverage ratio – Basel I Tier 1 risk-based capital

divided by adjusted average total assets.

Basel I Tier 1 risk-based capital – Total shareholders’ equity,

plus trust preferred capital securities, plus certain

noncontrolling interests that are held by others, less goodwill

and certain other intangible assets (net of eligible deferred

taxes relating to taxable and nontaxable combinations), less

equity investments in nonfinancial companies, less ineligible

servicing assets, and less net unrealized holding losses on

available for sale equity securities. Net unrealized holding

gains on available for sale equity securities, net unrealized

holding gains (losses) on available for sale debt securities and

net unrealized holding gains (losses) on cash flow hedge

derivatives are excluded from total shareholders’ equity for

Basel I Tier 1 risk-based capital purposes.

Basel I Tier 1 risk-based capital ratio – Basel I Tier 1 risk-based

capital divided by period-end Basel I risk-weighted assets.

Basel I Total risk-based capital – Basel I Tier 1 risk-based capital

plus qualifying subordinated debt and trust preferred securities,

other noncontrolling interests not qualified as Basel I Tier 1,

eligible gains on available for sale equity securities and the

allowance for loan and lease losses, subject to certain limitations.

Basel I Total risk-based capital ratio – Basel I Total risk-based

capital divided by period-end Basel I risk-weighted assets.

The PNC Financial Services Group, Inc. – Form 10-K 99