Reebok 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

124

2013

/

03.2

/

Group Business Performance

/

Economic and Sector Development

Modest growth of Europe’s sporting goods industry

In Europe, despite high unemployment and low consumer confidence in

many markets, the sporting goods industry grew modestly. The sector

faced challenging comparisons to the prior year, which had been buoyed

by the major sporting events of the London 2012 Olympic and Paralympic

Games as well as the UEFA EURO 2012. Nonetheless, the industry gained

momentum towards year-end due to the build-up to the 2014 FIFA World

Cup in Brazil, which helped drive sales of federation jerseys and football-

related products. In European emerging markets, slower disposable

income growth rates negatively impacted consumer sentiment and

spending, resulting in lower retail traffic in 2013, especially in Russia.

Robust retail activity drives North American sporting

goods industry

In the USA, the sporting goods industry posted a robust performance,

with relatively low inflation and slight improvements in consumer

confidence helping drive consumer spending. We estimate that sales in

the sporting goods sector increased at a mid- to high-single-digit rate,

driven by improvements in product mix as retailers focused on premium

and highly innovative products. Strong retail trends in basketball,

high-performance running and sporting lifestyle apparel more than

offset slight contractions in the lifestyle running, outdoor and golf

categories. Digital presence and e-commerce continued to see rapid

expansion across the industry in 2013. Cold weather in the USA towards

year-end encouraged consumers to go online and, in conjunction with

discounting, added momentum to this increasingly important channel.

US sports footwear sales are estimated to have increased at a mid- to

high-single-digit rate in 2013, driven in particular by increases in the

basketball and high-performance running categories. Highly innovative

performance products also fuelled growth in US sporting apparel sales,

which are estimated to have increased at a high-single-digit rate.

Asian sporting goods industry continues to expand

Strong wage increases and rising consumer spending, albeit lower than

in recent years, fuelled increases in Asia’s sporting goods industry,

which we estimate grew at a low- to mid-single-digit rate in 2013. The

region’s industry expansion continues to be driven by international

brands. In China, this trend was particularly evident, with many

domestic brands remaining focused on inventory clearance and store

network consolidation. In Japan, economic progress helped support

improvements in consumer spending and a recovery in retail and

sporting goods sales, particularly in the second half of the year.

Latin America’s sporting goods industry records

strong momentum

In Latin America, low unemployment levels and higher wages supported

healthy retail and sporting goods sales. However, high inflationary

pressures lessened the robust expansion of the sector during the year.

Due to the importance of football for the region, the sporting goods

sector also benefited, principally in the second half of 2013, from sales

relating to the build-up to the 2014 FIFA World Cup, which is being

hosted by Brazil.

adidas Group and competitors outperform economic

environment

adidas Group currency-neutral revenues and profitability, as well as that

of many competitors and retailers, increased in 2013. In most regions,

sales of our Group and other major sporting goods companies grew at a

higher rate than GDP and overall consumer spending.

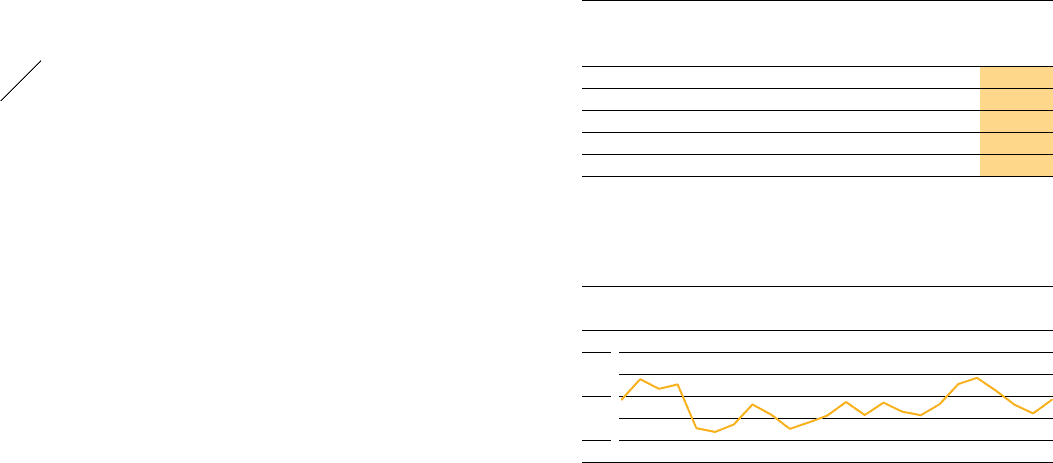

06

/

Oil price development 1) (in US $ per barrel)

| Jan. 1, 2012 Dec. 31, 2013 |

120

100

80

1) West Texas Intermediate Cushing crude oil. Source: Bloomberg.

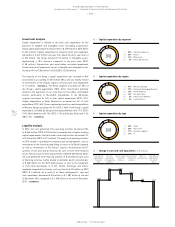

05

/

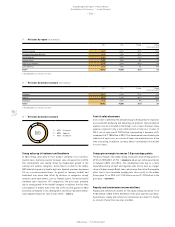

Exchange rate development 1) (€ 1 equals)

Average

rate

2012

Q1 2013 Q2 2013 Q3 2013 Q4 2013 Average

rate

2013

USD 1.2862 1.2805 1.3080 1.3505 1.3791 1.3283

GBP 0.8115 0.8456 0.8572 0.8361 0.8337 0.8492

JPY 102.65 120.87 129.39 131.78 144.72 129.58

RUB 39.951 39.802 42.783 43.682 45.137 42.298

CNY 8.1137 8.0341 8.0817 8.3029 8.4082 8.1674

1) Spot rates at quarter-end.