PNC Bank 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTE

7A

LLOWANCES FOR

L

OAN AND

L

EASE

L

OSSES AND

U

NFUNDED

L

OAN

C

OMMITMENTS

AND

L

ETTERS OF

C

REDIT

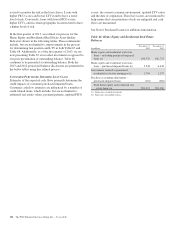

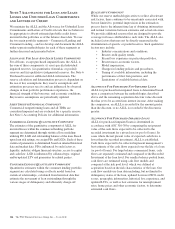

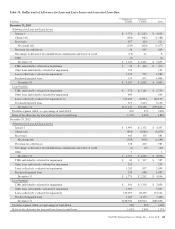

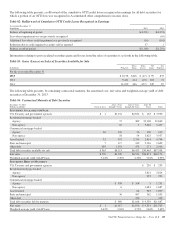

We maintain the ALLL and the Allowance for Unfunded Loan

Commitments and Letters of Credit at levels that we believe to

be appropriate to absorb estimated probable credit losses

incurred in the portfolios as of the balance sheet date. We use

the two main portfolio segments – Commercial Lending and

Consumer Lending – and we develop and document the ALLL

under separate methodologies for each of these segments as

further discussed and presented below.

A

LLOWANCE

F

OR

L

OAN

A

ND

L

EASE

L

OSSES

C

OMPONENTS

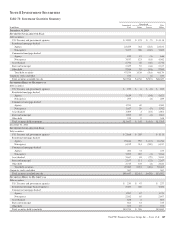

For all loans, except purchased impaired loans, the ALLL is

the sum of three components: (i) asset specific/individual

impaired reserves, (ii) quantitative (formulaic or pooled)

reserves and (iii) qualitative (judgmental) reserves. See Note 6

Purchased Loans for additional ALLL information. The

reserve calculation and determination process is dependent on

the use of key assumptions. Key reserve assumptions and

estimation processes react to and are influenced by observed

changes in loan portfolio performance experience, the

financial strength of the borrower, and economic conditions.

Key reserve assumptions are periodically updated.

A

SSET

S

PECIFIC

/I

NDIVIDUAL

C

OMPONENT

Commercial nonperforming loans and all TDRs are

considered impaired and are evaluated for a specific reserve.

See Note 1 Accounting Policies for additional information.

C

OMMERCIAL

L

ENDING

Q

UANTITATIVE

C

OMPONENT

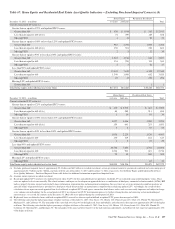

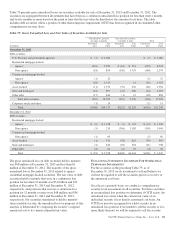

The estimates of the quantitative component of ALLL for

incurred losses within the commercial lending portfolio

segment are determined through statistical loss modeling

utilizing PD, LGD and outstanding balance of the loan. Based

upon loan risk ratings, we assign PDs and LGDs. Each of these

statistical parameters is determined based on internal historical

data and market data. PD is influenced by such factors as

liquidity, industry, obligor financial structure, access to capital

and cash flow. LGD is influenced by collateral type, original

and/or updated LTV and guarantees by related parties.

C

ONSUMER

L

ENDING

Q

UANTITATIVE

C

OMPONENT

Quantitative estimates within the consumer lending portfolio

segment are calculated using a roll-rate model based on

statistical relationships, calculated from historical data that

estimate the movement of loan outstandings through the

various stages of delinquency and ultimately charge-off.

Q

UALITATIVE

C

OMPONENT

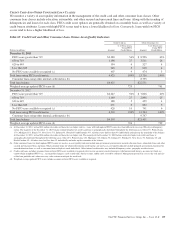

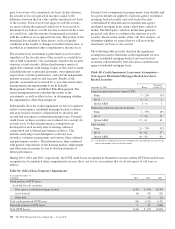

While our reserve methodologies strive to reflect all relevant

risk factors, there continues to be uncertainty associated with,

but not limited to, potential imprecision in the estimation

process due to the inherent time lag of obtaining information

and normal variations between estimates and actual outcomes.

We provide additional reserves that are designed to provide

coverage for losses attributable to such risks. The ALLL also

includes factors that may not be directly measured in the

determination of specific or pooled reserves. Such qualitative

factors may include:

• Industry concentrations and conditions,

• Recent credit quality trends,

• Recent loss experience in particular portfolios,

• Recent macro-economic factors,

• Model imprecision,

• Changes in lending policies and procedures,

• Timing of available information, including the

performance of first lien positions, and

• Limitations of available historical data.

A

LLOWANCE

F

OR

P

URCHASED

N

ON

-I

MPAIRED

L

OANS

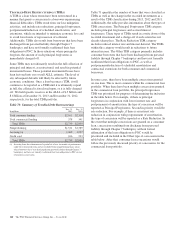

ALLL for purchased non-impaired loans is determined based

upon a comparison between the methodologies described

above and the remaining acquisition date fair value discount

that has yet to be accreted into interest income. After making

the comparison, an ALLL is recorded for the amount greater

than the discount, or no ALLL is recorded if the discount is

greater.

A

LLOWANCE

F

OR

P

URCHASED

I

MPAIRED

L

OANS

ALLL for purchased impaired loans is determined in

accordance with ASC 310-30 by comparing the net present

value of the cash flows expected to be collected to the

recorded investment for a given loan (or pool of loans). In

cases where the net present value of expected cash flows is

lower than the recorded investment, ALLL is established.

Cash flows expected to be collected represent management’s

best estimate of the cash flows expected over the life of a loan

(or pool of loans). For large balance commercial loans, cash

flows are separately estimated and compared to the Recorded

Investment at the loan level. For smaller balance pooled loans,

cash flows are estimated using cash flow models and

compared at the risk pool level, which was defined at

acquisition based on the risk characteristics of the loan. Our

cash flow models use loan data including, but not limited to,

delinquency status of the loan, updated borrower FICO credit

scores, geographic information, historical loss experience, and

updated LTVs, as well as best estimates for unemployment

rates, home prices and other economic factors, to determine

estimated cash flows.

146 The PNC Financial Services Group, Inc. – Form 10-K