Reebok 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

153

2013

Subsequent Events and Outlook

/

03.4

/

Sporting goods industry expansion to continue in 2014

In the absence of any major economic shocks, we expect the global

sporting goods industry to grow in 2014. In particular, the industry

should benefit from major sporting events, such as the world’s largest,

the FIFA World Cup, hosted by Brazil, as well as from the 2014 Winter

Olympic Games being held in Sochi, Russia. Many sporting goods

retailers will continue to move to a more omni-retail business model,

and e-commerce and investment in digital are anticipated to remain

growth areas. Following macroeconomic trends, consumer spending

on sporting goods in the emerging economies is expected to grow

faster than in the more developed markets. Private consumption in

many developed economies is forecasted to improve moderately in

2014, supporting modest industry expansion in those markets. While

inflationary pressures are projected to remain relatively contained in

most markets, the recent currency devaluations in several emerging

market countries are likely to lead to significant price increases over

time in the affected countries. In addition, wage growth in the faster-

growing economies is forecasted to continue to add significant costs to

the industry, especially where the industry sources and manufactures

sporting goods.

In Europe, improvements in consumer confidence and domestic

demand should positively impact the sporting goods industry in 2014.

The region’s industry will also gain momentum due to the large number

of European teams participating in the 2014 FIFA World Cup in Brazil

and the importance of football for those markets. This benefit will also

positively impact many European emerging markets, including Russia,

who also qualified. Russia’s sporting goods sector should also gain

additional momentum as the host nation for the 2014 Winter Olympic

Games. Nonetheless, trends of lower growth in disposable income rates

are expected to continue to negatively impact consumer sentiment and

spending, and lessen the sporting goods sector’s expansion in some

European emerging markets, especially in Russia.

In the USA, industry growth rates are expected to be ahead of the

economy’s overall growth. From a category perspective, the trend

towards high-performance technical running and training footwear

looks set to continue. Similarly, advanced and highly innovative apparel

products are also predicted to be significant sporting goods sales drivers

for the year. Lifestyle running is expected to recover and the US golf

market is also forecasted to see modest growth in 2014.

In Greater China, strong wage growth and domestic consumption is

predicted to propel sporting goods sales in 2014. The trend and market

share shift towards international brands is expected to continue. In other

Asian markets, the sporting goods industry is also forecasted to grow in

2014, albeit with regional differences. Japan’s sporting goods industry

is expected to grow modestly, with the weaker yen and the substantial

government stimulus programmes helping to drive improvements in

consumer sentiment and domestic spending. However, an expected

sales tax increase in April may negatively impact the industry. Most of

the other major Asian emerging markets are expected to see robust

sporting goods sales growth in 2014, as domestic demand increases and

rising wages continue to drive purchases of discretionary items.

The sporting goods industry in Latin America is projected to record

healthy growth in 2014, with wage growth expected to promote

consumer spending and discretionary purchases. Furthermore, given

the significance of football in this region, the industry is expected to

maintain momentum from sales relating to the 2014 FIFA World Cup

in Brazil.

01

/

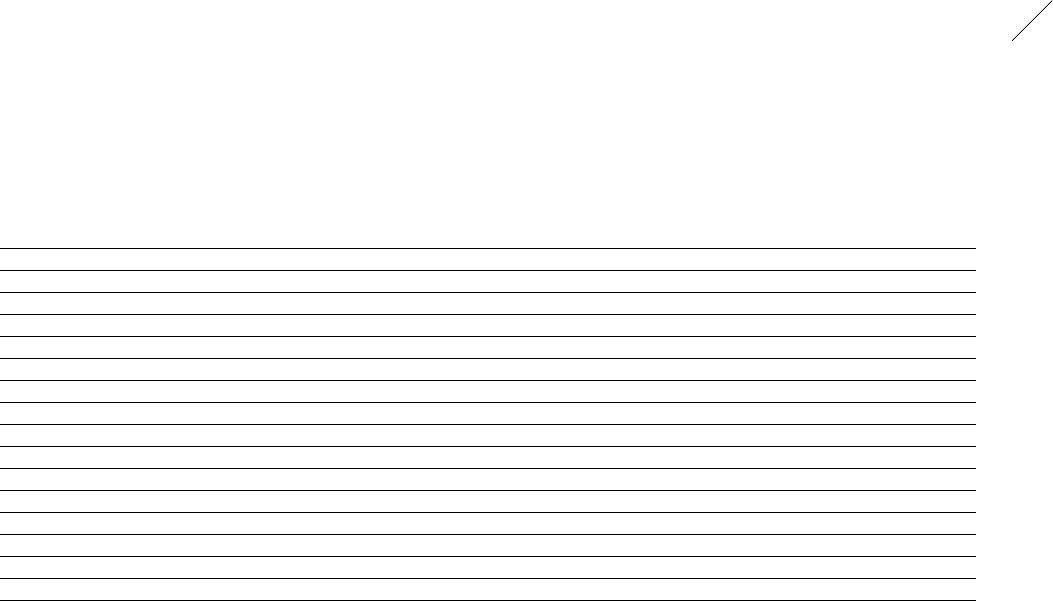

adidas Group 2014 outlook

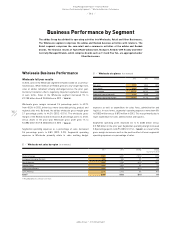

Currency-neutral sales development (in %):

adidas Group high-single-digit rate increase

Wholesale mid-single-digit rate increase

Retail high-single- to low-double-digit rate increase

Comparable store sales low- to mid-single-digit rate increase

Other Businesses low- to mid-single-digit rate increase

TaylorMade-adidas Golf low- to mid-single-digit rate increase

Rockport mid- to high-single-digit rate increase

Reebok-CCM Hockey mid-single-digit rate increase

Gross margin 49.5% to 49.8%

Operating margin between 8.5% and 9.0%

Net income attributable to shareholders € 830 million to € 930 million

Average operating working capital in % of net sales moderate decrease

Capital expenditure € 500 million to € 550 million

Store base net increase by around 250 stores

Gross borrowings decline