PNC Bank 2013 Annual Report Download - page 136

Download and view the complete annual report

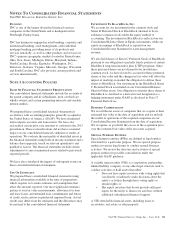

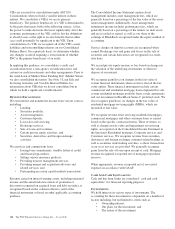

Please find page 136 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In certain circumstances, loans designated as held for sale may

be transferred to held for investment based on a change in

strategy. We transfer these loans at the lower of cost or

estimated fair value; however, any loans held for sale and

designated at fair value will remain at fair value for the life of

the loan.

N

ONPERFORMING

A

SSETS

Nonperforming assets consists of nonperforming loans and

leases, other real estate owned (OREO) and foreclosed assets.

Nonperforming loans and leases include nonperforming

troubled debt restructurings (TDRs).

C

OMMERCIAL

L

OANS

We generally classify Commercial Lending (Commercial,

Commercial Real Estate, and Equipment Lease Financing)

loans as nonperforming and place them on nonaccrual status

when we determine that the collection of interest or principal

is not probable, including when delinquency of interest or

principal payments has existed for 90 days or more and the

loans are not well-secured and/or in the process of collection.

A loan is considered well-secured when the collateral in the

form of liens on (or pledges of) real or personal property,

including marketable securities, has a realizable value

sufficient to discharge the debt in full, including accrued

interest. Such factors that would lead to nonperforming status

would include, but are not limited to, the following:

• Deterioration in the financial position of the borrower

resulting in the loan moving from accrual to cash

basis accounting,

• The collection of principal or interest is 90 days or

more past due unless the asset is both well-secured

and/or in the process of collection,

• Reasonable doubt exists as to the certainty of the

borrower’s future debt service ability, whether 90

days have passed or not,

• The borrower has filed or will likely file for

bankruptcy,

• The bank advances additional funds to cover

principal or interest,

• We are in the process of liquidating a commercial

borrower, or

• We are pursuing remedies under a guarantee.

We charge off commercial nonperforming loans when we

determine that a specific loan, or portion thereof, is

uncollectible. This determination is based on the specific facts

and circumstances of the individual loans. In making this

determination, we consider the viability of the business or

project as a going concern, the past due status when the asset

is not well-secured, the expected cash flows to repay the loan,

the value of the collateral, and the ability and willingness of

any guarantors to perform.

Additionally, in general, for smaller dollar commercial loans

of $1 million or less, a partial or full charge-off will occur at

120 days past due for term loans and 180 days past due for

revolvers.

Certain small business credit card balances are placed on

nonaccrual status when they become 90 days or more past

due. Such loans are charged-off at 180 days past due.

C

ONSUMER

L

OANS

Nonperforming loans are those loans accounted for at

amortized cost that have deteriorated in credit quality to the

extent that full collection of contractual principal and interest

is not probable. These loans are also classified as nonaccrual.

For these loans, the current year accrued and uncollected

interest is reversed through Net interest income and prior year

accrued and uncollected interest is charged-off. Additionally,

these loans may be charged-off down to the fair value less

costs to sell.

Loans acquired and accounted for under ASC 310-30 – Loans

and Debt Securities Acquired with Deteriorated Credit Quality

are reported as performing and accruing loans due to the

accretion of interest income.

Loans accounted for under the fair value option and loans

accounted for as held for sale are reported as performing loans

as these loans are accounted for at fair value and the lower of

carrying value or the fair value less costs to sell, respectively.

However, based upon the nonaccrual policies discussed

below, interest income is not accrued. Additionally, based

upon the nonaccrual policies discussed below, certain

government insured loans for which we do not expect to

collect substantially all principal and interest are reported as

nonperforming and do not accrue interest. Alternatively,

certain government insured loans for which we expect to

collect substantially all principal and interest are not reported

as nonperforming loans and continue to accrue interest.

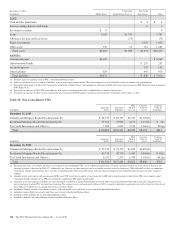

In the first quarter of 2013, we completed our alignment of

certain nonaccrual and charge-off policies consistent with

interagency supervisory guidance on practices for loans and

lines of credit related to consumer lending. This alignment

primarily related to (i) subordinate consumer loans (home

equity loans and lines of credit and residential mortgages)

where the first-lien loan was 90 days or more past due,

(ii) government guaranteed loans where the guarantee may not

result in collection of substantially all contractual principal

and interest and (iii) certain loans with borrowers in or

discharged from bankruptcy. In the first quarter of 2013, due

to classification as either nonperforming or, in the case of

loans accounted for under the fair value option, nonaccrual

loans, nonperforming loans increased by $426 million and net

charge-offs increased by $134 million as a result of

completing the alignment of the aforementioned policies.

Additionally, overall delinquencies decreased $395 million

due to loans now being reported as either nonperforming or, in

the case of loans accounted for under the fair value option,

nonaccruing, or having been charged-off. The impact of the

alignment of the policies was considered in our reserving

process in the determination of our Allowance for Loan and

Lease Losses (ALLL) at December 31, 2012. See Note 5

118 The PNC Financial Services Group, Inc. – Form 10-K