PNC Bank 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

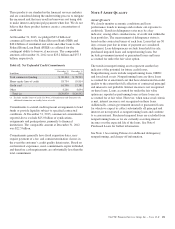

These products are standard in the financial services industry

and are considered during the underwriting process to mitigate

the increased risk that may result in borrowers not being able

to make interest and principal payments when due. We do not

believe that these product features create a concentration of

credit risk.

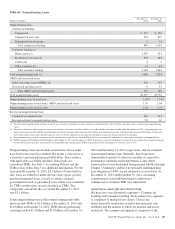

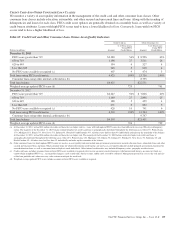

At December 31, 2013, we pledged $23.4 billion of

commercial loans to the Federal Reserve Bank (FRB) and

$40.4 billion of residential real estate and other loans to the

Federal Home Loan Bank (FHLB) as collateral for the

contingent ability to borrow, if necessary. The comparable

amounts at December 31, 2012 were $23.2 billion and $37.3

billion, respectively.

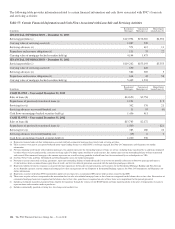

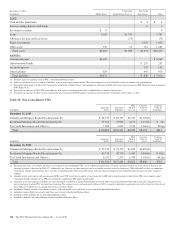

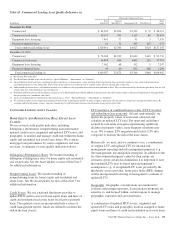

Table 62: Net Unfunded Credit Commitments

In millions

December 31

2013

December 31

2012

Total commercial lending $ 90,104 $ 78,703

Home equity lines of credit 18,754 19,814

Credit card 16,746 17,381

Other 4,266 4,694

Total (a) $129,870 $120,592

(a) Excludes standby letters of credit. See Note 24 Commitments and Guarantees for

additional information on standby letters of credit.

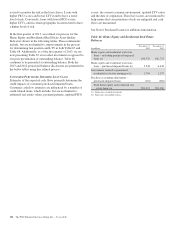

Commitments to extend credit represent arrangements to lend

funds or provide liquidity subject to specified contractual

conditions. At December 31, 2013, commercial commitments

reported above exclude $25.0 billion of syndications,

assignments and participations, primarily to financial

institutions. The comparable amount at December 31, 2012

was $22.5 billion.

Commitments generally have fixed expiration dates, may

require payment of a fee, and contain termination clauses in

the event the customer’s credit quality deteriorates. Based on

our historical experience, most commitments expire unfunded,

and therefore cash requirements are substantially less than the

total commitment.

N

OTE

5A

SSET

Q

UALITY

A

SSET

Q

UALITY

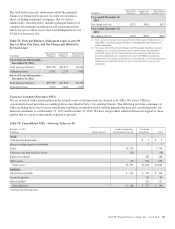

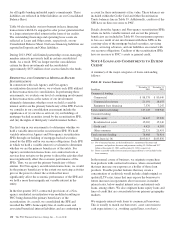

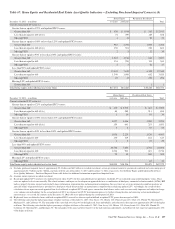

We closely monitor economic conditions and loan

performance trends to manage and evaluate our exposure to

credit risk. Trends in delinquency rates may be a key

indicator, among other considerations, of credit risk within the

loan portfolios. The measurement of delinquency status is

based on the contractual terms of each loan. Loans that are 30

days or more past due in terms of payment are considered

delinquent. Loan delinquencies exclude loans held for sale,

purchased impaired loans and nonperforming loans, but

include government insured or guaranteed loans and loans

accounted for under the fair value option.

The trends in nonperforming assets represent another key

indicator of the potential for future credit losses.

Nonperforming assets include nonperforming loans, OREO

and foreclosed assets. Nonperforming loans are those loans

accounted for at amortized cost that have deteriorated in credit

quality to the extent that full collection of contractual principal

and interest is not probable. Interest income is not recognized

on these loans. Loans accounted for under the fair value

option are reported as performing loans as these loans are

accounted for at fair value. However, when nonaccrual criteria

is met, interest income is not recognized on these loans.

Additionally, certain government insured or guaranteed loans

for which we expect to collect substantially all principal and

interest are not reported as nonperforming loans and continue

to accrue interest. Purchased impaired loans are excluded from

nonperforming loans as we are currently accreting interest

income over the expected life of the loans. See Note 6

Purchased Loans for further information.

See Note 1 Accounting Policies for additional delinquency,

nonperforming, and charge-off information.

The PNC Financial Services Group, Inc. – Form 10-K 131