Reebok 2013 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

167

2013

/

03.5

/

Risk and Opportunity Report

/

Operational Risks

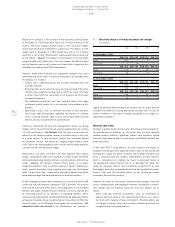

Therefore, the Group is committed to delivering outstanding customer

service, providing our retail partners with the support and tools to

establish and maintain a mutually successful business relationship.

Customer relationship management is not only a key activity for our

sales force but also of highest importance to our Group’s top executives

and second-line management. As a result, the Group’s CEO as well as

the Executive Board member responsible for Global Sales, for example,

regularly meet with key customers to ensure a strong partnership

between the Group and its retail customers. Due to our excellent

relationship with our retail customers and our commitment and

dedication to strengthening our partnerships, we believe that customer

relationship risks could have a moderate (2012: major) impact on our

Group’s performance. We regard the likelihood of being impacted to

such an extent as possible (2012: unlikely).

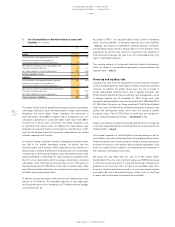

Sales and pricing risks

To achieve our sales and profitability targets, it is paramount to

successfully convert orders into sales, drive sell-through at the point of

sale and have product prices that are competitive in the marketplace.

Failure to do so would result in sales and profit shortfalls. In addition,

price increases required to compensate for higher product costs might

not be realised in the marketplace, leading to margin declines.

To mitigate these risks, we pursue a range of pricing strategies.

We closely monitor order book conversion as well as sell-out and

sell-through performance and adjust prices where required. In addition,

our continuous investment in brand-building and marketing helps us

drive our business at various price points and supports a premium

positioning. Furthermore, we work closely with our retail customers to

minimise mark-downs and potentially re-allocate product.

As a result of these mitigating actions, the experience we gained in

particular in the last twelve months related to pricing decisions as well

as our brand strength, broad product offering and pricing architecture,

we now assess the potential impact of sales and pricing as moderate

(2012: major). However, due to a difficult macroeconomic environment

and intense competition, particularly in Europe, we regard the likelihood

of being affected to such an extent as probable (2012: possible).

Supplier risks

Almost the entire adidas Group product offering is sourced through

independent suppliers, mainly located in Asia

/

SEE GLOBAL OPERATIONS,

P. 94. To reduce the risk of business interruptions following the

potential underperformance of a supplier or a potential supplier default,

we work with vendors who demonstrate reliability, quality, innovation

and continuous improvement.

Furthermore, in order to minimise any potential negative consequences

such as product quality shortfalls, increased product lead times or

violation of our Workplace Standards, we enforce strict control and

inspection procedures at our suppliers and also demand adherence to

social and environmental standards throughout our supply chain

/

SEE

SUSTAINABILITY, P. 111. In addition, we have selectively bought insurance

coverage for the risk of business interruptions caused by physical

damage to supplier premises. Despite our commitment to enhance our

mitigating actions and to minimise the potential impact of supplier risks,

we regard the potential impact as significant (2012: major). However, we

consider the likelihood of being impacted to such a degree as unlikely.

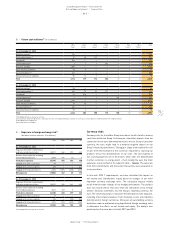

Inventory risks

As we place initial production orders around six months in advance

of delivery, the adidas Group is exposed to inventory risks relating to

misjudging consumer demand at the time of production planning. A

sudden decline in demand has the potential to cause excess inventories.

This can have negative implications for our financial performance,

including higher levels of clearance activity and inventory obsolescence

as well as reduced liquidity due to higher operating working capital

requirements.

Similarly, a sudden increase in demand can lead to product shortfalls

at the point of sale. In this situation, our Group faces the risk of missed

sales opportunities and/or customer and consumer disappointment,

which could lead to a reduction in brand loyalty and hurt our reputation

as an on-time, in-full supplier. In addition, the Group faces potential

profitability impacts from additional costs such as airfreight in efforts to

speed up replenishment.

In order to mitigate these risks, we continuously strive to improve our

forecasting and material planning processes. To that end, in 2013, we

further improved our forecasting approach by more closely aligning

processes and timelines of major business functions

/

SEE INTERNAL

GROUP MANAGEMENT SYSTEM, P. 118. In addition, our Global Operations

function offers sophisticated and tailored replenishment models in order

to shorten order-to-delivery times, ensuring availability of products

while avoiding excess inventories

/

SEE GLOBAL OPERATIONS, P. 94.

The expected over-proportionate growth of the Retail segment will

increase the exposure towards swings in consumer demand, and also

makes the Group more susceptible to the risk of inventory shrinkage

or excess inventory. However, as a result of continuous progress in our

improvement efforts regarding planning processes and supply chain

flexibility, we now assess the potential impact related to inventory

clearance to be moderate (2012: significant), albeit with a likelihood of

materialising of likely (2012: possible).