Reebok 2013 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

175

2013

/

03.5

/

Risk and Opportunity Report

/

Strategic and Operational Opportunities

/

Other fixed-rate financial instruments are measured at amortised

cost. Since a change in interest rates would not change the carrying

amount of this category of instruments, there is no net income impact

and they are excluded from this analysis.

The interest rate sensitivity analysis assumes a parallel shift of the

interest yield curve for all currencies and was performed on the same

basis for both 2012 and 2013. A 100 basis point increase in interest

rates at December 31, 2013 would have increased shareholders’ equity

by € 0.00 million (2012: increase by € 0.00 million) and decreased net

income by € 0.00 million (2012: decrease by € 0.00 million). A 100 basis

point decrease of the interest rates at December 31, 2013 would have

resulted in a € 0.00 million decrease in shareholders’ equity (2012:

decrease by € 0.00 million) and a € 0.00 million increase in net income

(2012: increase by € 0.00 million).

To reduce interest rate risks and maintain financial flexibility, a core

tenet of our Group’s financial strategy is to continue to use surplus cash

flow from operations to reduce gross borrowings

/

SEE TREASURY, P. 135.

Beyond that, the adidas Group is constantly looking for adequate hedging

strategies through interest rate derivatives in order to mitigate interest

rate risks.

In 2013, interest rates in Europe and North America remained at low

levels. Given the central banks’ current interest rate policies and

macroeconomic uncertainty, we do not foresee any major interest rate

increases in these regions for the near-term future. Since 90% of the

Group’s financing is in euros and US dollars, we regard the potential

impact of interest rate risks only as minor and we now regard the

likelihood that these risks will materialise as likely (2012: probable).

Risk related to impairment of goodwill/other

intangible assets

As a result of various acquisitions in the past, our balance sheet carries

book values of approximately € 1.2 billion in goodwill and € 1.4 billion

in other intangible assets (including trademarks). Deterioration in the

business performance and particularly in future business prospects

could require corrections of these book values by incurring impairment

charges. In addition, increases in market interest rates could trigger

increases in discount rates used in our impairment test for goodwill and

require impairment charges

/

SEE NOTE 02, P. 195. An impairment charge

would be a purely accounting, non-cash effect impacting the Group’s

operating result. We believe the effects on our financial results related to

impairment of goodwill and other intangible assets could be significant.

However, we regard the likelihood of a future impairment charge of such

magnitude as unlikely.

Strategic and Operational Opportunities

Macroeconomic and socio-political opportunities

Since we are a consumer goods company, consumer confidence and

spending can impact our sales development. Therefore, better than

initially forecasted macroeconomic developments, which support

increased private consumption, can have a positive impact on our sales

and profitability. Low unemployment rates, rising real incomes as well

as a growing middle class with increasing spending power are fuelling

consumption, particularly in emerging economies – and, subsequently,

our industry. In addition, legislative and regulatory changes, e.g. the

elimination of trade barriers, can potentially open new channels of

distribution or lead to lower import costs and positively impact Group

profitability.

Furthermore, governments are increasingly promoting living an

active lifestyle to fight obesity and cardiovascular disease. According

to the latest International Obesity Task Force (IOTF), more than 600

million adults are currently considered obese. An additional billion are

estimated to be overweight. Additionally, up to 200 million school-age

children are either obese or overweight. This development has serious

health consequences and a dramatic effect on health care expenditures.

As a result, governments and non-governmental organisations are

increasing their efforts to promote a healthy lifestyle and encourage

sports participation. This could lead to increases in sports participation,

in particular in categories considered suitable for weight loss, such as

training, running and walking. Given the strong global market position

the adidas Group and its brands enjoy, acceleration in this trend could

positively affect the Group’s sales development.

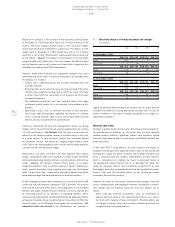

08

/

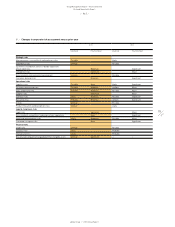

Corporate opportunities overview

Likelihood Potential impact

Strategic and operational opportunities

Macroeconomic and socio-political

opportunities

Unlikely Moderate

Organic growth opportunities Unlikely Major

Opportunities related to organisational

and process improvements

Possible Significant

Marketing and communication

opportunities

Possible Minor

Acquisition opportunities Possible Minor

Personnel opportunities Unlikely Significant

Financial opportunities

Favourable financial market changes Unlikely Major