Reebok 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

173

2013

/

03.5

/

Risk and Opportunity Report

/

Financial Risks

Currency risks

Currency risks for the adidas Group are a direct result of multi-currency

cash flows within the Group. Furthermore, translation impacts from the

conversion of non-euro-denominated results into our Group’s functional

currency, the euro, might lead to a material negative impact on our

Group’s financial performance. The biggest single driver behind this risk

results from the mismatch of the currencies required for sourcing our

products versus the denominations of our sales. The vast majority of

our sourcing expenses are in US dollars, while sales are denominated

in other currencies to a large extent – most notably the euro. Our main

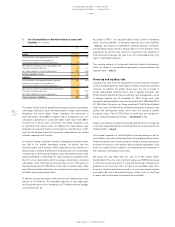

exposures are presented in the adjacent table

/

TABLE 06. The exposure

from firm commitments and forecasted transactions was calculated on

a one-year basis.

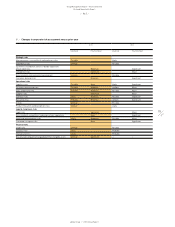

In line with IFRS 7 requirements, we have calculated the impact on

net income and shareholders’ equity based on changes in our most

important currency exchange rates. The calculated impacts mainly

result from fair value changes of our hedging instruments. The analysis

does not include effects that arise from the translation of our foreign

entities’ financial statements into the Group’s reporting currency, the

euro. The sensitivity analysis is based on the net balance sheet exposure,

including intercompany balances from monetary assets and liabilities

denominated in foreign currencies. Moreover, all outstanding currency

derivatives were re-evaluated using hypothetical foreign exchange rates

to determine the effects on net income and equity. The analysis was

performed on the same basis for both 2012 and 2013.

05

/

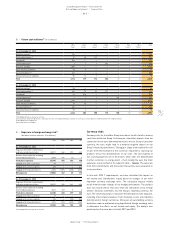

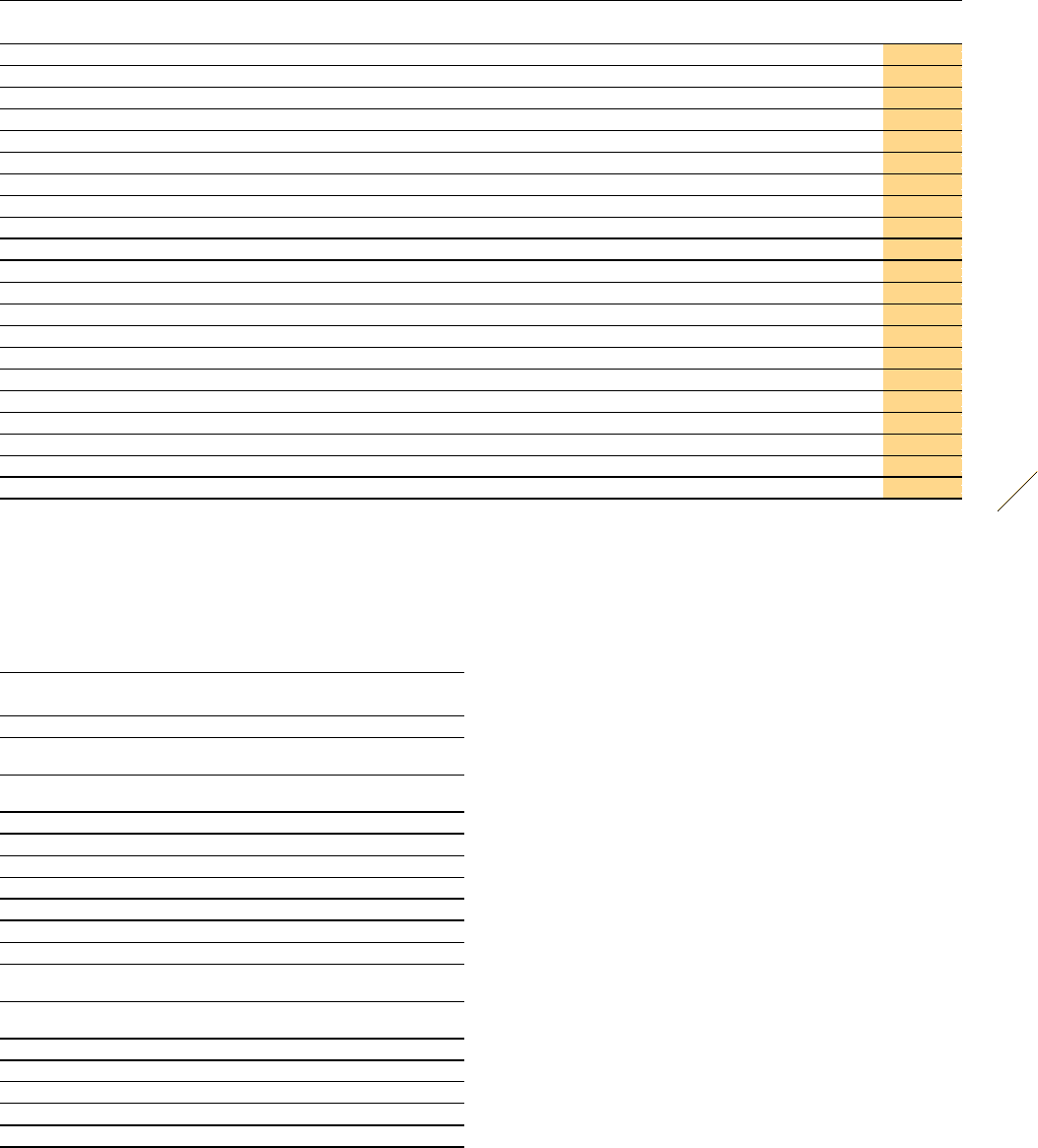

Future cash outflows 1) (€ in millions)

Up to

1 year

Up to

2 years

Up to

3 years

Up to

4 years

Up to

5 years

Up to

6 years

Up to

7 years

Total

As at December 31, 2013

Bank borrowings 2) 126 — — — — — — 126

Private placements 3) 70 95 111 — — — — 276

Eurobond 3) 514 — — — — — — 514

Convertible bond 3) 1 1 1 502 — — — 505

Accounts payable 1,825 ——————1,825

Other financial liabilities 33 9 — — — — — 42

Accrued liabilities 4) 464 — — — — — — 464

Derivative financial liabilities 80 12 1 — — — — 93

Total 3,113 117 113 502 — — — 3,845

As at December 31, 2012

Bank borrowings 2) 59 — — — — — — 59

Private placements 3) 242 70 99 117 — — — 528

Eurobond 3) 24 514 — — — — — 538

Convertible bond 3) 1 1 1 1 503 — — 507

Accounts payable 1,790 — — — — — — 1,790

Other financial liabilities 26 14 — — — — — 40

Accrued liabilities 4) 434 — — — — — — 434

Derivative financial liabilities 57 3 — — — — — 60

Total 2,633 602 100 118 503 — — 3,956

1) Rounding difference may arise in totals.

2) Classified as long-term (between 1 and 3 years) in the consolidated financial statements, as they are covered by the committed mid-term syndicated loan.

3) Including interest payments.

4) Accrued interest excluded.

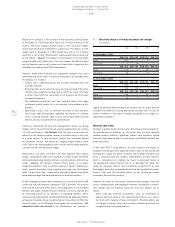

06

/

Exposure to foreign exchange risk 1)

(based on notional amounts, € in millions)

USD RUB GBP JPY

As at December 31, 2013

Exposure from firm commitments

and forecasted transactions (3,811) 348 370 362

Balance sheet exposure including

intercompany exposure (358) 106 (7) 6

Total gross exposure (4,169) 454 363 368

Hedged with other cash flows 87 — — —

Hedged with currency options 425 — — (47)

Hedged with forward contracts 2,604 (107) (298) (209)

Net exposure (1,053) 347 65 112

As at December 31, 2012

Exposure from firm commitments

and forecasted transactions (3,819) 359 369 354

Balance sheet exposure including

intercompany exposure (321) 109 8 8

Total gross exposure (4,140) 468 377 362

Hedged with other cash flows 91 — — —

Hedged with currency options 225 — (12) (24)

Hedged with forward contracts 2101 (72) (263) (188)

Net exposure (1,723) 396 102 150

1) Rounding difference may arise in totals.