Reebok 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

145

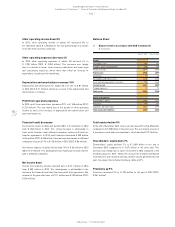

2013

/

03.3

/

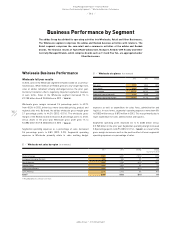

Business Performance by Segment

/

Wholesale Business Performance

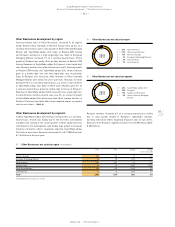

Wholesale development by region

In 2013, currency-neutral sales for the Wholesale segment increased

in all regions except Western Europe and North America. Currency-

neutral revenues in Western Europe decreased 9%, mainly due to sales

declines in the UK, Italy and Spain. Currency-neutral sales in European

Emerging Markets rose 8%, as a result of growth in most of the region’s

major markets. Currency-neutral Wholesale sales in North America

were down 3% due to declines in the USA. Revenues in Greater China

increased 7% on a currency-neutral basis. Sales in Other Asian Markets

grew 5% on a currency-neutral basis, driven by strong increases in

South Korea, India and Australia. In Latin America, currency-neutral

sales were up 16%, supported by double-digit sales growth in most of

the region’s major markets. Currency translation effects had a negative

impact on regional sales in euro terms

/

TABLE 02.

Wholesale development by brand

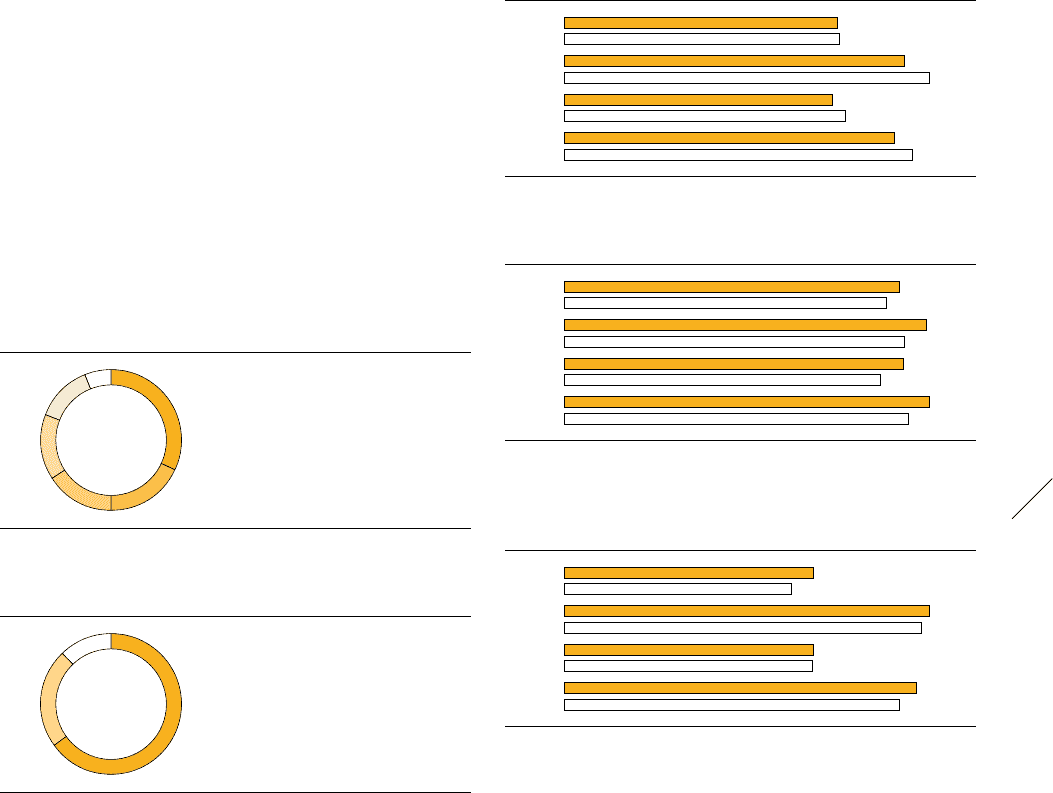

In 2013, adidas Sport Performance wholesale revenues grew 1% on a

currency-neutral basis. Growth was mainly a result of sales increases

in the training, running, football and outdoor categories, partly offset

by declines in categories closely related to prior year major sporting

events, such as Olympic sports. Currency translation effects had a

negative impact on revenues in euro terms. adidas Sport Performance

sales decreased 4% to € 5.917 billion from € 6.187 billion in the prior

year.

04

/

Wholesale net sales by brand

2013

1

/

65% adidas Sport Performance

2

/

23% adidas Originals &

Sport Style

3

/

12% Reebok

1

2

3

03

/

Wholesale net sales by region

2013

1

/

32% Western Europe

2

/

18% North America

3

/

16% Greater China

4

/

15% Other Asian Markets

5

/

13% Latin America

6

/

6% European Emerging Markets

6

5 1

2

3

4

Currency-neutral adidas Originals & Sport Style wholesale revenues

grew 2% in 2013. This increase was driven by double-digit sales growth

at the adidas NEO label. Currency translation effects had a negative

impact on revenues in euro terms. adidas Originals & Sport Style sales

decreased 2% to € 2.156 billion (2012: € 2.193 billion).

In 2013, Reebok wholesale revenues increased 1% on a currency-neutral

basis, mainly due to growth in the classics, fitness training and studio

categories. This development was partly offset by the negative impact of

the discontinuation of the NFL licence agreement. Currency translation

effects had a negative impact on revenues in euro terms. Reebok sales

were down 5% to € 1.050 billion (2012: € 1.109 billion).

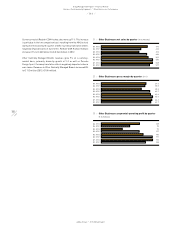

05

/

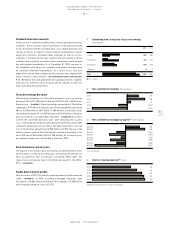

Wholesale net sales by quarter (€ in millions)

Q4 2013 2,052

Q4 2012 2,063

Q3 2013 2,553

Q3 2012 2,743

Q2 2013 2,014

Q2 2012 2,113

Q1 2013 2,481

Q1 2012 2,614

06

/

Wholesale gross margin by quarter (in %)

Q4 2013 40.7

Q4 2012 39.1

Q3 2013 43.9

Q3 2012 41.3

Q2 2013 41.1

Q2 2012 38.3

Q1 2013 44.3

Q1 2012 41.8

07

/

Wholesale segmental operating profit by quarter

(€ in millions)

Q4 2013 632

Q4 2012 577

Q3 2013 926

Q3 2012 907

Q2 2013 632

Q2 2012 630

Q1 2013 893

Q1 2012 851