Reebok 2013 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

172

2013

/

03.5

/

Risk and Opportunity Report

/

Financial Risks

The adidas Group Treasury department arranges currency and interest

rate hedges, and invests cash, with major banks of a high credit standing

throughout the world. adidas Group companies are authorised to

work with banks rated BBB+ or higher. Only in exceptional cases are

subsidiaries authorised to work with banks rated lower than BBB+.

To limit risk in these cases, restrictions are clearly stipulated, such

as maximum cash deposit levels. In addition, the credit default swap

premiums of our partner banks are monitored on a monthly basis. In the

event that the defined threshold is exceeded, credit balances are shifted

to banks compliant with the limit.

As financial market conditions remain challenging and highly volatile

and due to our overall investment volume, we believe that the

financial impact could be major (2012: moderate) but the likelihood of

materialising is unlikely. Furthermore, we believe our risk concentration

is limited due to the broad distribution of our investment business with

more than 20 banks. At December 31, 2013, no bank accounted for more

than 7% of our investments and the average concentration, including

subsidiaries’ short-term deposits in local banks, was 1%. This leads to a

maximum exposure of € 100 million in the event of default of any single

bank. We have further diversified our investment exposure by investing

into AAA-rated money market funds.

In addition, we held derivatives with a positive fair market value in the

amount of € 59 million. The maximum exposure to any single bank

resulting from these assets amounted to € 10 million and the average

concentration was 6%.

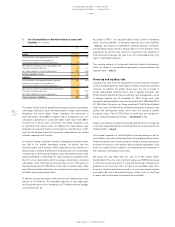

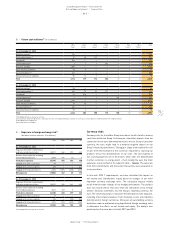

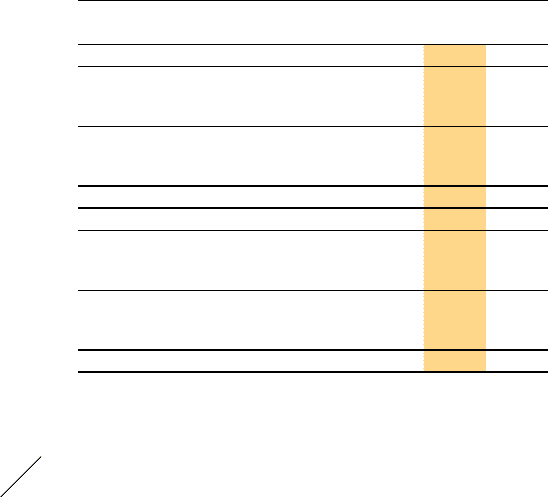

According to IFRS 7, the adjacent table includes further information

about set-off possibilities of derivative financial assets and liabilities

/

TABLE 04. The majority of agreements between financial institutions

and the adidas Group include a mutual right to set-off. However, these

agreements do not meet the criteria for offsetting in the statement of

financial position, because the right to set-off is enforceable only in the

event of counterparty defaults.

The carrying amounts of recognised derivative financial instruments,

which are subject to the mentioned agreements, are presented in the

adjacent table

/

TABLE 04.

Financing and liquidity risks

Liquidity risks arise from not having the necessary resources available

to meet maturing liabilities with regard to timing, volume and currency

structure. In addition, the adidas Group faces the risk of having to

accept unfavourable financing terms due to liquidity restraints. Our

Group Treasury department uses an efficient cash management system

to manage liquidity risk. At December 31, 2013, Group cash, cash

equivalents and marketable securities amounted to € 1.629 billion (2012:

€ 1.935 billion). Moreover, our Group maintains € 1.652 billion bilateral

credit lines and a € 500 million committed long-term syndicated loan

facility with international banks, which does not include a market

disruption clause. The € 2.152 billion in credit lines are designed to

ensure sufficient liquidity at all times

/

SEE TREASURY, P. 135.

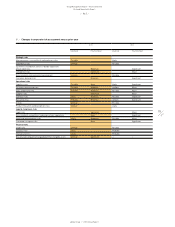

Future cash outflows arising from financial liabilities that are recognised

in the Consolidated Statement of Financial Position are presented in the

following table

/

TABLE 05.

This includes payments to settle obligations from borrowings as well as

cash outflows from cash-settled derivatives with negative market values.

Financial liabilities that may be settled in advance without penalty are

included on the basis of the earliest date of potential repayment. Cash

flows for variable-interest liabilities are determined with reference to

the conditions at the balance sheet date.

We ended the year 2013 with net cash of € 295 million (2012:

€ 448 million). Thus the ratio of net borrowings over EBITDA decreased

to –0.2 times at year-end, which is in line with the Group’s medium-term

guideline of less than two times. In light of our available credit lines,

financing structure and business model, our risk assessment remains

unchanged. We assess the potential impact of these risks on the Group

as minor and the likelihood of materialising as unlikely.

04

/

Set-off possibilities of derivative financial assets and

liabilities (€ in millions)

2013 2012

Assets

Gross amounts of recognised financial assets 59 61

Financial instruments which qualify for

set-off in the statement of financial position 0 0

Net amounts of financial assets presented in the

statement of financial position 59 61

Set-off possible due to master agreements (53) (48)

Total net amount of assets 6 13

Liabilities

Gross amounts of recognised financial liabilities (93) (60)

Financial instruments which qualify for

set-off in the statement of financial position 0 0

Net amounts of financial liabilities presented in the

statement of financial position (93) (60)

Set-off possible due to master agreements 53 48

Total net amount of liabilities (40) (12)