Reebok 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

134

2013

/

03.2

/

Group Business Performance

/

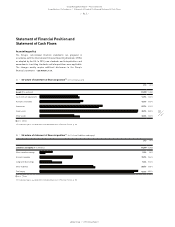

Statement of Financial Position and Statement of Cash Flows

Investment analysis

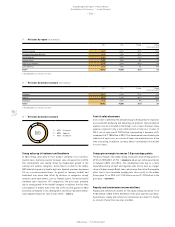

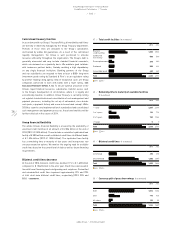

Capital expenditure is defined as the total cash expenditure for the

purchase of tangible and intangible assets (excluding acquisitions).

Group capital expenditure increased 10% to € 479 million in 2013 (2012:

€ 434 million). Capital expenditure in property, plant and equipment

amounted to € 427 million and was thus above the prior year level of

€ 376 million. The Group invested € 52 million in intangible assets,

representing a 10% decrease compared to the prior year (2012:

€ 58 million). Depreciation and amortisation excluding impairment

losses/reversal of impairment losses of tangible and intangible assets

increased 9% to € 286 million in 2013 (2012: € 263 million).

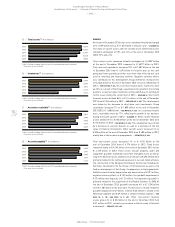

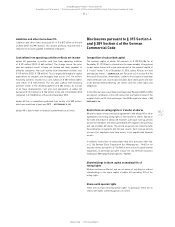

The majority of the Group’s capital expenditure was recorded in HQ/

Consolidation, accounting for 52% (2012: 58%), and was mainly related

to investments in the Group’s logistics infrastructure and deployment

of IT systems

/

DIAGRAM 42. The Retail segment accounted for 29% of

the Group’s capital expenditure (2012: 24%). Investments primarily

related to the expansion of our store base for the adidas and Reebok

brands, particularly in Russia/CIS. Expenditure in the Wholesale

segment accounted for 13% of total capital expenditure (2012: 12%).

Capital expenditure in Other Businesses accounted for 6% of total

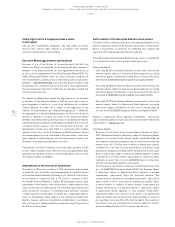

expenditure (2012: 6%). From a regional perspective, capital expenditure

in Western Europe accounted for 41% (2012: 45%) of the Group’s capital

expenditure, followed by European Emerging Markets with 17% (2012:

15%), North America with 16% (2012: 11%) and Greater China with 13%

(2012: 9%)

/

DIAGRAM 43.

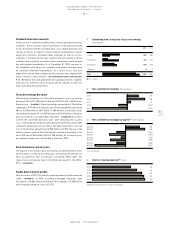

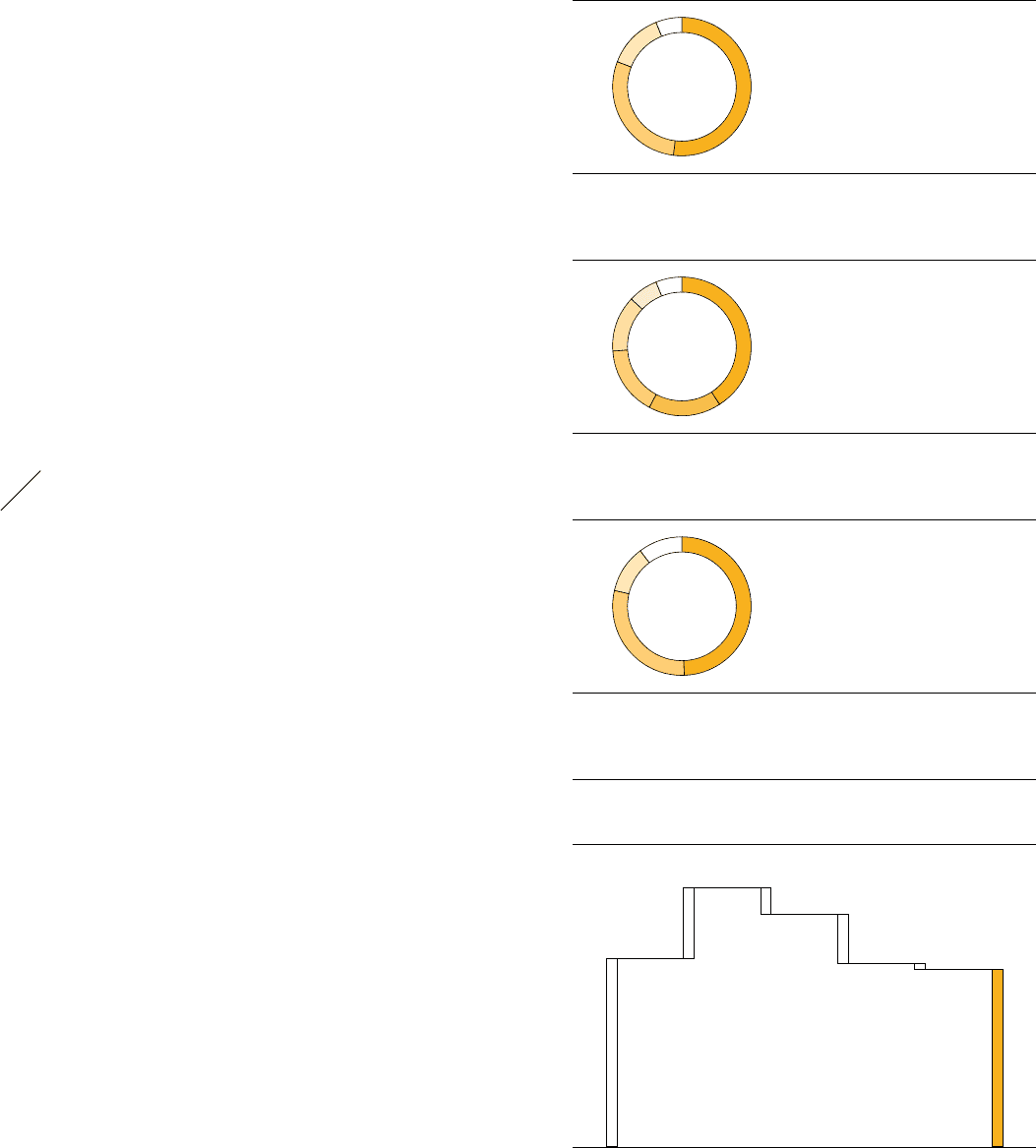

Liquidity analysis

In 2013, net cash generated from operating activities decreased 33%

to € 634 million (2012: € 942 million), primarily due to higher working

capital requirements. Net cash used in investing activities increased 12%

to € 243 million (2012: € 217 million). The majority of investing activities

in 2013 related to spending for property, plant and equipment, such as

investments in the furnishing and fitting of stores in our Retail segment

as well as investments in the Group’s logistics infrastructure and IT

systems. These were partly offset by the sale of short-term financial

assets. Net cash used in financing activities totalled € 439 million (2012:

net cash generated from financing activities of € 42 million). Cash used

in financing activities mainly related to dividends paid to shareholders

of € 282 million for the 2012 financial year as well as the repayment

of short-term borrowings of € 221 million. Exchange rate effects

negatively impacted the Group’s cash position by € 35 million in 2013

(2012: € 3 million). As a result of all these developments, cash and

cash equivalents decreased € 83 million to € 1.587 billion at the end

of December 2013 compared to € 1.670 billion at the end of December

2012

/

DIAGRAM 45.

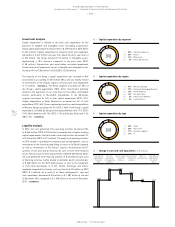

42

/

Capital expenditure by segment

43

/

Capital expenditure by region

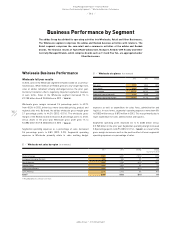

44

/

Capital expenditure by type

2013

2013

2013

1

/

52% HQ/Consolidation

2

/

29% Retail

3

/

13% Wholesale

4

/

6% Other Businesses

1

/

41% Western Europe

2

/

17% European Emerging Markets

3

/

16% North America

4

/

13% Greater China

5

/

7% Other Asian Markets

6

/

6% Latin America

1

/

49% Other

2

/

29% Own retail

3

/

11% Retailer support

4

/

11% IT

1

1

1

2

3

2

2

3

5

3

4

6

4

4

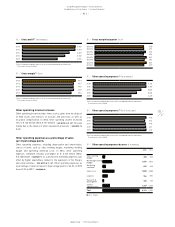

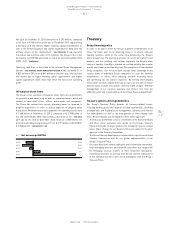

45

/

Change in cash and cash equivalents (€ in millions)

Cash and cash

equivalents at

the end of

2012

Net cash

generated

from operating

activities

Net cash used

in investing

activities

Net cash used

in financing

activities

Effect of

exchange rates

Cash and cash

equivalents at

the end of

2013

1,670

634 (243)

(35)

(439)

1,587