Reebok 2013 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

adidas Group

/

2013 Annual Report

Consolidated Financial Statements

216

2013

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

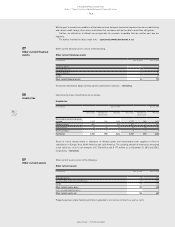

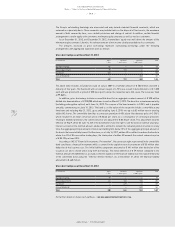

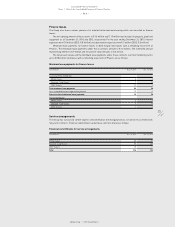

In the following table, the effects of reasonably conceivable changes in the actuarial assumptions on the present

value of the obligation from defined benefit pension plans are analysed. In addition, for Germany, UK and Japan

the average duration of the obligation is shown.

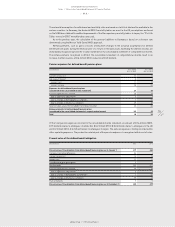

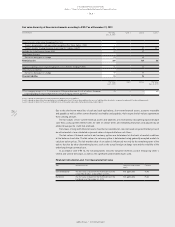

Sensitivity analysis of the obligation from defined benefit pension plans

(€ in millions) Dec. 31, 2013

Germany UK Japan

Present value of the obligation from defined benefit pension plans 224 41 14

Increase in the discount rate by 0.5% 207 35 13

Reduction in the discount rate by 0.5% 243 47 15

Average duration of the obligations (in years) 16 30 12

Since many pension plans are closed to future accrual, the salary trend plays a minor role in determining pension

obligations. Due to the fact that the benefits of the German pension plans are mainly paid as lump sums or

instalment payments, the pension increase rate and the mortality assumption have significantly less impact than

the discount rate when calculating the pension obligations.

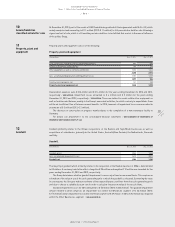

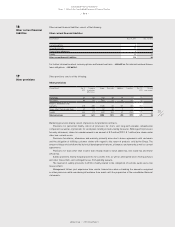

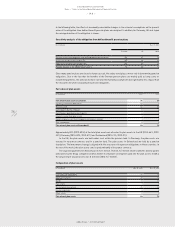

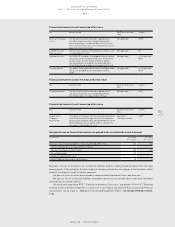

Fair value of plan assets

(€ in millions) 2013 2012

Fair value of plan assets at January 1 76 67

Currency translation differences (2) 2

Pensions paid (2) (4)

Contributions by the employer 5 4

Contributions paid by plan participants 0 0

Interest income from plan assets 3 3

Return on plan assets (not included in net interest income) 3 4

Plan settlements 0 0

Fair value of plan assets at December 31 83 76

Approximately 83% (2012: 85%) of the total plan assets are allocated to plan assets in the UK (2013: 44%, 2012:

45%), Germany (2013: 30%, 2012: 31%) and Switzerland (2013: 9%, 2012: 9%).

In the UK, the plan assets are held under trust within the pension fund. In Germany, the plan assets are

invested in insurance contracts and in a pension fund. The plan assets in Switzerland are held by a pension

foundation. The investment strategy is aligned with the structure of the pension obligations in these countries. In

the rest of the world, the plan assets consist predominantly of insurance contracts.

The expected payments for 2014 amount to € 11 million. Thereof, € 7 million relate to benefits directly paid to

pensioners by the Group companies and € 4 million to employer contributions paid into the plan assets. In 2013,

the actual return on plan assets was € 6 million (2012: € 7 million).

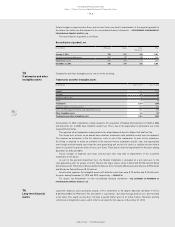

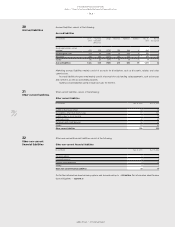

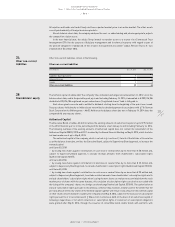

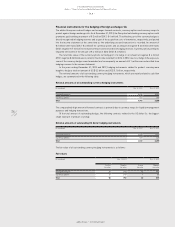

Composition of plan assets

(€ in millions) Dec. 31, 2013 Dec. 31, 2012

Cash and cash equivalents 14 13

Equity instruments 28 24

Bonds 11 10

Real estate 1 1

Pension plan reinsurance 25 24

Insurance policies 4 4

Other assets 0 0

Fair value of plan assets 83 76