Reebok 2013 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

180

2013

Management Assessment of Performance, Risks and Opportunities, and Outlook

/

03.6

/

Management Assessment of

Performance, Risks and Opportunities,

and Outlook

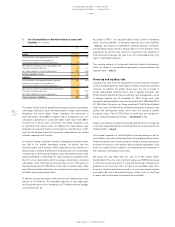

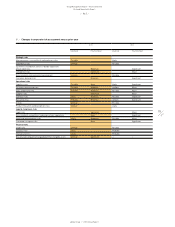

Assessment of performance versus targets

We communicate our Group’s financial targets on an annual basis. We

also provide updates throughout the year as appropriate

/

TABLE 01. In

2013, the adidas Group delivered a solid financial performance, despite

macroeconomic challenges in many regions, with currency-neutral

Group sales growth outperforming macroeconomic growth

/

SEE

ECONOMIC AND SECTOR DEVELOPMENT, P. 122.

As a result of intensified currency translation headwinds, distribution

constraints due to a warehouse issue and a softer consumer

environment in Russia/CIS as well as an overall weakness in the golf

market, we lowered our full year 2013 guidance in September, compared

to our initial expectations.

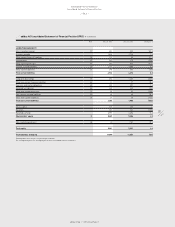

In 2013, Group revenues rose 3% on a currency-neutral basis, mainly due

to growth in emerging markets as well as the further expansion of our

own-retail activities. Group revenues increased below our initial guidance

of a mid-single-digit currency-neutral increase. This was driven by lower

sales growth than originally expected in Russia/CIS and at TaylorMade-

adidas Golf. Gross margin increased 1.5 percentage points to 49.3%,

above our initial expectations of 48.0% to 48.5%. This development was

due to a more favourable pricing, product and regional sales mix as well

as strong improvements in the Reebok brand gross margin. Operating

margin excluding goodwill impairment losses improved 0.7 percentage

points to 8.7%. This development was slightly below our initial guidance

of approaching 9.0%, as operating expenses as a percentage of sales

were higher than originally forecasted. This was mainly due to the lower

top-line growth as well as the faster expansion of own-retail activities

than originally planned. As a result, basic and diluted earnings per share

excluding goodwill impairment losses were € 4.01 and thus below our

initial guidance of € 4.25 to € 4.40. This result was mainly due to negative

currency translation effects, which significantly impacted our reported

results in 2013, as well as the lower sales growth in Russia/CIS and at

TaylorMade-adidas Golf

/

SEE INCOME STATEMENT, P. 125.

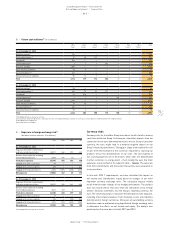

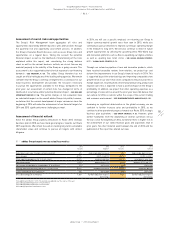

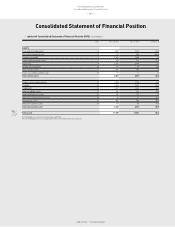

In 2013, operating working capital and cash management were negatively

impacted by increased working capital requirements towards the end of

the year. While we had expected average operating working capital as

a percentage of sales to increase moderately in 2013, our challenges

in Russia/CIS resulted in slightly higher inventories and, as a result,

a stronger increase than we had initially expected

/

SEE STATEMENT OF

FINANCIAL POSITION AND STATEMENT OF CASH FLOWS, P. 131.

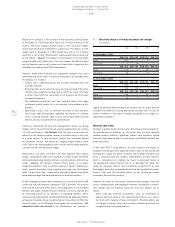

Beyond our financial performance, we also actively monitor the Group’s

key non-financial KPIs on a regular basis, as available

/

SEE INTERNAL

GROUP MANAGEMENT SYSTEM, P. 118. From a market share perspective, we

continue to be very encouraged by our strong performance compared to

our major competitors in key emerging markets. In particular, Greater

China and Latin America were notable standouts, as we significantly

improved our market share in both regions in 2013. Less pleasing,

however, was our underperformance in key developed markets such

as the USA and Western Europe. Nevertheless, in these markets, we

have seen signs of improvement towards the end of 2013, driven by

product launches in key categories such as football and running. Finally

in the golf market, despite a challenging year for the entire industry,

we continue to enjoy healthy market share positions. In metalwoods,

our market shares remain well above 30% in the USA and Western

Europe, slightly lower than the prior year. In both irons and footwear, we

increased market share in nearly all key regions in 2013.

Despite the distribution challenges we faced in Russia/CIS, we continued

to maintain a good level of on-time in-full deliveries to our customers

and own-retail stores in 2013

/

SEE GLOBAL OPERATIONS, P. 94. As in

prior years, the majority of our sales in 2013 were again generated

from products launched in the past 12 to 18 months. In addition, we

received several awards and industry recognitions for our new product

innovations

/

SEE RESEARCH AND DEVELOPMENT, P. 99. At a Group level, we

also completed our most comprehensive employee engagement survey

during 2013. The result was satisfactorily on average with the benchmark

of our external provider, with improvements in several areas since our

last survey in 2010

/

SEE EMPLOYEES, P. 105. Finally, our diligence and

discipline in sustainability matters continues to yield strong recognition

for our Group. For the 14th consecutive time, we were selected to join

the Dow Jones Sustainability Indexes (DJSI) and were named industry

leader in sustainability issues and corporate responsibility in the

category “Clothing, Accessories & Footwear” for the tenth time

/

SEE

SUSTAINABILITY, P. 111.