Reebok 2013 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

195

2013

Notes

/

04.8

/

New standards and interpretations as well as amendments to existing standards and interpretations are usually

not applied by the Group before the effective date, with the exception of the following standard:

/

IAS 36 Amendment – Recoverable Amount Disclosures for Non-Financial Assets (effective date: January 1,

2014): By applying this amendment early, the unintentionally introduced requirement to disclose the recoverable

amounts of cash-generating units irrespective of whether an impairment has actually occurred is waived.

The consolidated financial statements have in principle been prepared on the historical cost basis with the

exception of certain items in the statement of financial position such as financial instruments valued at fair

value through profit or loss, available-for-sale financial assets, derivative financial instruments, plan assets and

receivables, which are measured at fair value.

The consolidated financial statements are presented in euros (€) and all values are rounded to the

nearest million (€ in millions).

The consolidated financial statements are prepared in accordance with the consolidation, accounting and

valuation principles described below.

Principles of consolidation

The consolidated financial statements include the financial statements of adidas AG and all its direct and indirect

subsidiaries, which are prepared in accordance with uniform accounting principles. A company is considered

a subsidiary if it is controlled by adidas AG, e.g. by holding the majority of the voting rights and/or directly or

indirectly governing the financial and operating policies of the respective enterprise.

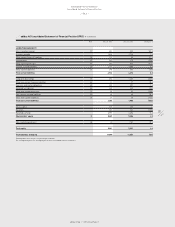

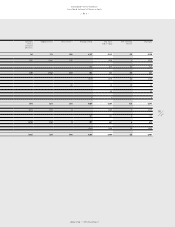

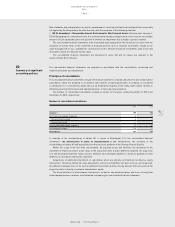

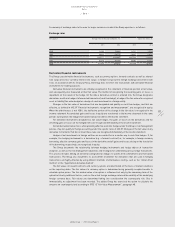

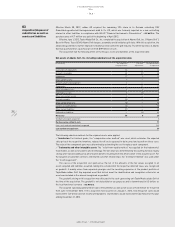

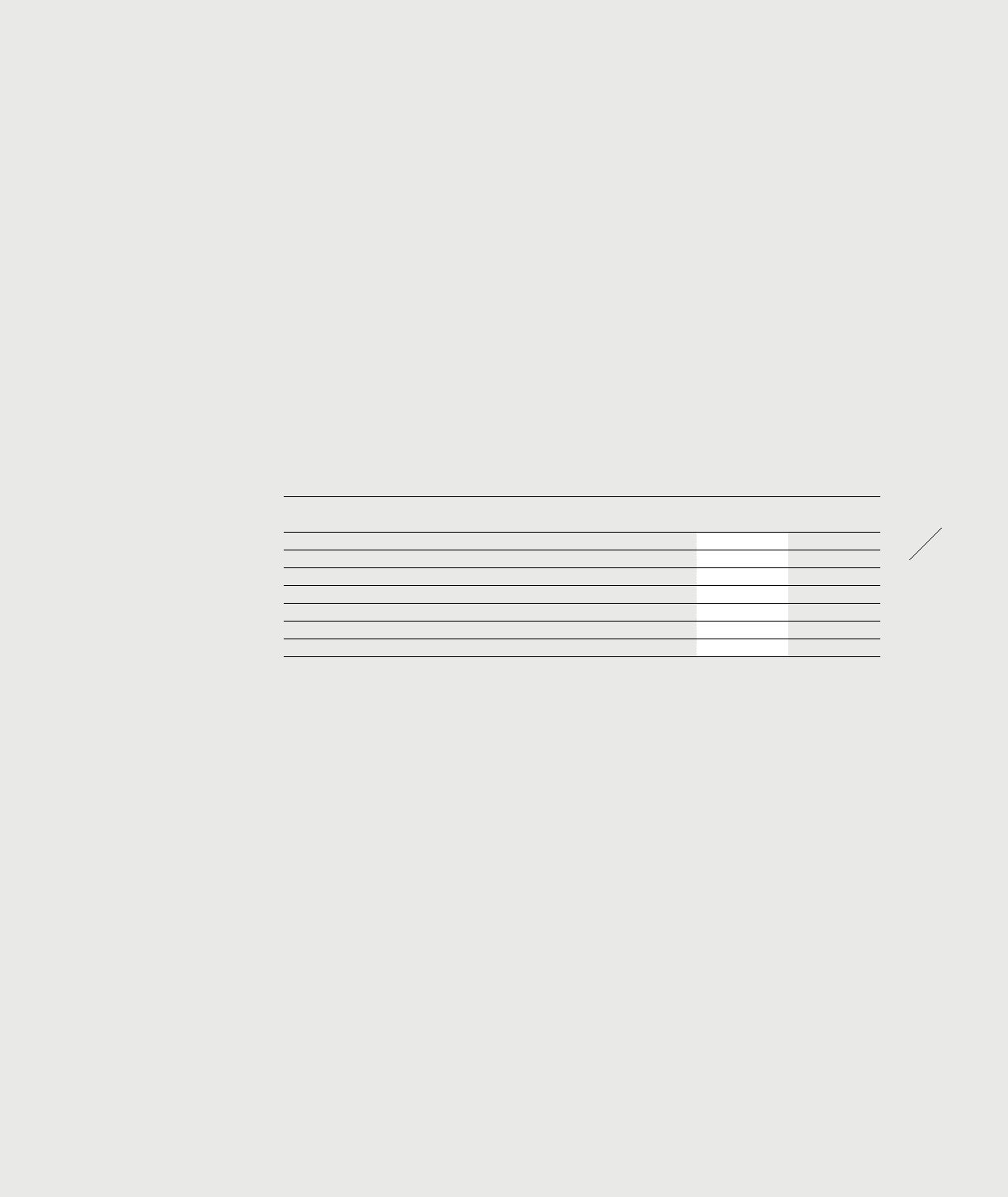

The number of consolidated subsidiaries evolved as follows for the years ending December 31, 2013 and

December 31, 2012, respectively:

Number of consolidated subsidiaries

2013 2012

January 1 177 173

First-time consolidated companies: 4 13

Thereof: newly founded 4 4

Thereof: purchased — 9

Deconsolidated/divested companies (7) (9)

Intercompany mergers (13) —

December 31 161 177

A schedule of the shareholdings of adidas AG is shown in Attachment II to the consolidated financial

statements

/

SEE SHAREHOLDINGS OF ADIDAS AG, HERZOGENAURACH, P. 240. Furthermore, the schedule of the

shareholdings of adidas AG will be published on the electronic platform of the German Federal Gazette.

Within the scope of the first-time consolidation, all acquired assets and liabilities are recognised in the

statement of financial position at fair value at the acquisition date. A debit difference between the acquisition

cost and the proportionate fair value of assets, liabilities and contingent liabilities is shown as goodwill. A credit

difference is recorded in the income statement.

Acquisitions of additional investments in subsidiaries which are already controlled are recorded as equity

transactions. Therefore, neither fair value adjustments of assets and liabilities nor gains or losses are recognised.

Any difference between the cost for such an additional investment and the carrying amount of the net assets at the

acquisition date is directly recorded in shareholders’ equity.

The financial effects of intercompany transactions, as well as any unrealised gains and losses arising from

intercompany business relations are eliminated in preparing the consolidated financial statements.

02

Summary of significant

accounting policies