Reebok 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

137

2013

/

03.2

/

Group Business Performance

/

Treasury

52

/

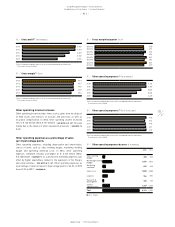

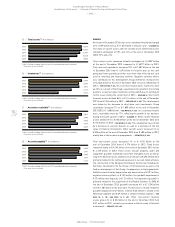

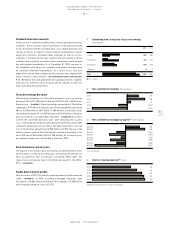

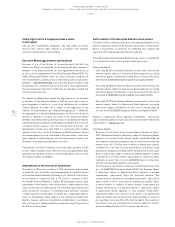

Net cash/(net borrowings) (€ in millions)

2013 295

2012 448

2011 90

2010 (221)

2009 (917)

54

/

Interest rate development 1) (in %)

2013 3.8

2012 4.4

2011 4.9

2010 5.1

2009 5.2

1) Weighted average interest rate of gross borrowings.

53

/

Net cash/(net borrowings) by quarter 1) (€ in millions)

Q4 2013 295

Q4 2012 448

Q3 2013 (180)

Q3 2012 (337)

Q2 2013 (94)

Q2 2012 (318)

Q1 2013 (180)

Q1 2012 (640)

1) At end of period.

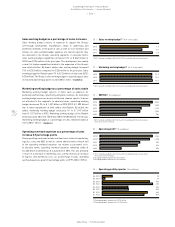

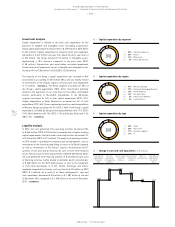

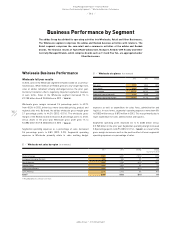

51

/

Remaining time to maturity of gross borrowings

(€ in millions)

2013 2012

< 1 year 681 280

1 to 3 years 193 644

3 to 5 years 460 563

> 5 years 00

Total 1,334 1,487

■ 2013 ■ 2012

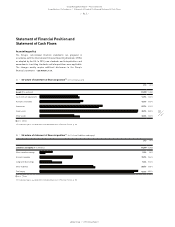

Standard financial covenants

In the case of our committed credit facilities, we have entered into various

covenants. These covenants may include limits on the disposal of fixed

assets, the amount of debt secured by liens, cross default provisions and

change of control. In addition, certain financial arrangements contain

equity ratio covenants, minimum equity covenants as well as net loss

covenants. If we failed to meet any covenant and were unable to obtain

a waiver from a majority of partner banks, borrowings would become

due and payable immediately. As at December 31, 2013, we were in

full compliance with all of our covenants, with ample coverage above

all stipulated minimum requirements. As a result of our cash flow

expectations, we are fully confident we will continue to be compliant with

these covenants going forward

/

SEE SUBSEQUENT EVENTS AND OUTLOOK,

P. 151. We believe that cash generated from operating activities, together

with access to external sources of funds, will be sufficient to meet our

future operating and capital needs.

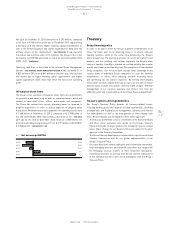

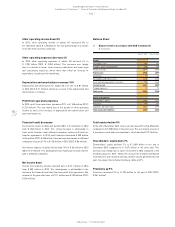

Gross borrowings decrease

Following the repayment of a US private placement, gross borrowings

decreased 10% to € 1.334 billion at the end of 2013 from € 1.487 billion in

the prior year

/

DIAGRAM 51. Bank borrowings amounted to € 126 million

compared to € 59 million in the prior year. Private placements decreased

48% to € 248 million in 2013 (2012: € 480 million). Convertible bonds

outstanding increased 3% to € 460 million from € 449 million in the prior

year, as a result of accruing the debt component

/

DIAGRAM 55. At issuance

in 2012, the convertible bond was split – after deducting the issuance

costs – into the equity component amounting to € 55 million and the debt

component amounting to € 441 million. The debt component is accrued

to its nominal value amounting to € 500 million until 2017 by use of the

effective interest method. The total amount of bonds outstanding at the

end of 2013 was € 960 million (2012: € 948 million). As in the prior year,

no commercial paper was outstanding at the end of 2013.

Euro dominates currency mix

The majority of our Group’s gross borrowings are denominated in euros

and US dollars. At the end of 2013, gross borrowings denominated in

euros accounted for 76% of total gross borrowings (2012: 68%). The

share of gross borrowings held in US dollars decreased to 14% (2012:

29%)

/

DIAGRAM 50.

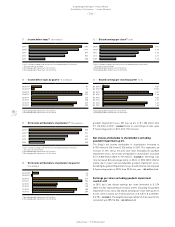

Stable debt maturity profile

Over the course of 2013, the Group’s financing maturity profile remained

stable

/

DIAGRAM 51. In 2014, assuming unchanged maturities, debt

instruments of € 681 million will mature. This compares to € 280 million

which matured during the course of 2013.