Reebok 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

156

2013

Subsequent Events and Outlook

/

03.4

/

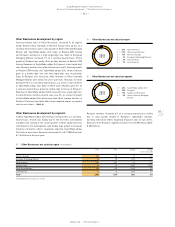

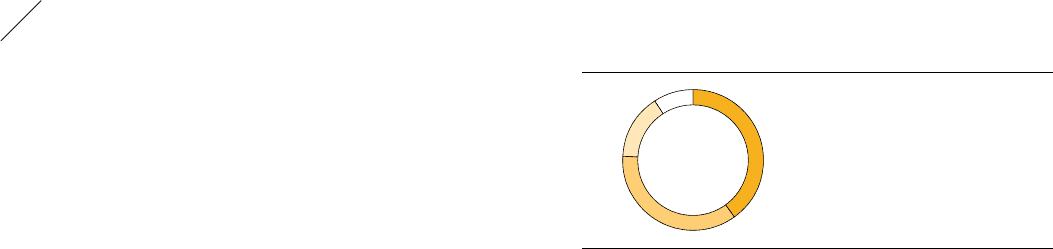

Capital expenditure to be between € 500 million

and € 550 million

In 2014, capital expenditure is expected to amount to between

€ 500 million and € 550 million (2013: € 479 million). Investments will

focus on adidas and Reebok controlled space initiatives, in particular

in emerging markets. These investments will account for around 50%

of total investments in 2014. Other areas of investment include the

Group’s logistics infrastructure, the further development of the adidas

Group headquarters in Herzogenaurach, Germany, and the increased

deployment of SAP and other IT systems in major subsidiaries within

the Group. Projected capital expenditure by segment is outlined in the

diagram

/

DIAGRAM 02. All investments within the adidas Group in 2014

are expected to be fully financed through cash generated from operating

activities.

Excess cash to be used to support growth initiatives

In 2014, we expect continued positive cash flow from operating activities.

Cash will be used to finance working capital needs, investment activities,

as well as dividend payments. We intend to largely use excess cash to

invest in our Route 2015 growth initiatives, in particular the further

expansion of our own-retail activities. In 2014, gross borrowings of

€ 681 million will mature. In order to ensure long-term flexibility, we

aim to maintain a ratio of net borrowings over EBITDA of less than two

times as measured at year-end (2013: –0.2).

Efficient liquidity management in place for 2014

and beyond

Efficient liquidity management remains a priority for the adidas Group

in 2014. We focus on continuously anticipating the operating cash flows

of our Group segments, as this represents the main source of liquidity

within the Group. Liquidity is planned on a rolling monthly basis under a

multi-year financial and liquidity plan. Long-term liquidity is ensured by

continued positive operating cash flows and sufficient financial flexibility

through unused credit facilities

/

SEE TREASURY, P. 135.

Management to propose dividend of € 1.50

In light of the strong generation of cash flow from operating activities

in 2013, Management will recommend paying a dividend of € 1.50 to

shareholders at the Annual General Meeting (AGM) on May 8, 2014,

representing an increase of 11% compared to the prior year (2012:

€ 1.35). Subject to shareholder approval, the dividend will be paid on

May 9, 2014. The proposal represents a payout ratio of 37.4% of net

income attributable to shareholders excluding goodwill impairment

losses, compared to 35.7% in the prior year. This complies with our

dividend policy, according to which we intend to pay out between 20%

and 40% of net income attributable to shareholders annually. Based on

the number of shares outstanding at the end of 2013, the dividend payout

will thus increase 11% to € 314 million (2012: € 282 million).

adidas Group expects further growth and

margin improvements in 2015

Based on the initiatives laid out in our Route 2015 strategic business

plan, we project adidas Group sales and net income to increase in 2015.

We also expect further improvements in operating margin. Further

details of our Route 2015 strategic goals and initiatives are outlined in

the Group Strategy section of this Annual Report

/

SEE GROUP STRATEGY,

P. 68.

02

/

Capital expenditure by segment

2014

1

/

40% HQ/Consolidation

2

/

36% Retail

3

/

15% Wholesale

4

/

9% Other Businesses

1

2

3

4