Reebok 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

122

2013

/

03.2

/

Group Business Performance

/

Economic and Sector Development

Group Business Performance

In 2013, the adidas Group delivered a solid financial performance, despite macroeconomic challenges

in many regions, especially Western Europe. Currency-neutral Group sales increased 3% as a result

of growth in Retail and Other Businesses. In euro terms, adidas Group revenues decreased 3% to

€ 14.492 billion from € 14.883 billion in 2012. The Group’s gross margin increased 1.5 percentage

points to 49.3% (2012: 47.7%), driven by the positive impact from a more favourable pricing, product

and regional sales mix as well as a larger share of higher-margin Retail sales. The Group’s gross profit

rose 1% to € 7.140 billion in 2013 versus € 7.103 billion in 2012. In 2013, the adidas Group incurred

goodwill impairment losses of € 52 million (2012: € 265 million). These one-off expenses were

non-cash in nature and did not affect the adidas Group’s liquidity. Excluding goodwill impairment

losses, the Group’s operating profit grew 6% to € 1.254 billion compared to € 1.185 billion in 2012,

representing an operating margin of 8.7%, up 0.7 percentage points. This was primarily due to the

increase in gross margin, which more than offset the negative effect from higher other operating

expenses as a percentage of sales. Net income attributable to shareholders excluding goodwill

impairment losses was up 6% to € 839 million (2012: € 791 million). Basic and diluted earnings per

share excluding goodwill impairment losses grew 6% to € 4.01 from € 3.78 in 2012.

Economic and Sector Development

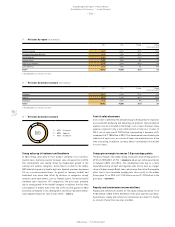

Global economy expands 2.4% in 2013

In 2013, according to the World Bank, global GDP growth moderated

slightly to 2.4%, compared to 2.5% in the prior year. The emerging

markets outperformed developed economies, growing 4.8% and 1.3%,

respectively. Relatively stable inflationary pressures and increases

in real disposable incomes supported consumption and GDP growth,

particularly in many emerging markets, albeit at a slightly lower rate

than that seen in previous years. Despite improvements in economic

activity and sentiment, many developed markets continued to face

economic challenges in 2013, particularly in the euro area, where low

growth and even recession in many mature economies remained as

significant negative pressure for the global economy.

In Western Europe, GDP growth was flat in 2013, which was an

improvement from the contraction of 0.3% in the prior year. This

reflects the overall stabilisation of the region. However, within the

region, the euro area remained in recession, with some of the union’s

major economies, such as Italy and Spain, contracting in 2013. This

was largely due to high unemployment levels and austerity measures

inhibiting investment, spending and confidence. These developments

offset modest growth in the euro area’s largest economies, Germany

and France, where a recovery in consumer demand and spending helped

drive moderate growth.

European emerging markets recorded positive GDP growth of around

2.2%, albeit at lower levels than in recent years (2012: 2.7%). This was

fuelled by robust industrial and export activity in most of the region’s

markets. Russia, the world’s largest energy exporter, was negatively

impacted by lower growth in global demand for oil and natural gas,

as well as relatively high inflationary pressures which resulted in a

deceleration in consumer and investment spending.

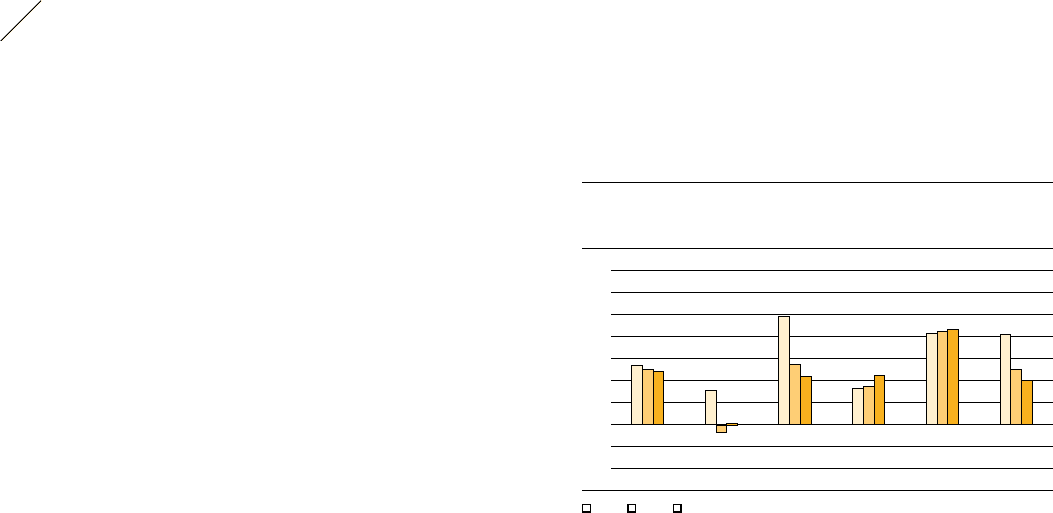

01

/

Regional GDP development 1) (in %)

Global 2) Western

Europe 3)

European

emerging

markets 3)

USA 4) Asia 3) 5) Latin

America 3)

6

4

2

0

(2)

■ 2011 ■ 2012 ■ 2013

1) Real, percentage change versus prior year;

2011 and 2012 figures restated compared to prior year.

2) Source: World Bank.

3) Source: HSBC.

4) Source: U.S. Federal Reserve.

5) Asia also includes Japan and Area Pacific.