Reebok 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2013 Annual Report

Group Management Report – Financial Review

129

2013

/

03.2

/

Group Business Performance

/

Income Statement

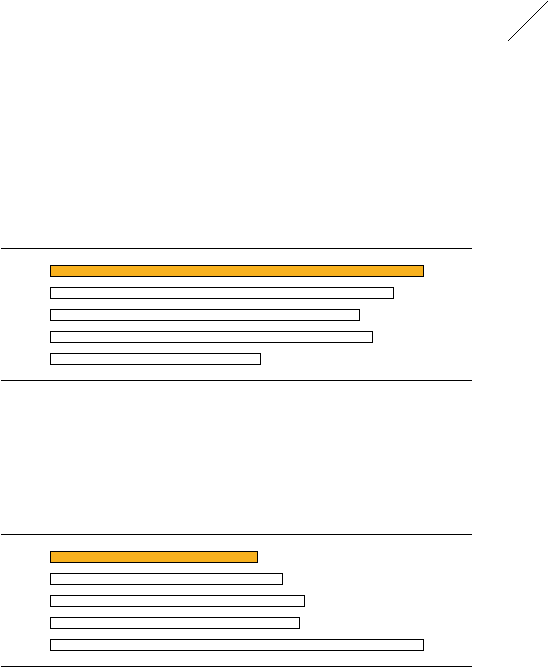

Operating margin excluding goodwill impairment

improves to 8.7%

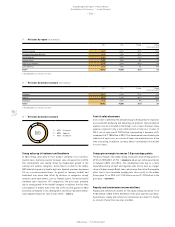

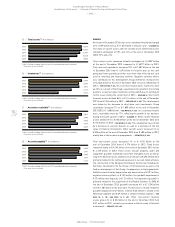

Group operating profit increased 31% to € 1.202 billion in 2013 versus

€ 920 million in 2012. The operating margin of the adidas Group

improved 2.1 percentage points to 8.3% (2012: 6.2%). Excluding the

goodwill impairment losses, operating profit grew 6% to € 1.254 billion

from € 1.185 billion last year

/

DIAGRAM 23, representing an operating

margin of 8.7%, up 0.7 percentage points (2012: 8.0%)

/

DIAGRAM 25. This

is below our initial expectations of an operating margin approaching

9.0%. The improvement in the operating margin was primarily due to

the positive effects from the increase in gross margin, which more than

offset higher other operating expenses as a percentage of sales.

Financial income down 28%

Financial income decreased 28% to € 26 million in 2013 from € 36 million

in the prior year, mainly due to a decrease in interest income

/

SEE NOTE

32, P. 228.

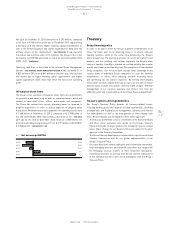

Financial expenses decrease 11%

Financial expenses declined 11% to € 94 million in 2013 (2012:

€ 105 million)

/

DIAGRAM 26. The decrease in interest expenses was the

main contributor to the decline

/

SEE NOTE 32, P. 228.

Income before taxes excluding goodwill

impairment up 6%

Income before taxes (IBT) for the adidas Group increased 33% to

€ 1.134 billion from € 851 million in 2012. IBT as a percentage of sales

rose 2.1 percentage points to 7.8% in 2013 (2012: 5.7%). Excluding the

26

/

Financial expenses 1) (€ in millions)

2013 94

2012 105

2011 115

2010 113

2009 169

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

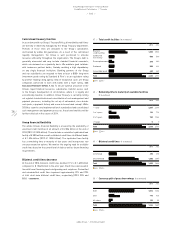

Number of Group employees up 10%

At the end of December 2013, the Group employed 50,728 people. This

represents an increase of 10% versus the prior year level of 46,306. New

hirings related to the expansion of the Group’s own-retail store base, in

particular in European Emerging Markets, were the main driver of this

development. On a full-time equivalent basis, the number of employees

increased 8% to 43,537 at the end of 2013 (2012: 40,168)

/

SEE EMPLOYEES,

P. 105.

EBITDA grows 5%

The Group’s earnings before interest, taxes, depreciation and amortisation

as well as impairment losses/reversal of impairment losses on property,

plant and equipment and intangible assets (EBITDA) increased 5% to

€ 1.523 billion in 2013 (2012: € 1.445 billion)

/

DIAGRAM 22. Depreciation

and amortisation expense for tangible and intangible assets (excluding

impairment losses/reversal of impairment losses) increased 9% to

€ 286 million in 2013 (2012: € 263 million). This development is mainly

due to an increase in property, plant and equipment. In accordance

with IFRS, intangible assets with indefinite useful lives (goodwill and

trademarks) are tested annually and additionally when there are

indications of potential impairment. In this connection, impairment of

intangible assets with unlimited useful lives was incurred in 2013.

Goodwill impairment in an amount of € 52 million

As a result of the annual impairment test, the adidas Group has

impaired goodwill and recorded a € 52 million pre-tax charge as

at December 31, 2013 (2012: € 265 million). Within the wholesale

cash-generating unit Iberia, goodwill impairment losses of € 23 million

were recognised. Within the retail cash-generating unit North America,

goodwill impairment losses of € 29 million were recognised. The

goodwill of these two cash-generating units is completely impaired.

The impairment losses were mainly caused by adjusted growth

assumptions and an increase in the country-specific discount rates. In

2012, the wholesale cash-generating unit North America was impaired

by € 106 million, Latin America by € 41 million, Brazil by € 15 million

and Iberia by € 11 million. The impairment loss in 2012 was mainly the

result of adjusted growth assumptions for the Reebok brand, especially

in North America, Latin America and Brazil, and an increase in the

country-specific discount rates as a result of the euro crisis. In addition,

in 2012 goodwill of € 68 million allocated to Reebok-CCM Hockey was

completely impaired and € 24 million allocated to Rockport was partially

impaired. These impairment losses were primarily the result of the

re-evaluation of future growth prospects and, with regard to Rockport,

also due to an increase in the discount rate. The impairment losses in

both years were non-cash in nature and do not affect the adidas Group’s

liquidity

/

SEE NOTE 02, P. 195.

25

/

Operating margin 1) (in %)

2013 2) 8.7

2012 3) 8.0

2011 7.2

2010 7.5

2009 4.9

1) 2011 restated according to IAS 8 in the 2012 consolidated financial statements.

Prior years are not restated.

2) Excluding goodwill impairment of € 52 million.

3) Excluding goodwill impairment of € 265 million.