PNC Bank 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the first quarter of 2014, we expect fee income to be lower

compared with the fourth quarter of 2013 due to the fourth

quarter benefit from the release of reserves for residential

mortgage repurchase obligations as well as some seasonal

impact on the comparison.

For full year 2014, we expect total revenue to continue to be

under pressure and likely to be down compared to 2013 due to

an expected $300 million decline in purchase accounting

accretion as well as lower expected residential mortgage

revenue, partially offset by the impact of our ability to grow

loans and sustain growth in our fee-based businesses.

P

ROVISION

F

OR

C

REDIT

L

OSSES

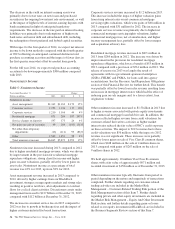

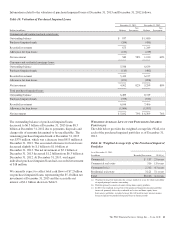

The provision for credit losses totaled $643 million in 2013

compared with $987 million in 2012. The decrease in

provision compared to prior year was the result of continued

credit quality improvement, including improvement in our

purchased impaired loan portfolio. Increasing value of

residential real estate is among the factors contributing to

improved credit quality.

We currently expect our provision for credit losses in the first

quarter of 2014 to be between $125 million and $200 million,

assuming credit quality improvements continue.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses.

N

ONINTEREST

E

XPENSE

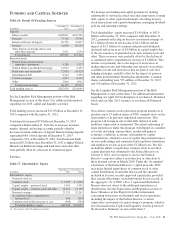

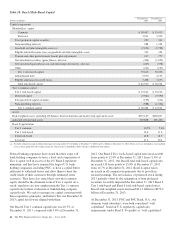

Noninterest expense was $9.8 billion for 2013, a decrease of

$.8 billion, or 7%, from $10.6 billion for 2012. The decline

reflected the impact of 2012 integration costs of $267 million

and a reduction in noncash charges related to redemption of

trust preferred securities to $57 million in 2013 from $295

million in 2012. Additionally, residential mortgage

foreclosure-related expenses declined to $56 million from

$225 million in the same comparison. These decreases to

noninterest expense were partially offset by the impact of a

full year of operating expense for the March 2012 RBC Bank

(USA) acquisition during 2013 compared to 2012.

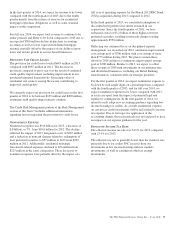

In the third quarter of 2013, we concluded redemptions of

discounted trust preferred securities assumed in our

acquisitions. Since the fourth quarter of 2011, we have

redeemed a total of $3.2 billion of these higher-rate trust

preferred securities, resulting in noncash charges totaling

approximately $550 million.

Reflecting our continued focus on disciplined expense

management, we exceeded our 2013 continuous improvement

cost savings goal of $700 million with cost savings of more

than $775 million during 2013. We plan to sustain these

efforts in 2014 and have a continuous improvement savings

goal of $500 million. Similar to 2013, we expect to offset

these savings in 2014 with investments in our infrastructure

and diversified businesses, including our Retail Banking

transformation, consistent with our strategic priorities.

For the first quarter of 2014, we expect noninterest expense to

be down by mid-single digits on a percentage basis compared

with the fourth quarter of 2013, and for full year 2014, we

expect noninterest expense to be lower compared with 2013,

in each case apart from the impact of potential legal and

regulatory contingencies. In the first quarter of 2014, we

intend to early adopt new accounting guidance regarding low

income housing tax credits. As a result, noninterest expense

on certain tax credit investments will be reclassified to income

tax expense. Due to retrospective application of the

accounting change, this reclassification is not expected to have

an impact on our expense guidance for the year.

E

FFECTIVE

I

NCOME

T

AX

R

ATE

The effective income tax rate was 24.1% for 2013 compared

with 23.9% for 2012.

The effective tax rate is generally lower than the statutory rate

primarily due to tax credits PNC receives from our

investments in low income housing and new markets

investments, as well as earnings in other tax exempt

investments.

The PNC Financial Services Group, Inc. – Form 10-K 37