PNC Bank 2013 Annual Report Download - page 51

Download and view the complete annual report

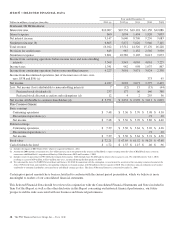

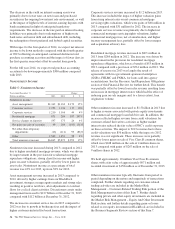

Please find page 51 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• PNC enhanced its liquidity position in light of

anticipated regulatory requirements as reflected in

higher balances of interest-earning deposits with

banks and borrowed funds.

• PNC’s well-positioned balance sheet remained core

funded with a loans to deposits ratio of 89% at

December 31, 2013.

• PNC had a strong capital position at December 31,

2013.

• The Basel I Tier 1 common capital ratio

increased to 10.5% compared with 9.6% at

December 31, 2012.

• The pro forma fully phased-in Basel III Tier 1

common capital ratio increased to an estimated

9.4% at December 31, 2013 compared with

7.5% at December 31, 2012. The ratio at

December 31, 2013 was calculated using

PNC’s estimated risk-weighted assets under the

Basel III standardized approach, while the ratio

for December 31, 2012 was calculated using

PNC’s estimated risk-weighted assets under the

Basel III advanced approaches. Our pro forma

fully phased-in Basel III Tier 1 common ratio

at December 31, 2013 calculated using PNC’s

estimated risk-weighted assets under the Basel

III advanced approaches was 9.5%. See the

Capital discussion and Table 19 in the

Consolidated Balance Sheet Review section of

this Item 7 for more detail.

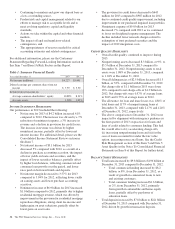

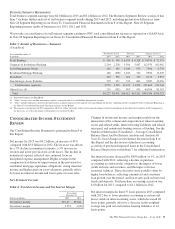

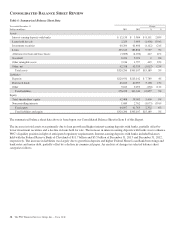

Our Consolidated Income Statement and Consolidated

Balance Sheet Review sections of this Financial Review

describe in greater detail the various items that impacted our

results during 2013 and 2012 and balances at December 31,

2013 and December 31, 2012, respectively.

C

APITAL AND

L

IQUIDITY

A

CTIONS

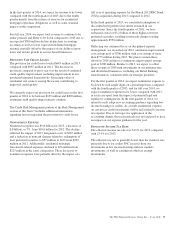

Our ability to take certain capital actions, including plans to

pay or increase common stock dividends or to repurchase

shares under current or future programs, is subject to the

results of the supervisory assessment of capital adequacy

undertaken by the Federal Reserve and our primary bank

regulators as part of the CCAR process.

In connection with the 2013 CCAR, PNC submitted its 2013

capital plan, approved by its Board of Directors, to the Federal

Reserve in January 2013. As we announced on March 14, 2013,

the Federal Reserve accepted the capital plan and did not object to

our proposed capital actions, which included a recommendation to

increase the quarterly common stock dividend in the second

quarter of 2013. In April 2013, our Board of Directors approved

an increase to PNC’s quarterly common stock dividend from 40

cents per common share to 44 cents per common share. A share

repurchase program for 2013 was not included in the capital plan

primarily as a result of PNC’s 2012 acquisition of RBC Bank

(USA) and expansion into Southeastern markets.

In connection with the 2014 CCAR, PNC submitted its 2014

capital plan, approved by its Board of Directors, to the Federal

Reserve in January 2014. PNC expects to receive the Federal

Reserve’s response (either a non-objection or objection) to the

capital plan submitted as part of the 2014 CCAR in March

2014.

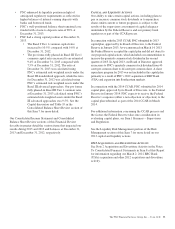

For additional information concerning the CCAR process and

the factors the Federal Reserve takes into consideration in

evaluating capital plans, see Item 1 Business – Supervision

and Regulation.

See the Liquidity Risk Management portion of the Risk

Management section of this Item 7 for more detail on our

2013 capital and liquidity actions.

2012 A

CQUISITION AND

D

IVESTITURE

A

CTIVITY

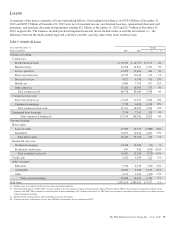

See Note 2 Acquisition and Divestiture Activity in the Notes

To Consolidated Financial Statements in Item 8 of this Report

for information regarding our March 2, 2012 RBC Bank

(USA) acquisition and other 2012 acquisition and divestiture

activity.

The PNC Financial Services Group, Inc. – Form 10-K 33