Reebok 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

To Our Shareholders

60

2013

/

01.10

/

Our Share

04

/

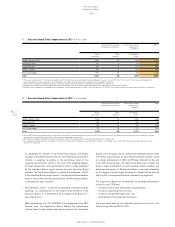

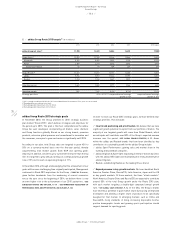

adidas AG high and low share prices per month 1) (in €)

| Jan. 1, 2013 Dec. 31, 2013 |

90

80

70

60

30-day moving average ■ High and low share prices Source: Bloomberg.

1) Based on daily Xetra closing prices.

05

/

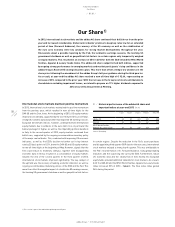

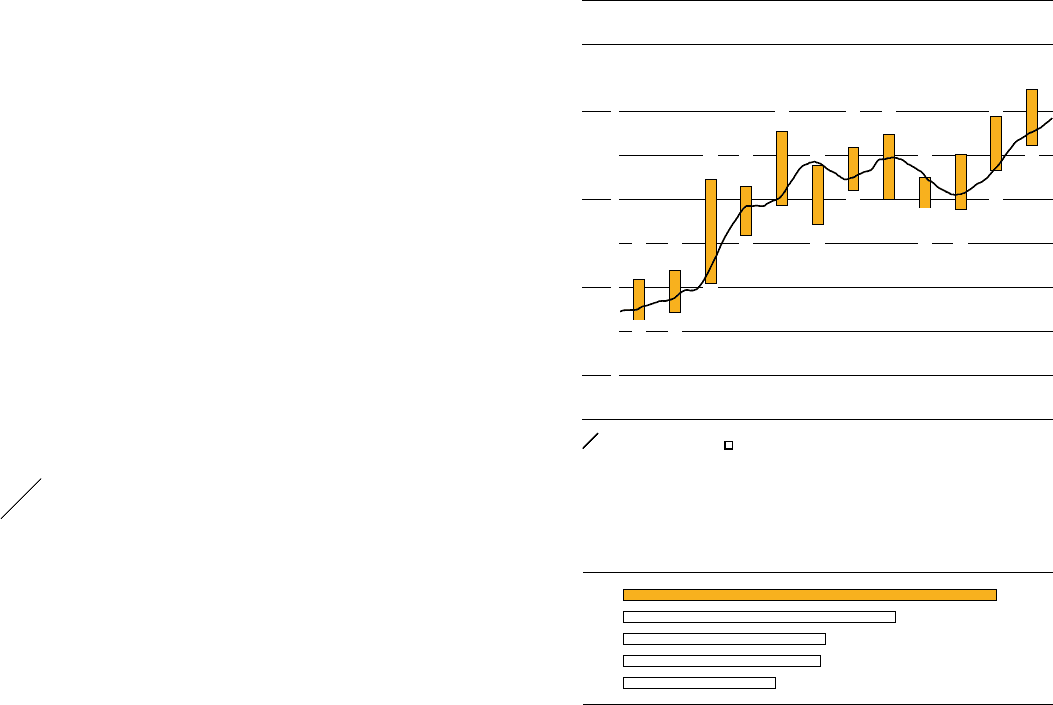

adidas AG market capitalisation at year-end (€ in billions)

2013 19.382

2012 14.087

2011 10.515

2010 10.229

2009 7.902

70.9966.28

72.1067.04

82.3170.28

81.6175.84

87.6679.30

83.8377.14

85.9281.00

87.5480.00

82.5879.02

85.3378.88

89.6083.37

92.6486.14

adidas AG share price outperforms market

At the beginning of the year, the adidas AG share continued its positive

trend from the end of 2012 and clearly outperformed the overall market

and sector, gaining 20% in the first quarter. This performance was

mainly driven by positive analyst commentary about the positioning of

the adidas Group’s brands and the Group’s ability to further improve

profitability in 2013 as well as the introduction of the new adidas

Boost technology, which was well perceived by media and the financial

community. In addition, the publication of the Group’s 2012 financial

results on March 7, with positive results in the company’s key markets,

solid balance sheet improvements and management’s proposal to

increase the dividend by 35%, further increased investor confidence.

At the beginning of the second quarter, the adidas AG share initially

suffered losses, as some investors took profits in light of the strong

share price appreciation year-to-date. However, from mid-April

onwards, the share price recovered, as several analysts commented

positively in the run-up to the adidas Group first quarter results.

Following the publication of first quarter results on May 3, the adidas

AG share gained considerably, as bottom-line results came in clearly

above market expectations. This prompted several recommendation

upgrades and target price increases by analysts and, together with

positive market sentiment, drove the adidas AG share price to a new

high of € 87.66 on May 22. Towards the end of the second quarter, the

adidas AG share came under pressure in line with overall equity market

weakness. While most stock markets suffered significant losses, the

adidas AG share however showed resilience and traded sideways. In

the third quarter, the adidas AG share declined and underperformed

the overall market. The publication of first half year results on August

8, which came in slightly below top- and bottom-line consensus, as

well as disappointing reports by major US retailers towards the end of

August, weighed on the share price development. During the first half of

September, the share price partially recovered due to improving market

trends. On September 19, the adidas Group amended its full year 2013

guidance, as a result of intensified currency headwinds, distribution

constraints and a softer consumer environment in Russia/CIS as well

as the overall weakness in the golf market, resulting in a 3% share

price decline on the day following the ad hoc press release. In the fourth

quarter, the adidas AG share recovered and gained steadily, supported

by the positive market feedback following the release of our nine

months results on November 7. In particular, sustained gross margin

strength as well as over-proportionate growth in emerging markets

was well received by market participants. On December 2 and 3, the

adidas Group Investor Field Trip, hosted in Herzogenaurach, Germany,

aimed at reinforcing confidence in our Route 2015 targets, helped to

sustain positive momentum. Benefiting from positive market feedback

following the event, the adidas AG share gained strongly towards the

end of the year. As a result, the adidas AG share closed 2013 at a new

all-time high of € 92.64, representing a 38% increase and a significant

outperformance relative to international stock markets

/

TABLE 01.

This implies a market capitalisation of € 19.4 billion at the end of 2013

versus € 14.1 billion at the end of 2012

/

DIAGRAM 05.

Average daily trading volume remains at similar levels

During 2013, the average daily trading volume of the adidas AG share on

all German stock exchanges (excluding bank trades) declined slightly to

0.8 million shares (2012: 0.9 million). The average daily trading volume

of the adidas AG share on alternative trading systems, such as CHI-X,

Turquoise and BATS Europe, remained stable at 0.5 million shares per

trading day (2012: 0.5 million). Share trading on OTC markets such as

BOAT and EuroNext OTC remained unchanged at 1.1 million shares per

trading day (2012: 1.1 million).