Reebok 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

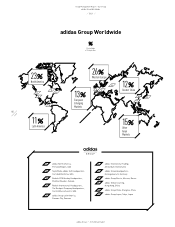

adidas Group

/

2013 Annual Report

Group Management Report – Our Group

74

2013

/

02.4

/

Global Sales Strategy

/

Retail Strategy

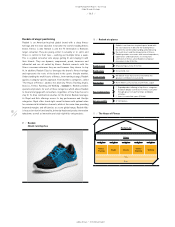

Customer and range segmentation to exploit

market potential

As part of our toolkit, our customer and range segmentation initiative

is a key enabler to consistent customer relationship management.

This facilitates the allocation of tailored product packages to groups

of comparable customers. In principle, the segmentation is based on

the distinction between sports and lifestyle retailers that have either a

brand-driven or a commercial positioning.

03

/

Foot Locker

Oberhausen, Germany

People development programme to build the

best sales team

Wholesale is facing a changing customer landscape, driven by further

consolidation, increased cross-border retail activities and a digital shift

in consumer behaviour. We strive to have the best team in our industry,

enabling us to react flexibly to all market developments. This means

continuous skills development. The Wholesale people development and

training framework called PEAK (Performance, Excellence, Activation

and Knowledge) sets the expectations for individual excellence and

provides tailored training programmes. All Wholesale employees attend

at least one training programme per year.

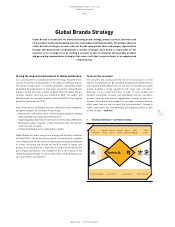

Retail Strategy

Retail plays an increasingly important role for the future of our Group

and our brands and is a key driver on our Route 2015 journey. The

reasons are manifold:

/

To showcase the breadth of our brands and product offering, for

example in our adidas Brand Centres, as a benchmark for retail

partners.

/

To provide consumers access to our products in mono-branded stores

in the high streets and malls around the world.

/

To create distribution in markets which do not have traditional

wholesale distribution.

/

To leverage our learnings from direct interaction with consumers

through own retail for the entire organisation.

/

To provide a clearance channel (i.e. factory outlets).

Our overall vision is to improve our operation KPIs and retail sophistication

with the goal of delivering healthy, sustainable growth with outstanding

return on investment, executing as a best-in-class retailer. In order to

achieve this, we will execute against the four key pillars:

/

Focus on the consumer.

/

Achieve operational excellence.

/

Exploit portfolio of brands.

/

Leverage our global presence and scale.

Focusing on customer service

Building on the strong foundation laid over the past years, our Retail

strategic initiatives are now structured and prioritised against the

principles of growth and efficiency. We want to further simplify our

structures and procedures in order to free up resources for all important

consumer-facing tasks. This focus on efficiencies will also enable the

successful implementation of our growth initiatives, which include:

/

Customer Service Model: Deliver and embed a defined Customer

Service Model that connects, engages and inspires our consumers

during their shopping experience.

/

Customer Relationship Management: Develop and implement a

tailored CRM programme.

/

Further drive product commonality by increasing the global

mandatory range share in all our own stores.

/

Drive people excellence through improved training and development

procedures.

/

Omni-channel focus: Create a seamless shopping experience for our

consumers by connecting our online and offline touchpoints.