Reebok 2013 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

227

2013

/

04.8

/

Notes

/

Notes to the Consolidated Income Statement

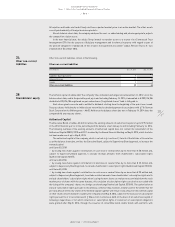

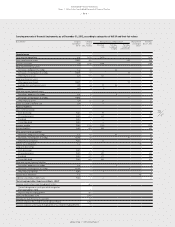

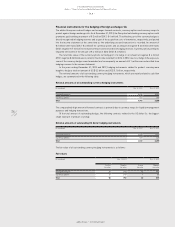

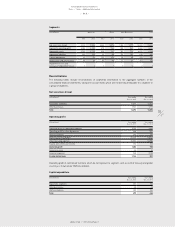

A total net fair value of negative € 36 million (2012: negative € 10 million) for forward contracts related to hedging

instruments falling under hedge accounting as per definition of IAS 39 “Financial Instruments: Recognition and

Measurement” was recorded in the hedging reserve. The remaining net fair value of € 4 million (2012: € 9 million),

mainly related to liquidity swaps for cash management purposes and to forward contracts hedging intercompany

dividend receivables, was recorded in the income statement. The total fair value of negative € 2 million (2012:

positive € 2 million) for outstanding currency options related to cash flow hedges. This consists of a positive

time value of € 8 million (2012: € 2 million) and of a negative time value of € 12 million (2012: € 5 million) and, in

contrast to the preceding table, does not include the intrinsic value of the options.

The fair value adjustments of outstanding cash flow hedges for forecasted sales are reported in the income

statement when the forecasted sales transactions are recorded. The vast majority of these transactions are

forecasted to occur in 2014. At the balance sheet date, inventories were adjusted by positive € 20 million (2012:

positive € 16 million) which will be recognised in the income statement in 2014.

In the hedging reserve, a negative amount of € 6 million (2012: negative € 21 million) is included for hedging

the currency risk of net investments in foreign entities, mainly for the subsidiaries LLC “adidas, Ltd.” and adidas

Sports (China) Co. Ltd. This reserve will remain until the investment in the foreign entity has been sold. As at

December 31, 2013, no ineffective part of the hedges was recorded in the income statement.

In order to determine the fair values of its derivatives that are not publicly traded, the adidas Group uses

generally accepted quantitative financial models based on market conditions prevailing at the balance sheet date.

In 2013, the fair values of the derivatives were determined applying mainly the “par method”, which uses

actively traded forward rates.

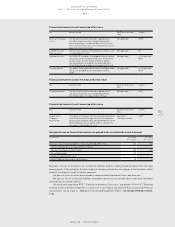

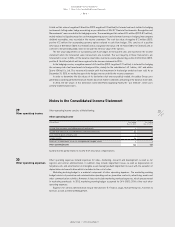

Notes to the Consolidated Income Statement

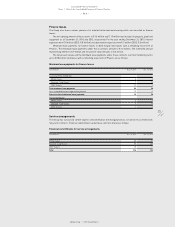

Other operating income consists of the following:

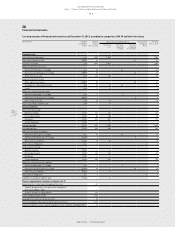

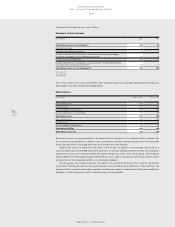

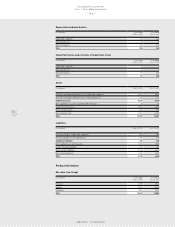

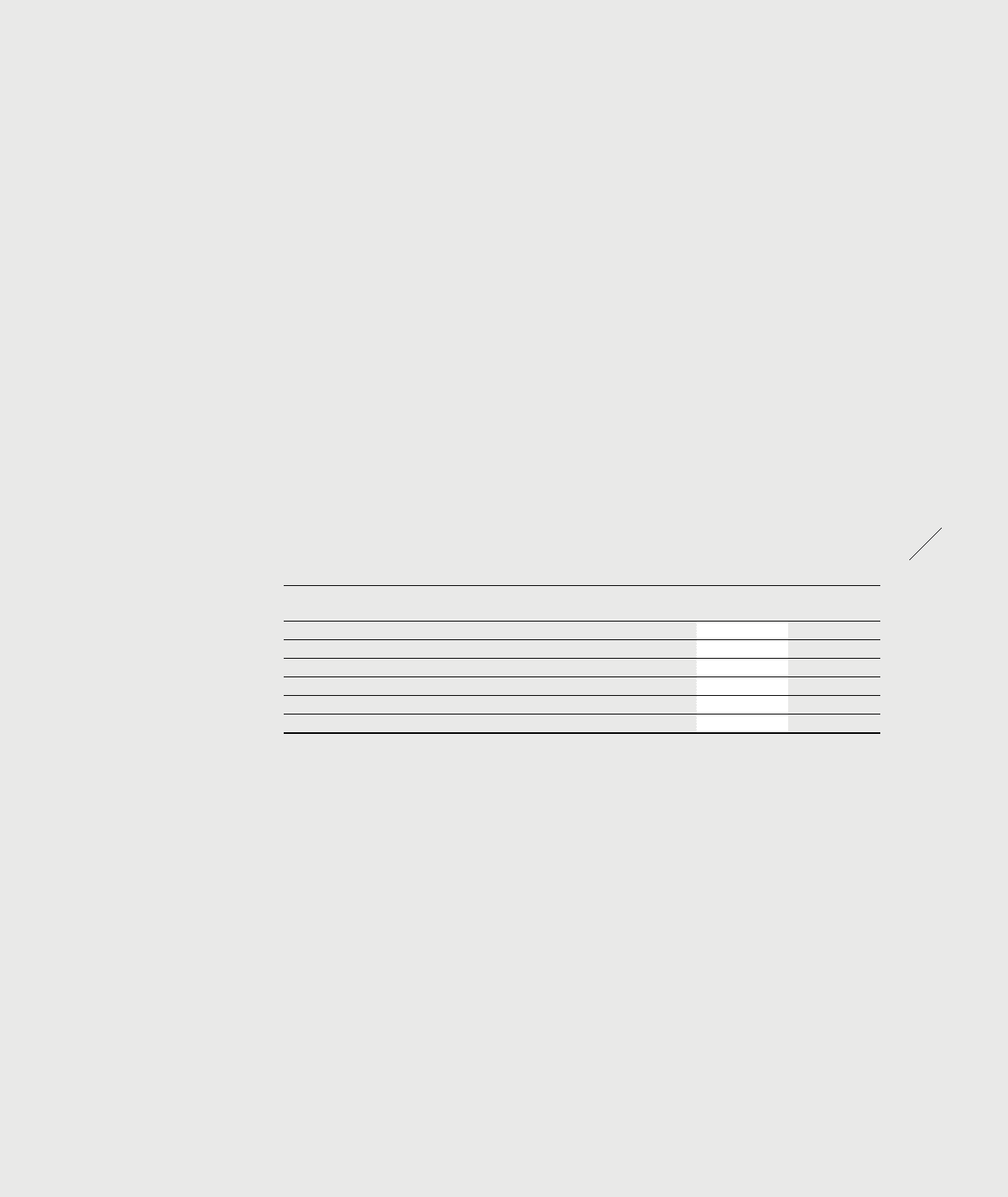

Other operating income

(€ in millions) Year ending

Dec. 31, 2013

Year ending

Dec. 31, 2012

Income from accounts receivable previously written off 3 4

Income from release of accrued liabilities and other provisions 83 37

Gains from disposal of fixed assets 1 1

Sundry income 54 83

Reversals of impairment losses for intangible and tangible assets 2 2

Other operating income 143 127

Sundry income partly relates to income from insurance compensations.

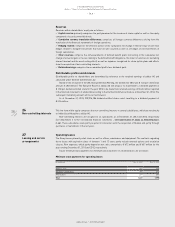

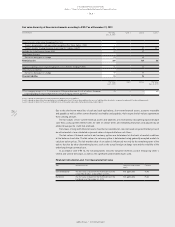

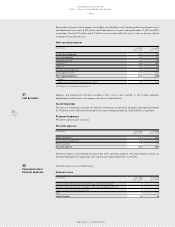

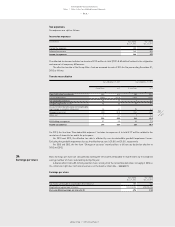

Other operating expenses include expenses for sales, marketing, research and development, as well as for

logistics and central administration. In addition, they include impairment losses as well as depreciation on

tangible assets and amortisation on intangible assets (except goodwill impairment losses), with the exception of

depreciation and amortisation which is included in the cost of sales.

Marketing working budget is a material component of other operating expenses. The marketing working

budget consists of promotion and communication spending such as promotion contracts, advertising, events and

other communication activities. However, it does not include marketing overhead expenses, which are presented

in marketing overheads. In 2013, marketing working budget accounted for 24% (2012: 25%) of the total other

operating expenses.

Expenses for central administration include the functions IT, Finance, Legal, Human Resources, Facilities &

Services as well as General Management.

29

Other operating income

30

Other operating expenses