PNC Bank 2013 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

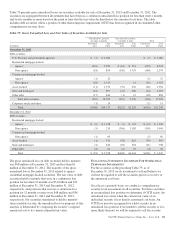

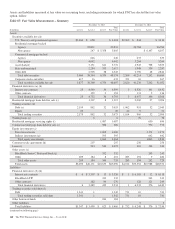

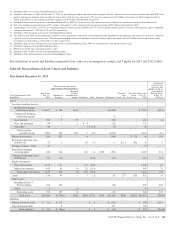

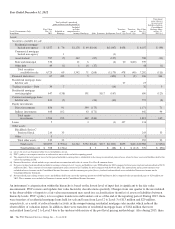

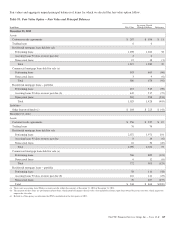

Assets and liabilities measured at fair value on a recurring basis, including instruments for which PNC has elected the fair value

option, follow.

Table 87: Fair Value Measurements – Summary

December 31, 2013 December 31, 2012

In millions Level 1 Level 2 Level 3

Total

Fair Value Level 1 Level 2 Level 3

Total

Fair Value

Assets

Securities available for sale

U.S. Treasury and government agencies $3,460 $ 658 $ 4,118 $2,269 $ 844 $ 3,113

Residential mortgage-backed

Agency 22,831 22,831 26,784 26,784

Non-agency 247 $ 5,358 5,605 $ 6,107 6,107

Commercial mortgage-backed

Agency 646 646 633 633

Non-agency 4,042 4,042 3,264 3,264

Asset-backed 5,131 641 5,772 4,945 708 5,653

State and municipal 2,284 333 2,617 1,948 339 2,287

Other debt 2,505 38 2,543 2,796 48 2,844

Total debt securities 3,460 38,344 6,370 48,174 2,269 41,214 7,202 50,685

Corporate stocks and other 417 16 433 351 16 367

Total securities available for sale 3,877 38,360 6,370 48,607 2,620 41,230 7,202 51,052

Financial derivatives (a) (b)

Interest rate contracts 25 4,540 34 4,599 5 8,326 101 8,432

Other contracts 192 2 194 131 5 136

Total financial derivatives 25 4,732 36 4,793 5 8,457 106 8,568

Residential mortgage loans held for sale (c) 1,307 8 1,315 2,069 27 2,096

Trading securities (d)

Debt (e) 2,159 862 32 3,053 1,062 951 32 2,045

Equity 20 20 42 9 51

Total trading securities 2,179 862 32 3,073 1,104 960 32 2,096

Trading loans (a) 6 6 76 76

Residential mortgage servicing rights (f) 1,087 1,087 650 650

Commercial mortgage loans held for sale (c) 586 586 772 772

Equity investments (a)

Direct investments 1,069 1,069 1,171 1,171

Indirect investments (g) 595 595 642 642

Total equity investments 1,664 1,664 1,813 1,813

Customer resale agreements (h) 207 207 256 256

Loans (i) 513 512 1,025 110 134 244

Other assets (a)

BlackRock Series C Preferred Stock (j) 332 332 243 243

Other 209 184 8 401 283 194 9 486

Total other assets 209 184 340 733 283 194 252 729

Total assets $6,290 $46,171 $10,635 $63,096 $4,012 $53,352 $10,988 $68,352

Liabilities

Financial derivatives (b) (k)

Interest rate contracts $ 6 $ 3,307 $ 13 $ 3,326 $ 1 $ 6,105 $ 12 $ 6,118

BlackRock LTIP 332 332 243 243

Other contracts 182 94 276 128 121 249

Total financial derivatives 6 3,489 439 3,934 1 6,233 376 6,610

Trading securities sold short (l)

Debt 1,341 1 1,342 731 10 741

Total trading securities sold short 1,341 1 1,342 731 10 741

Other borrowed funds 184 184

Other liabilities 55

Total liabilities $1,347 $ 3,490 $ 623 $ 5,460 $ 732 $ 6,248 $ 376 $ 7,356

(continued on following page)

160 The PNC Financial Services Group, Inc. – Form 10-K