Reebok 2013 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

163

2013

/

03.5

/

Risk and Opportunity Report

/

Strategic Risks

Strategic Risks

Macroeconomic, socio-political and regulatory risks

Growth in the sporting goods industry is highly dependent on consumer

spending and consumer confidence. Economic downturns and socio-

political factors such as civil unrest, nationalisation or expropriation, in

particular in regions where the Group is highly represented, therefore

pose a significant risk to sales development. In addition, significant

changes in the regulatory environment (e.g. trade restrictions, tax

legislation, product quality and safety standards, etc.) could lead

to potential sales shortfalls or cost increases. To mitigate these

macroeconomic, socio-political and regulatory risks, the Group strives to

balance sales across key global regions and also between developed and

emerging markets. We also continuously monitor the macroeconomic,

political and regulatory landscape in all our key markets to anticipate

potential problem areas, so that we are able to quickly adjust our

business activities accordingly upon any change in conditions. Potential

adjustments may be more conservative product purchasing, tight

working capital management and an increased focus on cost control.

Furthermore, a core element of our positioning in performance sports

is the utilisation of an extensive global event and partnership portfolio

where demand is more predictable and less sensitive to macroeconomic

influences. In addition, by building on our leading position within the

sporting goods industry, we actively engage in supporting policymakers

and regulators to liberalise global trade, curtail trade barriers and

proactively adapt to significant changes in the regulatory environment.

In 2014, we expect the global economy to grow, albeit with varying

degrees of performance geographically

/

SEE SUBSEQUENT EVENTS

AND OUTLOOK, P. 151. However, as a result of the still challenging

macroeconomic environment in many European countries, slowing

economic growth rates in the emerging markets as well as political

and regulatory uncertainty in certain countries in Latin America, the

Middle East and Southeast Asia, we still regard the potential impact of

macroeconomic, socio-political and regulatory factors as major. Given

our broad-based risk mitigation, we now assess the likelihood that

adverse macroeconomic, socio-political or regulatory events could

impact our business to that extent as possible (2012: likely).

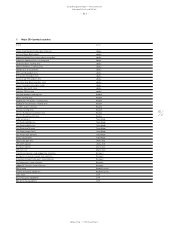

03

/

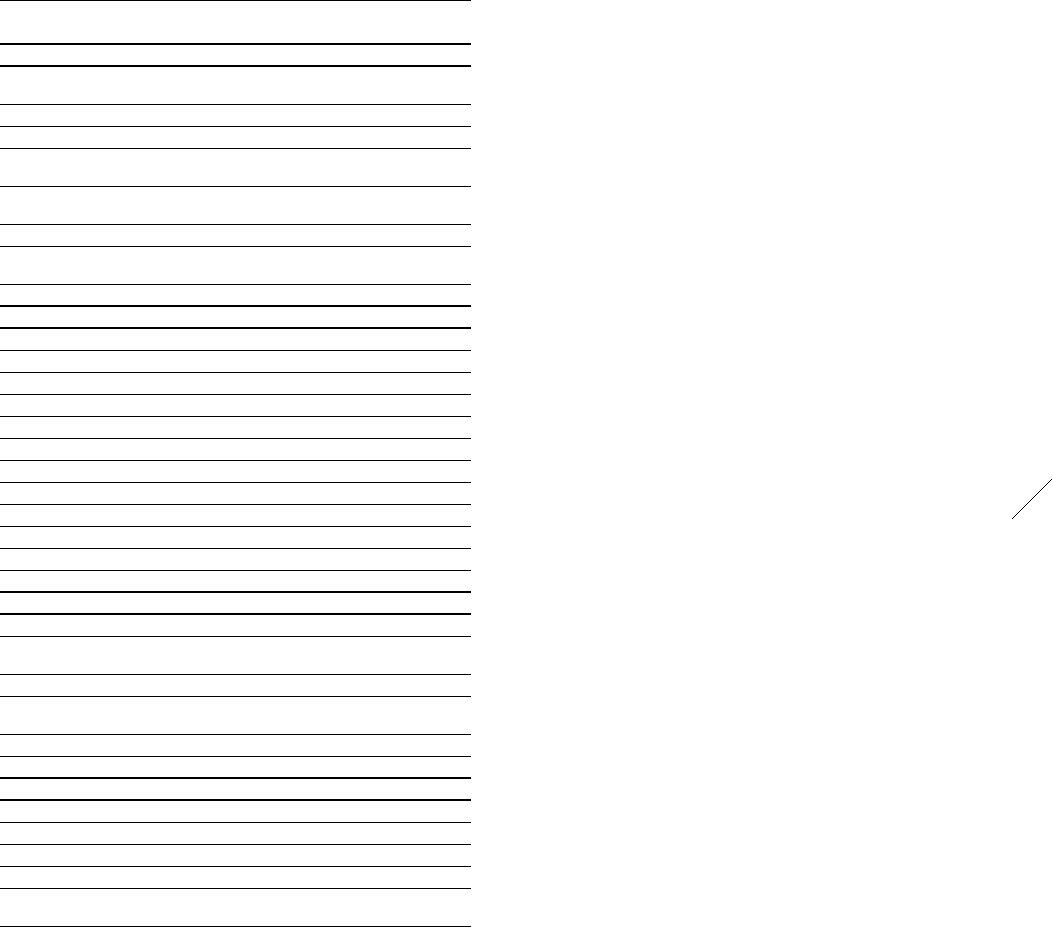

Corporate risk overview

Likelihood Potential impact

Strategic risks

Macroeconomic, socio-political and

regulatory risks

Possible Major

Risks related to distribution strategy Possible Significant

Dependency risks Unlikely Significant

Risks related to media and stakeholder

activities

Likely Significant

Customer consolidation and cross-border

expansion/private label risks

Possible Moderate

Competition risks Possible Significant

Risks related to risk and control

environment

Unlikely Major

Consumer demand risks Possible Moderate

Operational risks

Own-retail risks Possible Major

Logistics risks Possible Major

Marketing risks Likely Significant

Customer relationship risks Possible Moderate

Sales and pricing risks Probable Moderate

Supplier risks Unlikely Significant

Inventory risks Likely Moderate

Hazard risks Possible Major

Personnel risks Probable Moderate

IT risks Unlikely Major

Product innovation and development risks Unlikely Moderate

Risks related to rising input costs Likely Moderate

Legal & compliance risks

Legal risks Possible Significant

Risks related to competition, trade and

customs regulations

Possible Major

Social and environmental risks Likely Moderate

Risks related to product counterfeiting and

imitation

Unlikely Significant

Product quality risks Possible Significant

Fraud and corruption risks Unlikely Major

Financial risks

Credit risks Unlikely Major

Financing and liquidity risks Unlikely Minor

Currency risks Likely Major

Interest rate risks Likely Minor

Risk related to impairment of

goodwill/other intangible assets

Unlikely Significant